Millennials Not Buying Homes: The Student Debt Effect

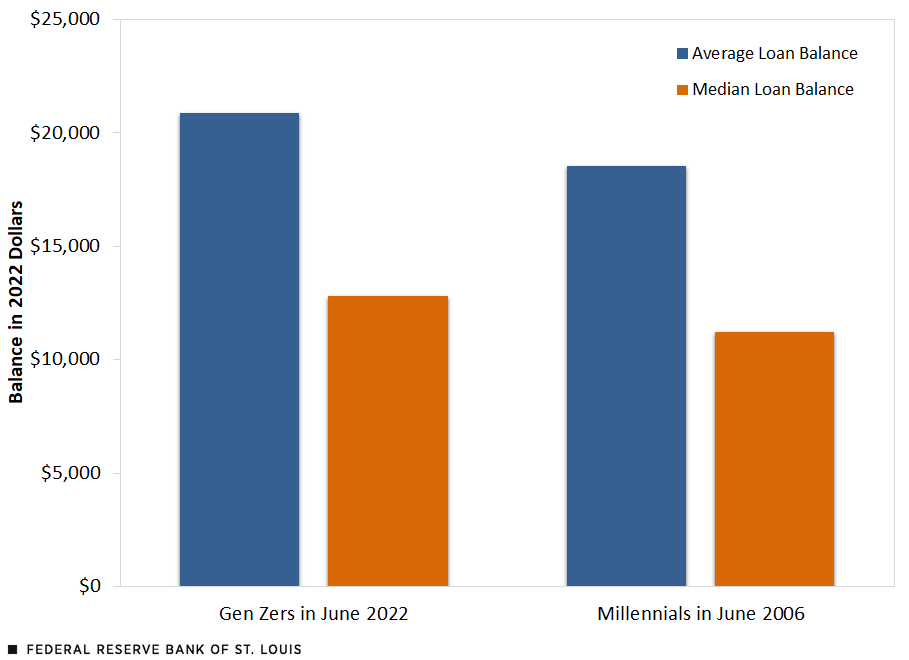

Millennials are not buying homes largely due to the burden of student debt. This financial strain limits their ability to save for a down payment.

The trend of millennials abstaining from homeownership is a complex issue rooted in economic challenges unique to their generation. With many grappling with substantial student loans, the dream of purchasing a home becomes increasingly out of reach. Consequently, this demographic often postpones or entirely foregoes this traditional milestone.

As these younger adults prioritize debt repayment, the housing market feels the impact of their financial constraints. Understanding this dynamic is crucial for industries and policymakers who aim to address the changing patterns of home buying among younger generations. This overview sets the stage for a deeper dive into the financial realities facing millennials and how it shapes the future of the real estate market.

