What is Dom in Trading: A Comprehensive Guide

The dom in trading stands for the “depth of market.” It is a real-time display that shows the quantity of buy and sell orders at different prices for a particular security or commodity.

As a trader, being able to analyze the dom is crucial to understand the market’s supply and demand. The depth of market provides traders with the flexibility to tweak their trading strategies accordingly. Understanding the dom can help traders to determine the most crucial price levels and quickly identify potential trading opportunities.

It is an essential tool for active traders who engage in short-term market speculation and scalping. Additionally, analyzing the dom allows traders to assess the market’s liquidity, which can influence trading decisions. Therefore, it’s essential for traders to have an in-depth knowledge of dom, how to read and interpret it to make successful trading decisions.

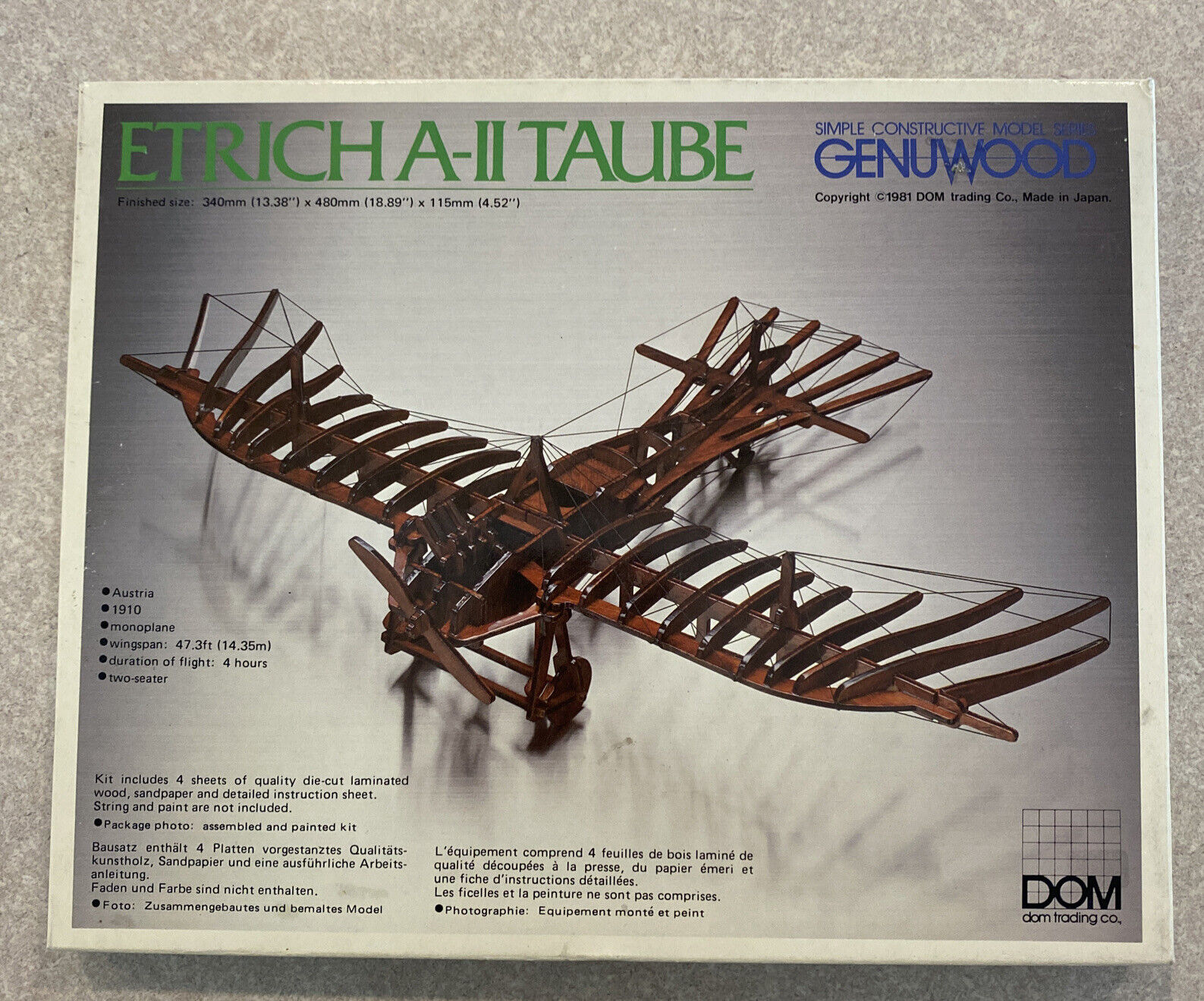

Credit: www.ebay.com

Understanding Order Flow

What Is Dom In Trading?

Do you want to gain an edge in trading? Then it is crucial to understand the dom or depth of market. The dom displays the best bid and ask prices of a financial instrument along with their corresponding volumes. If you are a trader, you can use this information to observe the order flow and determine the market sentiment, identify entry and exit points, and manage your trades effectively.

Definition Of Order Flow

The order flow refers to the buying and selling activities of market participants at each price level. By analyzing the order flow, traders can understand the market dynamics and anticipate future price movements. The order flow consists of market orders, limit orders, and stop orders.

Order Types

Limit Orders

A limit order is an order to buy or sell an asset at a specific price or better. For example, if the current price of an asset is $100, and you want to buy it when it goes down to $95, then you can place a limit buy order at $95.

Once the market reaches $95, your limit order will execute. Limit orders are useful for traders who want to control the price of their orders and avoid slippage.

Market Orders

A market order is an order to buy or sell an asset at the current market price. When you place a market order, your order will execute immediately at the prevailing market price. Market orders are useful for traders who want to enter or exit a trade quickly and do not care about the price.

Stop Orders

A stop order is an order to buy or sell an asset when the market reaches a specific price. For example, if you have a long position in an asset and want to limit your losses, you can place a stop sell order at a specific price.

