What is Cvd in Trading: Everything Traders Need to Know!

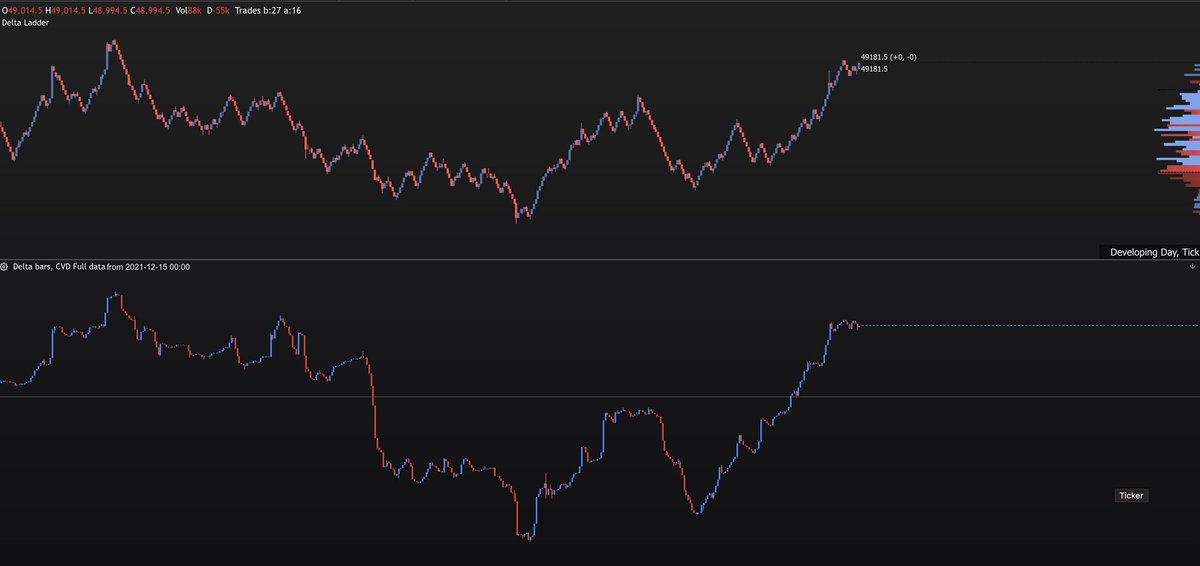

Cvd stands for ‘cumulative volume delta’ in trading. It is a technical analysis tool used to measure the buying and selling pressure in the market.

Cvd is a popular trading indicator used by traders to better understand the market’s trends. The tool measures the difference between the buying and selling trend by calculating the cumulative volume of up (buying) and down (selling) ticks. This provides traders with insights into market direction, momentum, and trend analysis.

Cvd is commonly used in combination with other trading indicators to confirm market trends and make informed trading decisions. As such, cvd is a valuable tool for both beginner and experienced traders seeking to maximize profits with a data-driven approach. In this article, we will go into further detail about cvd and how it works in trading.

Credit: twitter.com

What Is Cvd In Trading: Everything Traders Need To Know!

What Is Cvd In Trading

In trading, cvd stands for cumulative volume delta, which refers to the difference between the total volume of orders initiated by buyers and the total volume initiated by sellers. Understanding cvd is essential for traders as it can provide insights into market trends and allow traders to make informed trading decisions.

Define Cvd In Trading

- Cvd in trading refers to the cumulative volume delta.

- It’s the difference between the total volume of orders from buyers and the total volume of orders from sellers.

- Cvd can provide insights into market trends and help traders make informed trading decisions.

Explain The Reasons Why It Occurs

- Cvd occurs because each trade consists of a buyer and a seller.

- The volume of orders initiated by buyers and sellers determines the price of the asset, and the difference between the two volumes is the cvd.

- Cvd can be positive or negative, indicating whether buyers or sellers are dominating the market.

Discuss The Impact Of Cvd On Trading

- Cvd can help traders identify market trends and provide insights into market sentiment.

- A positive cvd indicates that buyers are dominating the market, which can be seen as a bullish sign. Conversely, a negative cvd indicates that sellers are dominating the market, which can be seen as bearish.

- Traders can use cvd as part of their analysis to determine whether to buy or sell an asset.

Understanding cvd in trading is essential for traders, as it can provide valuable insights into market trends and allow traders to make informed trading decisions. By analyzing the cumulative volume delta, traders can identify market sentiment and determine whether to buy or sell an asset.

Types Of Cvd In Trading

Cvd or cash vs. Derivative is a technique used in trading that involves the use of both cash and derivative instruments in a single trade. This method is used to protect against losses and to take advantage of favorable market conditions.

Cvd trades are popular because they offer flexibility, liquidity, and diversification in a single transaction. We will explore the different types of cvd in trading and explain their characteristics, similarities, and differences.

Introduce The Different Types Of Cvd In Trading

Cvd trades are classified into four different types, namely:

- Long cash, short derivative (lcsd)

- Short cash, long derivative (scld)

- Long cash, long derivative (lcld)

- Short cash, short derivative (scsd)

Each type has its unique characteristics and advantages.

Explain Each Type In Detail

- Long cash, short derivative (lcsd)

- In an lcsd trade, an investor purchases a long position in a security with cash and takes a short position in its derivative.

- The aim is to protect the cash position against a fall in the underlying asset’s value while allowing the trader to benefit from a rise in price.

- For instance, if an investor buys 100 shares of a stock at $50 per share and sells 100 call options on the stock at $6 per contract, the investor has established an lcsd trade.

