Student Loan Debt Stops Millennials from Moving: The Struggle

Student loan debt hinders millennials from relocating. Financial burdens restrict their mobility and home-buying capabilities.

High levels of student loan debt are becoming a significant barrier for millennials trying to make major life moves, such as purchasing a home or changing locations. With many grappling with substantial loan repayments, their ability to save for a down payment on a house or afford relocation costs is severely compromised.

This debt load also affects millennials’ credit scores, which can further limit their housing options and ability to move. The lingering financial strain from education loans often means that other life decisions, like starting a family or investing, must be put on hold. Saddled with this financial instability, millennials are facing challenges that can delay their progression toward traditional milestones associated with adult independence.

Credit: www.cfr.org

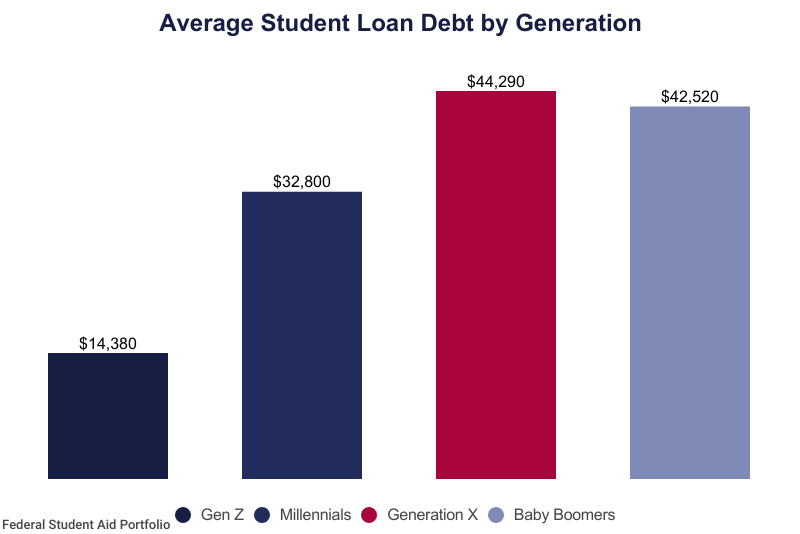

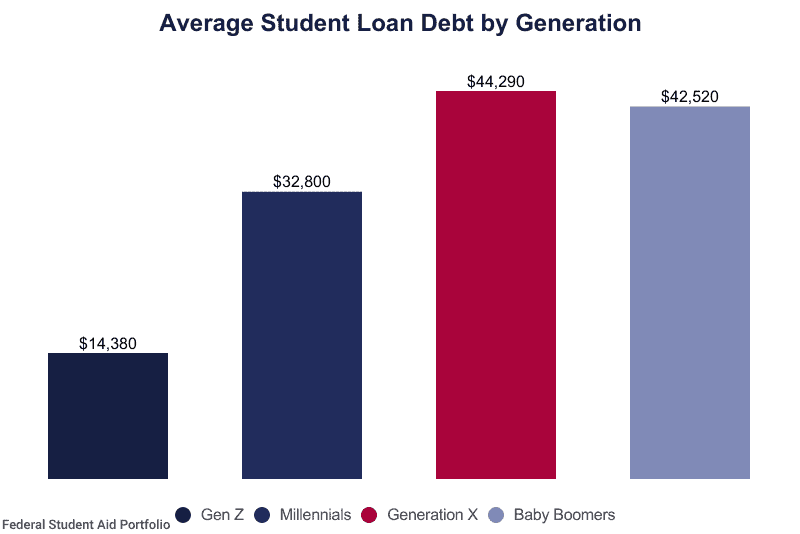

The Millennial Burden: Rising Student Loan Debt

Imagine a weight so heavy that dreams feel out of reach. That’s the reality for many millennials. Rising student loan debt shapes their financial futures. It’s more than just a monthly payment. It’s a barrier to life’s milestones like buying homes and starting families. Let’s explore how the soaring costs of higher education contribute to this burden and the financial obligations that come with it.