If the market falls to that price, your stop order will execute, and your position will be closed. Stop orders are useful for traders who want to limit their losses or lock in their profits.

Understanding the order flow and different order types is crucial for trades to execute effective trades and manage them efficiently. Utilizing dom in order to recognize buying and selling activities of market participants, as well as order flow data can be useful in determining market trends and potential future market movements.

Introduction To Depth Of Market (Dom)

Definition Of Dom

Depth of market (dom) is a trading indicator that displays the pending orders or buy/sell limit orders for a particular instrument. It shows the total volume of open buy and sell orders at different price levels. Dom is useful for traders who want to determine the current market sentiment, potential support and resistance levels, as well as identify the ideal entry and exit points for their trades.

Difference Between Level 1 And Level 2 Market Data

Market data refers to the real-time or delayed information about the current trading activity of a particular instrument. Level 1 market data provides basic trading information, such as the latest prices, bid-ask spread, and volume. On the other hand, level 2 market data provides more detailed information, including the total volume of open buy and sell orders, the price levels of these orders, and the traders who placed them.

In short, while level 1 only shows the best bid and ask prices, level 2 provides traders with a more realistic view of the market.

How Order Book Works

The order book displays all the bids and asks that traders have placed for a particular instrument at every given moment. When a trader wants to buy an instrument, he or she will place a bid order. Conversely, when a trader wants to sell an instrument, he or she will place an ask order.

The order book will organize these orders in price and time priority. The buy orders with the highest price for a particular instrument will appear at the top of the book, and sell orders with the lowest price will appear at the bottom.

The orders in between will be ranked in order of price priority, with the highest bid and the lowest ask creating the bid-ask spread.

Now that you understand the basic concepts of dom and order book, you can use this knowledge to help you make better trading decisions. By analyzing dom data, you can identify support and resistance levels, as well as determine the overall market sentiment.

Combining it with the order book data can give you a clearer view of the market and help you develop a more effective trading strategy.

