What is Cryptocurrency: An In-Depth Guide

Cryptocurrency has been making waves in the financial world since its creation in 2009. Initially, it was seen as a niche market for tech enthusiasts, but now it’s become a mainstream topic in finance and investment. Despite its growing popularity, many people still don’t understand what cryptocurrency is, how it works, and why it’s important. In this article, we’ll provide a comprehensive guide to help you understand cryptocurrency and how it’s changing the financial landscape.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. Unlike traditional currencies, cryptocurrency operates on a decentralized platform and is not controlled by a single entity. This decentralization makes it more secure and resistant to manipulation and fraud.

The first and most well-known cryptocurrency is Bitcoin, created by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Since then, thousands of other cryptocurrencies have been created, each with their own unique features and uses.

How Does Cryptocurrency Work?

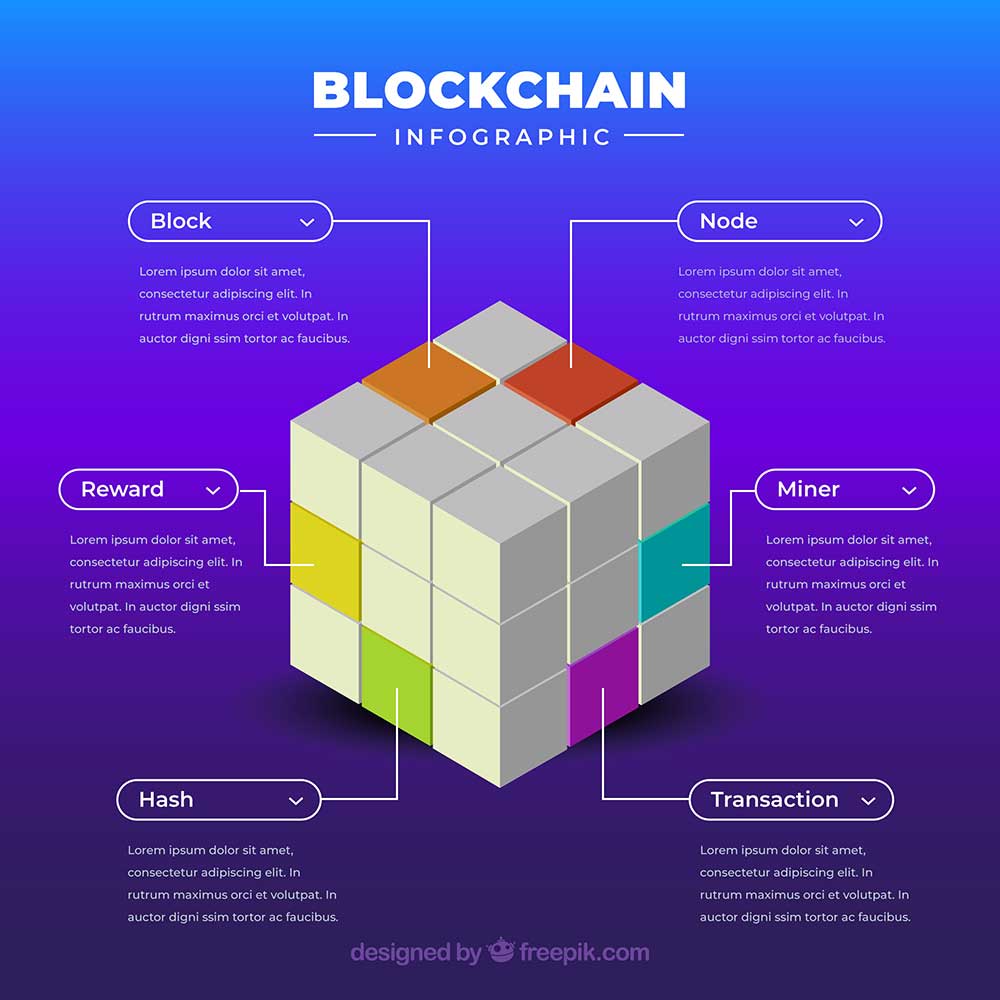

Cryptocurrency operates on a blockchain, which is a decentralized digital ledger that records transactions on multiple computers. Each block in the chain contains a list of transactions, and once a block is added to the chain, the information it contains is permanent and cannot be altered. This creates a secure and transparent record of all transactions, which is publicly accessible to anyone on the network.

Each cryptocurrency has its own unique blockchain, and transactions are verified by a network of users known as nodes. When a transaction is made, the nodes validate it and add it to the blockchain. The nodes are incentivized to validate transactions through a process known as mining, where they earn a reward in the form of new cryptocurrency for verifying transactions.

Why is Cryptocurrency Important?

Cryptocurrency has the potential to revolutionize the financial industry in several ways. One of the biggest benefits of cryptocurrency is that it operates independently of a central bank, which makes it less susceptible to government interference and manipulation. This gives individuals greater control over their financial assets and allows for faster and cheaper international transactions.

Another benefit of cryptocurrency is that it operates on a decentralized platform, making it more secure and resistant to fraud and hacking. This is because the blockchain is maintained by a network of nodes, making it more difficult for a single entity to manipulate the system.

Additionally, cryptocurrency offers greater privacy and anonymity compared to traditional financial transactions. This is because all transactions are recorded on a public blockchain, but the identity of the individuals involved in the transaction is kept private.

How to Invest in Cryptocurrency

If you’re interested in investing in cryptocurrency, there are several ways to get started. The most common way is to purchase cryptocurrency on an exchange, such as Coinbase, Binance, or Kraken. Before making a purchase, it’s important to do your own research and understand the risks involved with investing in cryptocurrency.

Another option is to invest in a cryptocurrency-focused fund, which allows you to invest in a basket of cryptocurrencies without having to purchase each one individually. This can be a good option for individuals who are new to the world of cryptocurrency and want to diversify their investment portfolio.

Regardless of how you choose to invest in cryptocurrency, it’s important to understand the risks involved and do your own research before making any investment decisions.

Conclusion

Cryptocurrency has come a long way since its creation in 2009, and it’s quickly becoming a mainstream topic in finance and investment. Despite its growing popularity, many people still don’t understand what cryptocurrency is and how it works. In this article, we’ve provided a comprehensive guide to help you understand cryptocurrency and how it’s changing the financial landscape. From its decentralized platform and resistance to manipulation, to its potential for faster and cheaper international transactions and greater privacy and anonymity, cryptocurrency has a lot to offer.

Investing in cryptocurrency can be a good option for those looking to diversify their investment portfolio, but it’s important to understand the risks involved and do your own research before making any investment decisions. Whether you’re new to the world of cryptocurrency or a seasoned investor, it’s important to stay informed and up-to-date on the latest developments in the industry.

Overall, cryptocurrency has the potential to completely change the financial industry and give individuals greater control over their financial assets. As the technology continues to evolve and more people become interested in cryptocurrency, it will be interesting to see how it continues to shape the financial landscape in the years to come.