Crash Course in Identifying Premium Trading Bonds

The bond that is trading at a premium can be identified by analyzing its coupon rate and the current market interest rates. Premium refers to the bond selling price being higher than its face value.

In other words, the bond’s market price is higher than the amount that the bond should be worth. Premium bonds are usually attractive to investors who are willing to pay more to receive higher returns from a bond with a high coupon rate.

On the other hand, discount bonds are those that are worth less than their face value. Bond premium and discount rates heavily rely upon prevailing interest rates in the market. In this article, we will explore the types and characteristics of premium bonds, and how they compare to discount bonds. We will also highlight various factors that cause bonds to trade at a premium and their significance in bond pricing.

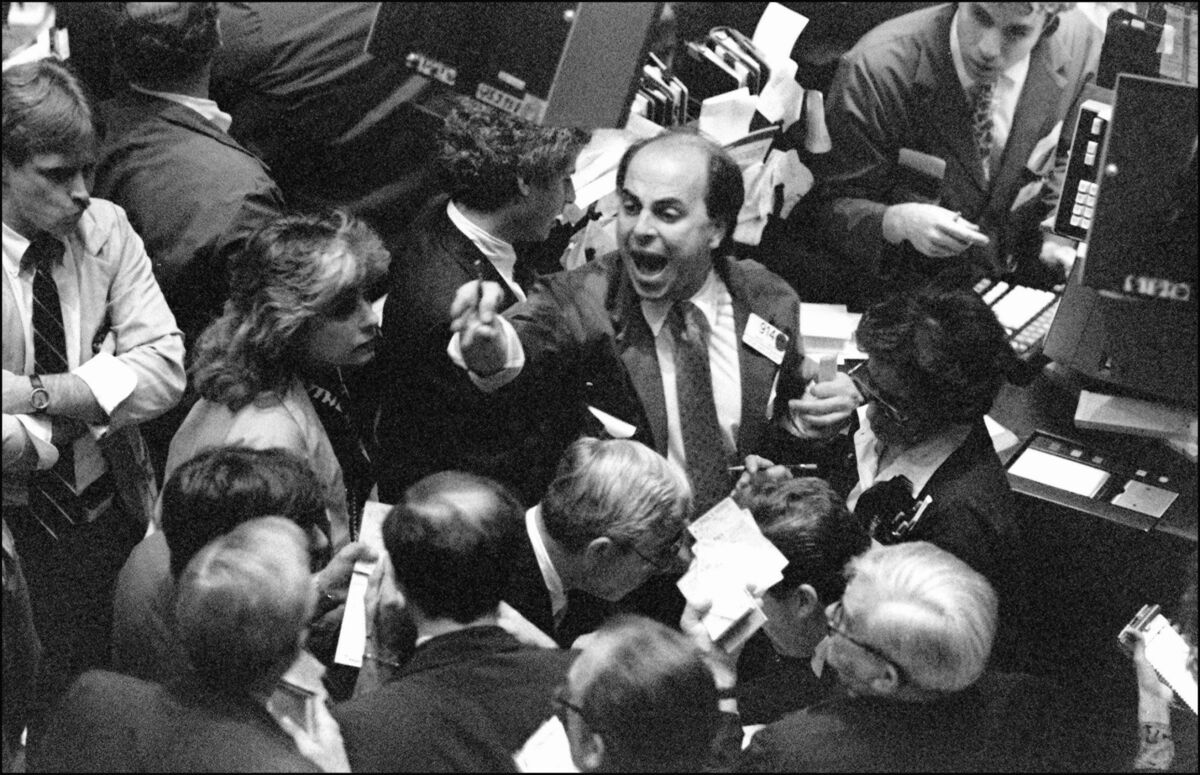

Credit: www.bloomberg.com

What Are Premium Trading Bonds?

Premium trading bonds are a unique type of bond that investors should closely consider. These bonds trade at a higher price than their face value, and they offer a higher yield than other types of bonds. Let’s dive into what premium trading bonds are and why they are important for investment.

Definition Of Premium Trading Bonds And How They Differ From Other Types Of Bonds

Premium trading bonds are bonds that are offered for a price higher than their face value. When investors purchase these bonds, they are paying more than the bond’s stated value to receive the predetermined interest payments.