Analyzing The Dom

When it comes to trading, it is essential to keep up with the current market situation to make informed decisions. One of the crucial tools used by traders worldwide is the dom, or depth of market. The dom enables traders to view real-time order book data, displaying the buy and sell orders on an exchange.

It provides valuable insights into the market’s supply and demand, allowing traders to analyze market trends, and make informed trading decisions.

How To Read The Dom

Reading the dom provides traders with vital information to predict market trends. Here are some essential elements that you need to understand when interpreting data from the dom:

- The bid and ask columns: The dom contains two columns, with the bid prices on the left and ask prices on the right. The bid column displays the buyers’ demand levels, while the ask column displays the sellers’ supply levels.

- The bid and ask quantity: Next to each price is the quantity. This quantity shows how many contracts are available for purchase or sale at that specific price level.

- Colors: The dom incorporates colors to display the price levels according to their movement. Red indicates a price drop, while green means that the price has increased.

- The trades: The dom also displays the number of trades that have taken place at each price level.

Concept Of Bids And Asks

In trading, bids and asks are the foundation of the market. Here’s a brief overview of what bids and asks are:

- Bids: Bids are the prices buyers are willing to pay to purchase an asset.

- Asks: Asks, also known as offers, are the prices sellers are looking to receive by selling an asset.

When buyers and sellers agree on a price, a trade occurs, and the market moves. The dom’s bid and ask columns show the supply and demand levels at different price levels, providing traders with vital information about market trends.

Order Book Visualization

The dom displays order book visualization, representing the total bid and ask quantities. The order book shows the different prices and quantity levels, giving traders the ability to identify significant demand and supply zones. By analyzing order books, traders can identify price movements, market trends, and potential reversal points.

A trader who knows how to analyze the dom can make informed decisions about trading. The dom provides the traders with insights into market trends and allows them to make profitable trades. Understanding the concept of bids and asks and interpreting the order book visualization is crucial for successful trading.

Dom Trading Techniques

Trading can be a challenging activity, especially when you’re dealing with high-frequency trading. Dom or depth of market is a tool that displays the market’s depth and can assist traders in making informed trading decisions. Dom trading techniques help traders to understand the market by observing the order books and how they behave.

In this section, we’ll explore how traders can use dom trading techniques to optimize their trading.

Picking The Right Dom Data Feed

Many trading platforms offer dom as a tool to monitor market depth, but not all doms are created equal. As a trader, you need a reliable and high-quality dom data feed that updates in real-time to help you make informed decisions.

Here are some factors to consider when choosing the right dom data feed:

- Data accuracy

- Execution speed

- Data transparency

- Data customization options

Scalping With Dom

Scalping is a popular trading strategy with traders trying to make small profits repeatedly. Trading with dom can provide traders with an advantage when scalping in the market. Here’s how you can use dom trading techniques to optimize your scalping strategy:

- Identify support and resistance levels.

- Monitor market depth to identify buying and selling pressure.

- Use limit orders to enter and exit trades quickly.

Dom Trading With Large Orders

Order flow is essential when trading with large orders. Dom trading techniques can provide traders with an edge when dealing with large volumes of trades. Here are some techniques you can use:

- Monitor the order flow and trading volume to understand the market’s sentiments.

- Use trailing stops to maximize profits.

- Optimize your trading strategy by adjusting your dom settings to fit your specific trading style.

Dom trading techniques can help traders understand market depth and make informed trading decisions. By selecting the right dom data feed, utilizing scalping techniques, and dealing with large orders appropriately, traders can optimize their trading strategy and increase their chances of success.

Trading Dom With Indicators

If you are a day trader, then you are probably familiar with the concept of dom (depth of market). It displays the number of buy and sell orders for an asset at different price levels. However, dom trading is not as simple as it seems, and many traders use various indicators to gain an edge.