- Short cash, long derivative (scld)

- In an scld trade, the investor takes a short position in a cash security and a long position in its derivative.

- This method is used to exploit market conditions, with the hope of profiting from both the fall and rise in prices.

- For instance, assume an investor sells short 100 shares of a stock at $20 and buys 100 put options on the same stock at $3 per contract. The investor has established an scld trade.

- Long cash, long derivative (lcld)

- An lcld trade involves taking a long position in both the cash security and its derivative.

- This method is used to leverage an investor’s position in a stock while still maintaining a level of protection against losses.

- For example, assume an investor simultaneously buys 100 shares of a stock at $40 and 100 call options on the same stock at $5. The investor has established an lcld trade.

- Short cash, short derivative (scsd)

- An scsd trade involves shorting both the cash security and its derivative.

- This method is used to profit from a decline in the underlying’s price while also reducing risk exposure.

- For instance, assume an investor short sells 100 shares of a stock at $30 and also sells 100 put options on the same stock at $4. The investor has established an scsd trade.

Highlight The Similarities And Differences Between The Types

- The primary similarity between the types of cvd trades is that they all use both cash and derivative instruments to manage risk and potential returns.

- The principal difference is in the specific combination of positions they use to achieve their goals.

- Lcsd and scld trades differ in their attitude towards the underlying stock or security, with lcsds being optimistic and sclds being pessimistic.

- Lcld trades offer a higher level of leverage, whereas scsd trades offer more protection against losses.

Cvd trades are a complex yet effective way to reduce risk exposure and diversify a portfolio while taking advantage of market conditions. Understanding their different types and how they work is an essential aspect of successful trading.

Managing Cvd In Trading

Cvd, or continuous value derivatives, is a critical aspect of trading that every trader must effectively manage to be profitable. It is the calculation of the interest rate charged on the margin loans taken by a trader to carry their positions overnight.

Factors that affect cvd include the amount of borrowed funds, the prevailing interest rates, and the length of time that the trader holds on to their position. In this section of the blog post, we will focus on the importance of managing cvd in trading, the different ways traders can manage it, and practical tips for managing it effectively.

Discuss The Importance Of Managing Cvd In Trading

Managing cvd in trading is essential because it has a direct impact on a trader’s profits or losses. If the cvd charge exceeds the profit from a position, a trader may end up losing money even though their position made a profit.

Therefore, managing cvd helps traders minimize the risk of loss and increase their profitability. Additionally, managing cvd has the following benefits:

- Avoiding the accumulation of charges on unprofitable trades

- Helping traders optimize their margin and leverage ratios

- Helping traders better understand their trading costs and plan their strategies accordingly.

Highlight The Different Ways Traders Can Manage Cvd

Traders can use several strategies to manage cvd, depending on their personal preferences and trading goals. Here are some popular cvd management techniques:

- Trade shorter timeframes to reduce the duration of the position and, therefore, the cvd charges.

- Use stop-loss orders to protect trades from sudden price fluctuations and limit potential losses, consequently reducing cvd charges.

- Choose a trading platform that offers low cvd charges and margin requirements.

- Only hold profitable positions overnight, and close out unprofitable positions before market close to avoid unnecessary cvd charges.

- Maintain a balance between the size of the position and available capital, ensuring the cvd charges do not exceed potential profits.

Provide Practical Tips For Managing Cvd

To effectively manage cvd, traders should follow these practical tips:

- Always consider the cvd charges when opening and closing positions and factor it into profit and loss calculations.

- Keep an eye on the interest rates and fluctuations, as cvd charges can increase during high volatility periods.

- Avoid holding overnight losing positions to prevent incurring additional cvd charges.

- Always use leverage wisely, ensuring that the potential profits outweigh the cvd fees.

- Carefully monitor margin requirements and available balances to ensure that cvd charges do not result in margin calls.

Managing cvd in trading plays a crucial role in your potential profitability. By implementing effective strategies and practical tips, traders can optimize their trading costs and maximize their earnings.

Frequently Asked Questions On What Is Cvd In Trading

What Is Cvd In Trading?

Cvd is the cost of carry, volatility and dividend. It’s used to calculate the price of futures.

How Is Cvd Used To Calculate Futures Prices?

Cvd takes into account the cost of holding a futures contract, the volatility of the underlying asset, and any dividends that may be paid. By factoring in these variables, cvd can help calculate the fair price of a futures contract.

What Are The Benefits Of Using Cvd In Trading?

Using cvd can help traders determine the fair value of futures contracts, which can help them make more informed decisions about when to buy or sell. It’s also a useful tool for hedging against price changes in the underlying asset.

How Important Is Cvd In Futures Trading?

Cvd is a crucial component of futures trading because it helps traders determine the fair price of a contract. Without taking into account the cost of carry, volatility, and dividends, traders may not be making the best decisions.

Conclusion

To sum up, cvd or current value to daily range is a technical tool that measures volatility and risk in the market. It helps traders and investors to assess the potential profit and loss before making a trade. Cvd is a simple yet powerful trading indicator that can be used on stocks, options, futures, and forex.

By understanding how cvd works, traders can make better and informed decisions and manage risk effectively. Although cvd is not a guarantee for success, it is a valuable tool for any trader who wants to improve their trading performance. It is important to remember that trading involves risk, and understanding and utilizing the proper tools is essential to achieve success.

So, if you are a serious trader looking to enhance your trading strategy, be sure to include cvd in your arsenal of tools and don’t forget to keep your emotions in check. Happy trading!