The Soaring Costs Of Higher Education

College tuition fees have skyrocketed over the past few decades. This surge outpaces inflation and family income growth. As a result, millennials face towering education expenses. These costs don’t include textbooks, accommodation, and other essentials. Below is a breakdown of how these expenses stack up:

| Expense Type | Cost Range |

|---|---|

| Tuition & Fees | $10,000 – $50,000 (annually) |

| Room & Board | $8,000 – $12,000 (annually) |

| Books & Supplies | $1,200 – $1,500 (annually) |

| Personal Expenses | Varies |

Millennials’ Mounting Financial Obligations

Student loans are just one piece of the puzzle. Millennials juggle multiple financial obligations. These often include credit card debt, housing costs, and car payments. An overview of these obligations shows:

- Credit Card Debt: Often used to cover daily expenses and emergencies.

- Housing Costs: Rent or mortgage payments consume a significant portion of income.

- Car Payments: Necessary for commuting, especially in areas with limited public transit.

- Healthcare: Monthly premiums and out-of-pocket expenses add up.

This financial strain holds millennials back from investing in their future or experiencing life to the fullest. The struggle is more than making ends meet; it’s about how to thrive amid this debt crisis. With each passing year, the gap between debt and opportunities widens. We must concentrate on solutions to lighten this load and restore the financial freedom of an entire generation.

Credit: www.amazon.com

Impact On Life Milestones

Moving through life brings big steps, but millennial strides are stunted by student loan debt. Winging it to pivotal life chapters, like buying a home or starting a family, gets tough. Skyscraper-sized student loans loom, shackling feet to the ground. We peek into how this financial burden nudges major life milestones off course.

Homeownership Dreams Deferred

Snagging the keys to a new home? A milestone turned mirage for many millennials. Here’s why:

- Savings drained: Student loans guzzle funds, leaving little for down payments.

- Credit strains: Debt-to-income ratios climb, making mortgage approvals rare birds.

- Investment hesitance: Long-term commitments clash with loan repayment marathons.

The dream isn’t dashed, but the timeline for home buying stretches thinner.

Delay In Marriage And Family Planning

Student debt doesn’t just dent wallets—it dings the heart, too. Delays hit major relationship milestones:

- Wedding bells on hold: Ceremonies cost a pretty penny; loans demand those pennies first.

- Family trees stunted: The financial tug-of-war between loan payments and child-rearing costs causes hesitation.

Young love flourishes, yet fiscal pressures pump the brakes on life’s shared journeys.

Student Loans Versus Geographic Mobility

Exploring the intricate relationship between student loans and geographic mobility reveals a pressing challenge for millennials. Burdened by student debt, many young people find their options limited, impacting crucial life decisions including relocation for better opportunities.

The Reluctance To Relocate

Financial constraints from student loans cause millennials to rethink moving. High monthly payments restrict their budget, making the costs associated with relocation seem daunting. There’s a clear connection:

- Student debt equals less savings for moving expenses.

- Security deposits and upfront rents become high hurdles.

- Long-distance moves are often out of reach.

Consequently, many remain tied to their current location, unable to chase the dream jobs or lifestyles a move could enable.

Career Opportunities Lost To Debt

Student debt inadvertently shapes career trajectories. With fewer millennials moving, job opportunities in dynamic markets remain untapped. Understandably, cautious perspectives dominate:

- Job stability becomes preferable to risky moves.

- Earning potential in new cities often weighed against debt obligations.

- Growth and promotion opportunities in existing jobs favored over unknowns.

This leads to a considerable proportion of the workforce stagnating in their professional growth, simply due to loan repayment pressures.

Psychological Effects On A Debt-laden Generation

The burden of student loan debt casts a long shadow over the lives of many millennials, significantly impacting their psychological well-being. This weight of financial obligation not only influences their current mental health but also reshapes their future aspirations.

Mental Health Challenges

Carrying large sums of student loan debt often leads to a multitude of mental health concerns. Mounting bills become a constant source of stress, contributing to feelings of worry and hopelessness.

- Anxiety over making timely payments

- Sleep disturbances due to financial stress

- Decreased self-esteem tied to debt burden

Studies suggest a strong correlation between high levels of debt and incidences of depression among young adults. It is not uncommon for millennials to report symptoms related to mental health challenges as they juggle to stay afloat financially.