Premium trading bonds differ from other types of bonds, such as discount bonds and par bonds, because they are priced higher than their face value. Discount bonds, on the other hand, are priced lower than their face value, while par bonds are priced exactly at their face value.

What makes premium trading bonds stand out is their higher yield compared to other bonds. This yield is calculated by dividing the bond’s coupon payment by its market price.

Importance Of Premium Trading Bonds In Investment

Premium trading bonds are essential for investors because they offer higher returns than other types of bonds. Here are some other reasons why premium trading bonds are important in investment:

- Diversification: Investing in premium trading bonds can diversify an investor’s portfolio, protecting them from market volatility.

- Predictable income: Because premium trading bonds pay a higher yield, investors can predict how much income they will receive from these bonds.

- Safe investment: Premium trading bonds are considered a safe investment because they are often backed by governments or corporations with solid credit ratings.

Premium trading bonds are a valuable investment option for those looking for higher yields and a safe investment. With their unique structure, they offer many potential benefits for investors looking to diversify their holdings.

Factors Involved In Identifying Premium Trading Bonds

Premium bonds are bonds that trade at a higher price than their face value, mostly due to higher interest rates or higher credit ratings. It is essential to identify premium bonds for investors to make wise investment decisions. Several factors come into play when identifying premium trading bonds.

Analysis Of The Different Factors That Come Into Play When Identifying Premium Trading Bonds

Several factors come into play when identifying premium trading bonds. These factors include market indicators, economic factors, credit ratings, and the yield curve. Investors must pay close attention to these factors to identify premium bonds and invest their money wisely.

The Role Played By Credit Ratings In Identifying Premium Trading Bonds

Credit ratings are an essential factor in identifying premium trading bonds. A credit rating is an assessment of the creditworthiness of a bond issuer and their ability to meet financial obligations. Bonds with high credit ratings usually trade at a premium, as investors are willing to pay a higher price for the perceived safety and reliability of the issuer.

The Role Played By The Yield Curve In Identifying Premium Trading Bonds

The yield curve is another critical factor in identifying premium trading bonds. A yield curve is a graphical representation of interest rates for bonds with different maturities. When the yield curve is upward sloping, the bonds with longer maturities have higher yields than those with shorter maturities.

In this situation, long-term bonds usually trade at a premium, as investors expect higher returns due to the risks associated with longer-term investments.

The Role Played By Other Market Indicators In Identifying Premium Trading Bonds

Other market indicators such as inflation, economic growth, and interest rates can also impact the trading price of bonds. These indicators affect the demand and supply of bonds in the market, which can lead to the price of premium bonds.

For instance, if the inflation rate is high, investors may be willing to pay a higher price for bonds that offer a higher interest rate, thus leading to a premium trading price.

Identifying premium trading bonds is essential for investors to make wise investment decisions. By paying close attention to the factors mentioned above, investors can make informed decisions and take advantage of the benefits of premium trading bonds.

Strategies For Identifying Premium Trading Bonds

Premium trading bonds refer to bonds that are trading above their face value or par value. These bonds are attractive to investors because they offer a higher yield compared to bonds trading at face value or discount. As an investor, it is crucial to identify premium trading bonds to make informed investment decisions.

In this section, we’ll discuss different investment strategies that can be employed to identify premium trading bonds and analyze the advantages and disadvantages of each strategy.

Discussion Of Different Investment Strategies That Can Be Employed To Identify Premium Trading Bonds

Yield Curve Strategy

- Identify the shape of the yield curve

- Look for bonds trading above the curve

- Buy bonds that offer a yield-to-maturity higher than the yield curve rate

Credit Spread Strategy

- Identify the credit rating of the issuer

- Compare the yield of the bond to the yield of a treasury bond with the same maturity

- Buy bonds that offer a higher yield than the treasury bond

Industry Strategy

- Identify the performance of an industry

- Look for bonds issued by companies in the industry that are trading at a premium

- Buy bonds that offer a yield higher than the industry average

Analysis Of The Advantages And Disadvantages Of Each Strategy

Yield Curve Strategy

Advantages:

- Helps to identify long-term trends in interest rates

- Provides a clear picture of the market

Disadvantages:

- Ignores credit risk in bond selection

- Assumes that interest rates will remain constant

Credit Spread Strategy

Advantages:

- Incorporates credit risk in bond selection

- Compares bond yield to a risk-free asset

Disadvantages:

- Assumes that treasury bonds are risk-free

- Doesn’t account for market trends

Industry Strategy

Advantages:

- Helps to identify bonds in specific industries

- Incorporates market trends in bond selection

Disadvantages:

- Ignores credit risk in bond selection

- Assumes that all companies in the industry have similar credit risk levels

There are different investment strategies that an investor can employ to identify premium trading bonds. However, each strategy comes with its advantages and disadvantages, and it is essential to understand them before investing in premium trading bonds. As a result, investors can make informed investment decisions and optimize their bond investments.