Using Volume Indicator With Dom

The volume indicator is the most common technical indicator used in dom trading. It shows the total number of shares or contracts traded for an asset within a specific period. Below are some key points to remember:

- When the volume spikes in the dom, it indicates that many traders are interested in a particular price level. That implies the price is likely to move in that direction.

- Low volume in the dom can indicate a lack of interest in the asset at that price point. Traders may want to wait for increased volume before making a trade.

- A sudden increase in the volume at a particular price level can indicate a trend reversal. Traders can use this information to enter or exit a trade.

Other Technical Indicators In Dom Trading

Besides the volume indicator, traders can use several other technical indicators to enhance their dom trading experience. Some of the popular indicators are:

- Moving averages: It is a trend-following indicator that smooths out the price data by calculating the average of the closing price for a specific period. Traders use it to identify market trends and support and resistance levels in the dom.

- Relative strength index (rsi): It measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the dom.

- Bollinger bands: These are bands plotted two standard deviations away from a simple moving average. Traders use it to determine the volatility of an asset in the dom.

Incorporating technical indicators in dom trading can help traders make informed decisions and identify potential opportunities. However, it’s essential to remember that no indicator can guarantee profits, and traders must use them with caution.

Automated Trading Using Dom

Automated Trading Using Dom: Introduction To Algo Trading With Dom

Trading financial instruments using automated trading systems is a popular trend among traders globally. Automated trading using the dom, also known as the depth of market, is a more advanced type of algorithmic trading that can enhance trading performance. In this section, we will explore the basics of automated trading and the different types of algorithmic trading using the dom.

Automated trading basics:

- Automated trading is a form of trading that uses computer programs to perform trading activities automatically. It is also known as algorithmic trading or algo trading.

- Automated trading relies on a set of predetermined rules or mathematical models to analyze market data and initiate trades.

- Automated trading systems can continuously monitor the market for trading opportunities, and execute trades with greater speed, precision, and accuracy than manual trading.

Types of algo trading using dom:

1. Volume Weighted Average Price (Vwap) Trading

Vwap is a popular algorithmic trading strategy that uses a mathematical formula to determine the average price of a security based on its volume. Vwap trading can help traders to execute trades at a better price and reduce slippage.

2. Time Weighted Average Price (Twap) Trading

Twap is a trading strategy that aims to execute trades at regular intervals throughout the trading session. This algorithmic trading strategy can help traders achieve better execution prices during volatile market conditions.

3. Iceberg Order Trading

Iceberg orders are used by traders to split large orders into smaller orders to avoid market impact and signaling risk. The automated trading systems using the dom can execute iceberg order trading with ease.

4. Stop Loss Order Trading

Stop-loss orders are a type of order that allows traders to automatically sell a security when it reaches a certain predetermined price level. The dom can automatically execute stop-loss orders with high accuracy, reducing the risk of slippage.

Automated trading using the dom is a highly advanced form of algorithmic trading that can significantly enhance trading performance. With the different types of algorithmic trading strategies available, traders can choose the one that best suits their trading style and take advantage of market efficiencies while mitigating risk.

Dom And Market Microstructure

Market microstructure refers to market participants, rules, and trading systems that determine how financial assets are priced and traded. The order book, a central component of market microstructure, consists of all limit orders made by market participants and provides insights into the order flow.

Dom, or the depth of market, refers to the visual representation of the order book that displays the outstanding orders to buy and sell a financial asset at various prices. Understanding the relationship between dom and market microstructure is essential for successful trading in financial markets.

Link Between Dom And Liquidity

Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. The dom provides valuable information on the liquidity of a financial asset as it displays the number of buy and sell orders at various prices.

Higher liquidity means that there is significant buy and sell activity at a particular price level, and trading at that level is more likely to be executed quickly. In contrast, higher liquidity dispersion indicates a lack of demand or supply at a particular price level, causing price movements and potentially unfavorable trading conditions.

Understanding Order Book Imbalance

The order book’s imbalance occurs when there are more sell or buy orders at a particular price level, causing price movements to occur. Imbalance is the underlying force that drives price movement in financial markets. It often creates trading opportunities for traders who can leverage orders to buy or sell once there is an order book imbalance.