The Reshaping Of Millennial Aspirations

The dreams and ambitions of an entire generation are being shaped by the towering presence of student loans. Key life milestones, such as purchasing homes or starting families, are often delayed or discarded entirely.

| Milestone | Impact of Debt |

|---|---|

| Homeownership | Savings diverted to debt repayment, impeding down payments |

| Entrepreneurship | Risk aversion due to financial instability, stifling innovation |

| Retirement Savings | Contributions postponed, compromising future security |

Financial uncertainty fuels a shift in priorities, often leading millennials to seek job security over career fulfillment. The vision of achieving personal success is frequently replaced by the pursuit of economic survival.

Policy Solutions And Debt Forgiveness

Student loan debt is a significant barrier for many millennials, preventing them from making key life moves. Thoughtful policy solutions and debt forgiveness programs could provide much-needed relief. Policymakers and experts have proposed various strategies to reduce this financial burden. These strategies range from government assistance to outright debt cancellation.

Government Interventions And Assistance Programs

To ease student loan debt, the government has rolled out several interventions:

- Income-driven repayment plans – Adjust payments based on income.

- Public Service Loan Forgiveness – Forgives loans for those in public service jobs after 120 qualifying payments.

- Teacher Loan Forgiveness – Helps educators working in low-income schools.

Still, eligible recipients must navigate a complex application process. Awareness campaigns boost participation in these programs.

The Debate Around Student Loan Cancellation

While some advocate for blanket student debt cancellation, others warn of the cost. Here’s a snapshot of the arguments:

| Pros | Cons |

|---|---|

| Boosts economy by increasing spending. | |

| Allows millennials to invest in homes and start families. | Cost to taxpayers could be substantial. |

| Can reduce the racial wealth gap. | Benefits higher earners more than low-income graduates. |

Solutions like targeted forgiveness for vulnerable groups find common ground. Debate emphasizes fair and equitable approaches.

Navigating Towards Financial Independence

Millennials face a unique financial challenge with the burden of student loan debt. This debt can delay major life milestones such as buying a home, investing, or starting a business. Yet, achieving financial independence remains possible with the right strategies.

Practical Debt Management Strategies

Tackling student loan debt requires a solid plan and disciplined execution. Here are some practical ways to take control:

- Understand Your Debt: Create a summary of all loans to see the total amount owed, interest rates, and due dates.

- Refinance and Consolidate: Reduce your interest rates and monthly payments where possible.

- Automate Payments: Avoid late fees and simplify your finances.

- Extra Payments: Apply any extra income to your principal balance to cut the debt faster.

- Budgeting: Prioritize your spending to allocate more funds towards debt reduction.

Success Stories And Inspirational Models

Proven success stories offer powerful motivation and practical insights. Meet some inspiring individuals who have conquered their student loans:

| Name | Debt Amount | Time Taken | Strategies Used |

|---|---|---|---|

| Emily | $30,000 | 3 years | Freelancing, Budgeting |

| Marcus | $45,000 | 5 years | Side Business, Debt Snowball |

| Lisa | $25,000 | 4 years | Meal Planning, Extra Shifts |

These stories illuminate the path to paying off debt and sprinting toward financial independence.

Credit: educationdata.org

Frequently Asked Questions For Student Loan Debt Stops Millennials From Moving

How Does Student Loan Debt Affect Millennials’ Mobility?

Student loan debt can limit millennials’ financial freedom, making it challenging for them to afford moving costs or security deposits. High monthly repayments can also restrict their ability to save for relocation, impacting job opportunities and homeownership prospects.

What Percentage Of Millennials Are Hindered By Student Loans?

Nearly 1 in 4 millennials report that student loan debt is the main barrier to their moving decisions. This high debt load often delays life milestones, like purchasing a home or relocating for better employment opportunities.

Can Refinancing Help Millennials Move Despite Student Loans?

Refinancing student loans may lower monthly payments, potentially freeing up funds for moving expenses. However, eligibility depends on creditworthiness and job stability. It’s crucial to weigh refinancing benefits against potential loss of federal loan protections.

How Do Student Loans Impact Millennials’ Home Buying?

Student loans increase debt-to-income ratios, making it harder for millennials to qualify for mortgages. As a result, many delay home buying or settle for less desirable homes, as significant portions of their income are tied up in loan repayments.

Conclusion

Navigating the impact of student loan debt, millennials face significant hurdles in achieving life milestones. Homeownership and relocation are often delayed due to this financial burden. It’s crucial to address these challenges to help this generation thrive. Empowering millennials financially is key for them to move forward, building their futures with confidence.