Credit: www.stlouisfed.org

The Homeownership Gap

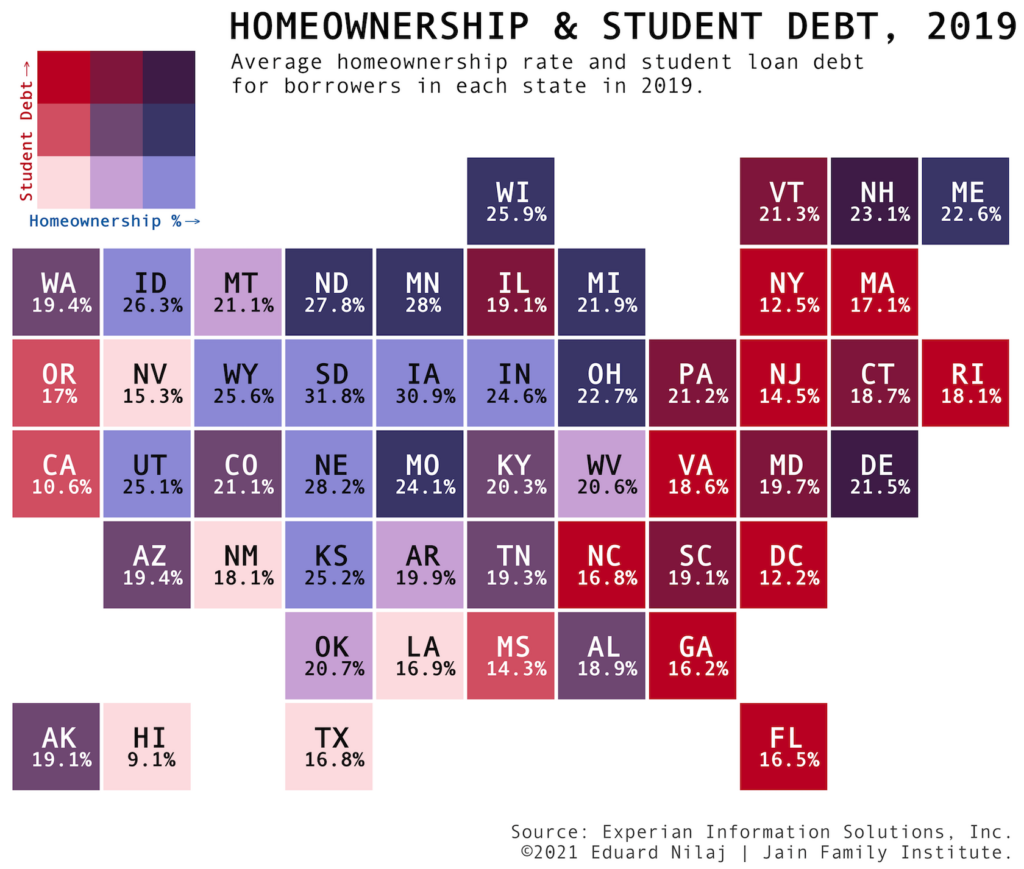

Exploring the modern housing landscape reveals a stark contrast. Millennials face unique challenges that prevent them from owning homes. Among these, student debt stands out as a significant barrier to homeownership. This has resulted in a growing gap between the expectation of owning a home and the reality for many within this generation.

Millennial Homeownership Rates

Millennials are buying homes at lower rates than previous generations. Data highlights a downward trend, with economic factors heavily influencing this shift. High levels of student debt, rising home prices, and the changing job market all play a role. These barriers lead to lower percentages of homeowning millennials.

- Student Debt Impact: Stifles saving for down payments.

- Rising Home Prices: Outpaces income growth.

- Job Market: Necessitates career flexibility and mobility.

Historical Comparison

When comparing millennials to their parents and grandparents, a distinct drop in homeownership becomes evident. At similar ages, Baby Boomers and Gen Xers owned homes at higher rates. Millennials lag behind their counterpart’s milestones. The economic environment of past decades was more conducive to early homeownership.

| Generation | Homeownership at Age 30 |

|---|---|

| Baby Boomers | 48% |

| Gen Xers | 51% |

| Millennials | 42% |

The table showcases the decline across generations, with millennials facing the steepest uphill climb to homeownership.

In summary, millennials aren’t just facing a homeownership gap; they’re navigating an entirely different real estate reality. Understanding these nuances is key to grasping the broader economic shifts at play.

Student Debt Surge

The ‘Student Debt Surge’ marks a growing problem for Millennials. It shapes their financial reality and life choices, including home ownership. Soaring student loans now prevent a whole generation from achieving what many once saw as a milestone of success. Let’s delve into the reasons and repercussions of this debt explosion.

Rising Cost Of Education

Educational expenses have skyrocketed beyond the rise in general cost of living. Tuition fees, textbooks, and living expenses pile up, leaving students with hefty debt. Below is a breakdown of average costs:

| Education Level | Average Annual Tuition Fees | Average Textbook Costs | Average Living Expenses |

|---|---|---|---|

| Undergraduate | $10,000 – $30,000 | $1,200 | $12,000 |

| Graduate | $15,000 – $40,000 | $1,500 | $15,000 |

Financial aid and scholarships help some but remain insufficient for many. Students resort to loans, starting careers in debt.