Risks Involved In Trading Premium Trading Bonds

Trading bonds that offer a premium yield could be an enticing proposition for many investors. However, like all investment instruments, premium trading bonds have their own share of risks. It is essential to identify these potential risks and take necessary measures to avoid them.

In this section, we will discuss the possible risks of trading premium trading bonds and how to mitigate them.

Identification Of Potential Risks Involved In Trading Premium Trading Bonds

Before investing in any investment instrument, it is mandatory to conduct thorough research and assess the risks involved. Here are some of the potential risks of trading premium trading bonds that you must consider:

- Default risk: There is always a chance of default from bond issuers. The issuer may be unable to repay the principal invested. This can lead to a potential loss for investors

- Interest rate risk: The majority of bonds are susceptible to changes in interest rates. When the market interest rates rise, the value of the bond declines. This is especially true with premium trading bonds

- Inflation risk: The fixed income provided by the bonds may be insufficient to maintain purchasing power in the face of inflation

- Prepayment risk: Firms may choose to repay their high-yield bonds before maturity, resulting in a loss in opportunity for investors as well as a call premium, which is the amount paid over par value at the time of calling

Explanation Of How To Mitigate These Risks

Mitigating risks involved in investing in premium trading bonds is only possible if investors have a good understanding of the risks and have been following the market closely. Here are some of the essential measures you can take to mitigate the mentioned risks:

- Diversification of portfolio: Investors can minimize risks by diversifying their portfolios with different types of bonds, maturities, and credit ratings. This minimizes the exposure to any single bond or issuer

- Asset allocation: Asset allocation is critical to mitigate risks within a portfolio. One can invest in low-risk assets such as money market funds or savings while allocating a small fraction of the portfolio to premium trading bonds

- Monitor interest rates: Monitoring interest rates can provide early warning signals to investors. Higher interest rates may result in a decline in the bond’s value, while lower interest rates can drive the bond’s price up

- Stay attuned to market indicators: Monitoring credit ratings and the overall performance of the market is crucial. Credit ratings changes can have significant implications for a bond’s value

- Use professional financial advisors: Investors are advised to seek the guidance of professional financial advisors. Advisors can provide valuable insights into mitigating risks and design a customized investment strategy.

Ultimately, investors should thoroughly research and take into consideration all the potential risks involved in trading premium trading bonds. Investors must be vigilant and adopt a proactive approach to mitigate these risks.

Frequently Asked Questions Of Which Of The Following Bonds Is Trading At A Premium

Which Bonds Are Trading At A Premium?

Some bonds are trading at a premium if their coupon rate is higher than the current market interest rate.

What Is The Difference Between Premium And Discount Bonds?

Premium bonds are those whose price is above their face value, while discount bonds are priced below face value.

Why Do Bonds Trade At A Premium Or Discount?

Bonds may trade at a premium or discount based on changes in interest rates, credit risk, or market demand.

What Are The Benefits Of Investing In Premium Bonds?

Investing in premium bonds can offer a higher yield compared to other investments, especially if interest rates remain low.

Conclusion

It is crucial for investors to understand how bonds trading at a premium differ from those trading at a discount. A bond trading at a premium means the market value of the bond is higher than its face value, while a bond trading at a discount means the market value is lower.

The bond’s coupon rate and yield to maturity also play a significant role in determining its premium or discount status. In this blog post, we looked at the three types of bonds: zero-coupon bonds, convertible bonds, and high-yield bonds, and discussed which of them is most likely to trade at a premium.

Generally, high-yield bonds are more likely to trade at a premium due to their attractive returns and lower credit risk. Financial advisors recommend investors to study the bond’s features, underlying securities, and market trends before investing in bonds trading at a premium.