Traders who understand how to read the dom can forecast price movements effectively and take advantage of market imbalances.

Order Flow Trading

Order flow trading involves using the information provided by the dom to identify market imbalances and execute trades based on the order flow. Traders who use order flow trading analyze the order flow and infer an asset’s future price movements.

They use a combination of price action and order flow to coach a trading decision aimed at taking advantage of market imbalances and customizing their trading strategies based on their unique appetite for risk.

Dom is a tool for traders to analyze market microstructure and make better trading decisions. By understanding how to read the dom, traders can forecast price movements actively, making it a vital tool for all types of trading, whether you are a day trader, swing trader, or long-term investor.

Dom And Trading Psychology

Understanding Market Sentiment Via Dom

Depth of market (dom) is a trading tool that provides insight into market sentiment and price action. By analyzing the flow of orders (bids and offers) at different price levels, dom can help traders make informed decisions. Here are some key points to remember when using dom to understand market sentiment:

- Dom displays real-time order book data showing the number of buyers and sellers at various price levels.

- Traders can use dom to identify areas of support and resistance, which helps them determine where to place stop loss and take profit orders.

- Dom can help traders identify the prevailing market sentiment. For example, if there are more buyers at a particular price level, it suggests bullish sentiment, while more sellers suggest bearish sentiment.

Impact Of Emotions On Dom Trading

Trading psychology plays a crucial role in successful trading, and dom is no exception. Emotions such as fear and greed can cause traders to make irrational decisions, leading to losses. Here are some key points to remember when using dom to manage emotions:

- Dom can help traders make disciplined trading decisions based on objective data rather than emotions.

- Fear can cause traders to panic and exit trades prematurely. Dom can help traders identify areas of support where buyers may come in, allowing them to stay in profitable trades longer.

- Greed can cause traders to hold onto losing positions for too long. Dom can help traders identify areas of resistance where sellers may weigh in, prompting them to cut losses and exit trades before they worsen.

Keeping Trades Disciplined Via Dom

Discipline is essential for successful trading, and dom can help traders stay disciplined by providing objective data. Here are some key points to remember when using dom to keep trades disciplined:

- Dom can help traders identify areas of congestion where price may move sideways, prompting them to avoid entering trades.

- Dom can help traders identify areas of liquidity where price may move rapidly, prompting them to enter trades with caution.

- Dom can help traders set realistic profit targets based on areas of resistance and support, and avoid chasing unrealistic gains.

Using dom in trading requires discipline and an understanding of trading psychology. By analyzing market sentiment, managing emotions, and staying disciplined, traders can use dom to make informed decisions and succeed in the markets.

Frequently Asked Questions On What Is Dom In Trading

What Is Dom In Trading?

Dom, or depth of market, is a trading tool that displays the volume and price levels for buying and selling assets.

How Does The Dom Work?

The dom displays real-time data on available buy and sell orders, allowing traders to make informed decisions on their trades.

Why Is Dom Important In Trading?

The dom is important because it provides transparency and helps traders to see the current state of the market and make better-informed decisions.

How Can You Use Dom To Trade?

Traders can use the dom to identify trends and entry and exit points, gauge market sentiment, and execute trades with greater efficiency and accuracy.

Conclusion

To sum up, depth of market (dom) is an essential tool for traders who want to make informed decisions in the financial markets. It provides real-time information on the market depth and liquidity, allowing traders to see the buy and sell orders of other market participants.

Dom helps traders to analyze and interpret market activity, identify possible trends, and make profitable trading decisions. By utilizing dom, traders can have a better understanding of the overall market sentiment, increasing their chances of making profitable trades. Dom offers a transparent view of the market, enabling traders to trade with confidence and manage their risk effectively.

With the right knowledge and skillsets, traders can take advantage of dom to gain a competitive edge in the financial markets.