Impact On Personal Finance

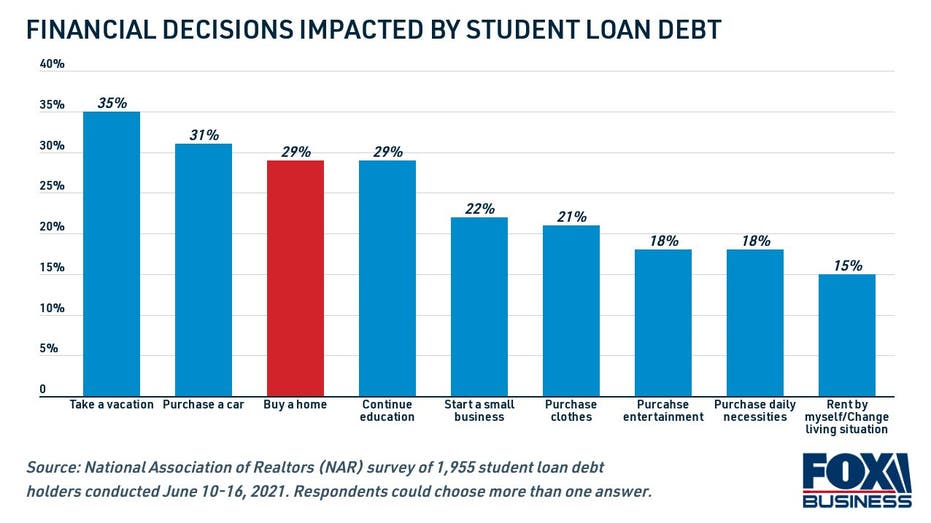

Student loans don’t just pay for education; they affect future decisions too. Below are key points illustrating their impact:

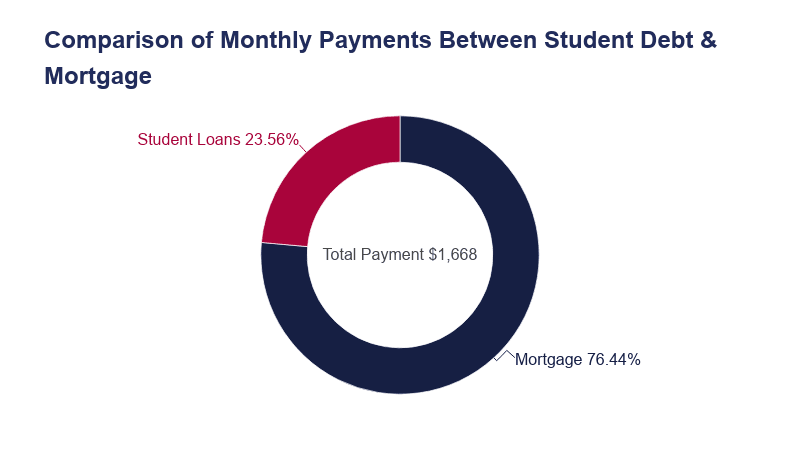

- Delayed Home Purchases: With heavy loan repayments, saving for a house becomes difficult.

- Credit Score Effects: Missed payments or defaults on student loans negatively impact credit scores.

- Tighter Budgets: Monthly repayments lead to strict budgeting, less spending on goods, and reduced economic stimulus.

- Limited Emergency Savings: Many struggle to build an emergency fund, risking financial instability during unforeseen events.

Such financial constraints shape a new economic landscape. Millennials prioritize debt over homeownership, upending prior generational trends.

Economic Aftermath

The ripple effect of student loans is significant. Millennials face a tough economic landscape. This debt hinders their ability to take traditional fiscal steps. It reverberates across the housing market. Young adults struggle to save for down payments. They grapple with credit scores impacted by large debt loads. Let’s explore two critical areas where this aftermath is most evident.

Labor Market Challenges

Millennials entered a labor market fraught with challenges. High unemployment rates post-recession left scars. They compete with more experienced workers for fewer jobs. Many accept roles below their qualifications. Student debt obligates them to prioritize immediate income over career growth.

