Waht Percent of Millennials Have Student Loan Debt: Striking Stats Unveiled

Approximately 43% of millennial college graduates have student loan debt. This reflects a significant portion of the generation burdened by education financing.

Understanding the financial challenges faced by millennials is critical, particularly when it comes to student loan debt. This generation, born between 1981 and 1996, has been shaped by rapidly rising college tuition costs, leading many to take on substantial loans to fund their education.

The repercussions of this debt extend far beyond just financial strain, impacting millennials’ life choices from homeownership to retirement savings. Navigating these fiscal waters is crucial for both millennials and the economy at large, as their ability to contribute to market growth is closely linked to their financial well-being. With nearly half of millennial college graduates starting their careers with student debt, recognizing and addressing this issue is more important than ever.

Credit: www.capradio.org

Millennial Burden

The millennial generation faces unique financial challenges. A significant one is student loan debt. Many millennials entered the job market with hefty loans. Now, they’re navigating careers and lives with this burden.

The Alarming Rise Of Student Loan Debt

Student loan debt has skyrocketed in recent years. This is not news. Millennials are at the core of this crisis. Facts show a startling percentage struggle under the weight of these debts. Data reveals more than 60% of millennials carry student loans. They average nearly $30,000 in educational debt per borrower. This impacts their financial freedom.

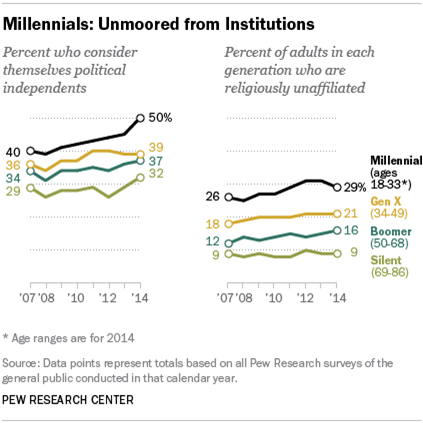

Comparing Generations: Who Bears The Heaviest Debt?

Let’s look across generations. The debt load varies. Baby Boomers and Gen Xers also have student loans. Yet, millennials top the chart. They hold more educational debt than any previous generation at the same age. Reports highlight a stark contrast.

- Millennials: High education costs, rising student loan figures.

- Gen Xers: Less debt than millennials, but still impacted.

- Baby Boomers: Lowest student loan debt, face repayment in retirement.

Comparative studies depict millennial debt as heavier. The implication extends to delayed milestones. Housing, marriage, and savings are affected. This deep dive into the numbers paints a clear picture. The millennial generation confronts a student loan challenge unmatched by others.

Credit: www.cfr.org

Student Debt By The Numbers

Peering into the wallet of a Millennial often reveals a hidden burden: student loan debt. Understanding the impact of this financial strain is more than a matter of numbers. It paints a picture of a generation striving for education amidst soaring costs. ‘Student Debt by the Numbers’ sheds light on the reality of what many Millennials face as they forge ahead in their careers and lives. Let the figures tell the story.

Current Statistics On Millennial Student Debt

The financial load carried by Millennials is staggering. Reports suggest a significant percentage is struggling with student loans.

| Year | Percentage of Millennials with Student Debt |

|---|---|

| Recent | Over 60% |

These numbers reveal a trend that sees the vast majority of Millennials juggling education loans well into their professional years.

Breaking Down Debt: How Much Do Millennials Really Owe?

Not every Millennial owes the same amount. Different studies show a range of debt levels depending on factors like college type and area of study.

- Public College Graduates: Average debt less than private college counterparts.

- Private College Graduates: Often owe tens of thousands more.

- Advanced Degree Holders: Can accumulate six-figure debts.

Understanding these numbers is crucial in grasping the true scope of the student debt crisis among Millennials.

Impact On Millennial Lives

Student loan debt affects more than just bank accounts for millennials. This financial burden reshapes their journey through adulthood, influencing many aspects of their lives.

Delaying Life Milestones Because Of Debt

Debt leads many millennials to postpone major life events.