- Increased competition for entry-level positions

- Underemployment rates higher among graduates

- Wage stagnation affects ability to repay debts

Delayed Milestones

Traditional milestones are delayed for this group. Homeownership remains a distant dream. They delay marriage and starting families. Large monthly debt payments limit saving capabilities. The impact is clear:

| Life Event | % Delayed Due to Student Debt |

|---|---|

| Home Purchasing | 45% |

| Marriage | 21% |

| Starting a Family | 26% |

Credit: www.phenomenalworld.org

Lifestyle And Values

Millennials encounter unique lifestyle and value-driven choices that greatly influence their housing decisions. Unlike previous generations, owning a home isn’t always the ultimate dream. Sky-high student debt, evolving career dynamics, and value shifts account for these new patterns. Today, we explore how these changes manifest in the living arrangements of many millennials.

Preference Shifts Among Millennials

Today’s Millennials prioritize flexibility, experience, and freedom. There’s a growing importance placed on travels, career changes, and self-growth. This often leads to delaying traditional milestones such as home ownership. Instead of a long-term investment in property, many choose pursuits that promise immediate fulfillment.

- Travel over mortgage payments

- Career mobility over property maintenance

- Financial freedom over long-term debt

The Renting Phenomenon

Renting offers a solution that fits the millennial lifestyle like a glove. The ability to relocate easily is vital for career or personal reasons. Renting also allows for living in prime locations, often closer to work and amenities. This convenience often trumps the perceived value of home ownership.

| Reasons for Renting | Benefits |

|---|---|

| Job Flexibility | Move closer to job opportunities |

| Low Upfront Costs | Avoid large down payments |

| No Maintenance Hassles | Landlords handle repairs |

| Lifestyle Freedom | Easy to change living spaces |

Renting aligns with the millennial quest for minimizing ties and responsibilities that a mortgage usually brings. As we delve deeper, the numbers and social attitudes reinforce the trend – homeownership isn’t the norm for an entire generation redefining success.

Policy And Potential Solutions

Exploring the policies and potential solutions around the issue of millennials not purchasing homes due to student debt sheds light on a vital economic challenge. These solutions aim to alleviate the financial burdens and enable home ownership for a generation weighed down by educational loans.

Loan Forgiveness Programs

Loan forgiveness programs can be a lifeline for struggling graduates. By reducing or eliminating student loan debt, these initiatives can free up income. This may transform the dream of buying a home into a reality for many millennials.

Current loan forgiveness options include:

- Public Service Loan Forgiveness (PSLF): A program for those in non-profit and government sectors.

- Income-Driven Repayment (IDR) Plans: Payments based on income and family size, with potential for loan forgiveness after a set number of years.

- Teacher Loan Forgiveness: Available to educators serving in low-income schools for a specified period.

Affordable Housing Initiatives

Affordable housing initiatives aim to make home ownership more accessible for everyone, including those with substantial student debt. These policies focus on reducing the upfront costs and ongoing expenses associated with purchasing a house.

Effective strategies include:

| Strategy | Benefit |

|---|---|

| Down Payment Assistance | Grants or low-interest loans to cover initial costs. |

| Reduced Mortgage Rates | Lower monthly payments for qualifying individuals. |

| Supportive Zoning Laws | Allowing for more affordable housing developments. |

Credit: educationdata.org

Frequently Asked Questions Of Millennials Not Buying Homes Student Debt

How Does Student Debt Affect Home Buying?

Student debt can significantly impact home buying by increasing debt-to-income ratios, making it harder for millennials to qualify for mortgages. High monthly loan payments can also reduce the amount they can afford for housing.

Are Millennials Buying Homes Less Than Previous Generations?

Yes, millennials are buying homes at a lower rate compared to previous generations at the same age. Factors like student debt, housing prices, and changing lifestyles contribute to this trend.

Can Student Loans Prevent Getting A Mortgage?

Student loans can make getting a mortgage more challenging but not impossible. Lenders consider student debt in debt-to-income calculations, which can limit mortgage size or eligibility.

What Percentage Of Millennials Own Homes?

As of recent statistics, around 47. 9% of millennials own homes. This is lower compared to the homeownership rate of baby boomers and Gen Xers when they were the same age.

Conclusion

Navigating the housing market with student debt is a millennial challenge. As we’ve explored, hefty loans dampen home-buying prospects. Yet opportunities remain for informed decision-making. Support systems and financial planning can unlock doors, literally. Millennials can redefine the American Dream, one step at a time.

Let’s embark on that journey together.