- Homeownership is often pushed back.

- Many delay marriage and starting families.

- Starting a business becomes a distant dream.

These delays change the traditional path once followed by earlier generations.

Mental Health And The Strain Of Financial Obligations

The weight of student loans goes beyond monthly payments.

- It leads to heightened stress and anxiety.

- Sleepless nights and constant worry are common.

- Some report feelings of regret for their educational choices.

Thus, financial pressures take a serious toll on mental well-being.

Dissecting The Causes

Millennials face a financial landscape unlike any before. A significant factor in this landscape is student loan debt. Understanding why so many millennials find themselves with student loan debt requires a closer look at the driving forces behind this economic burden.

The Increasing Cost Of Higher Education

Tuition fees have skyrocketed over the past few decades. As a result, obtaining a degree has become more expensive. Below is a breakdown of how costs have increased.

| Year | Average Annual Tuition Cost (Public College) | Average Annual Tuition Cost (Private College) |

|---|---|---|

| 2000 | $3,508 | $16,233 |

| 2010 | $8,244 | $27,293 |

| 2020 | $10,560 | $37,650 |

Federal funding has not kept pace with rising costs. Grants and scholarships often fall short. Millennials must turn to loans to bridge the gap.

Contributing Factors: Why Student Debt Is Unavoidable For Many

Diverse reasons exist for the unavoidable nature of student debt among millennials. These factors contribute heavily:

- Limited financial aid making loans necessary

- Wage stagnation versus rising living costs

- The notion that a degree is essential for a successful career

- Parental support may be insufficient due to economic factors

- Access to credit has become easier, encouraging more borrowing

Students from low to middle-income families often find themselves in a tough spot. They can’t afford college on savings or income alone. This scenario forces reliance on student loans.

Solutions And Relief Efforts

A large share of millennials carry the burden of student loan debt. Finding solutions and exploring relief efforts is crucial for financial freedom. Various programs and personal strategies exist to ease this load. It’s important to understand and utilize them effectively. Let’s delve into some of these options.

Government Programs Aimed At Alleviating Debt

Government initiatives provide significant support for those struggling with student loans. These programs can reduce payments or even forgive debts in certain cases. For instance, Income-Driven Repayment Plans (IDR) adjust monthly payments. They base them on income and family size.

The Public Service Loan Forgiveness (PSLF) program is another lifeline. It’s for employees in public service jobs. After 120 qualifying payments, it forgives the remaining balance.

The government also offers loan consolidation. This can simplify repayment and potentially lower interest rates.

- Income-Driven Repayment Plans

- Public Service Loan Forgiveness

- Loan Consolidation Options

Personal Finance Strategies To Tackle Student Loans

Personal finance tactics can greatly impact loan repayment. Creating a budget is essential. It helps identify areas to cut costs and allocate more towards loan payments.

Another strategy involves paying more than the minimum amount due each month. It reduces the principal balance and interest, shortening the loan term.

| Strategy | Benefit |

|---|---|

| Extra Payments | Reduce Total Interest |

| Refinance | Lower Interest Rates |

Refinancing student loans can also be a smart move. It entails obtaining a new loan with a lower interest rate to pay off existing loans. This can save money over the loan’s life.

The snowball and avalanche methods are popular repayment strategies. They focus on paying off debts systematically, providing both financial and psychological wins.

- Start with the smallest debt (Snowball)

- Target highest interest rates first (Avalanche)

Moving Forward

Moving Forward, exploring the landscape of student loan debt among millennials opens questions about what the future holds. This demographic faces unique financial challenges. Data shows that a significant portion of millennials carries the burden of student loans. Yet, they persist. Innovations in higher education financing and shifts in perspectives on the value of college are on the horizon. Let’s dive into these transformative areas.

The Future Of Higher Education Financing

Colleges and policymakers alike are seeking more sustainable solutions for tuition costs. New financing models, such as income share agreements, allow repayments contingent on graduate earnings. Grant availability is expanding, offering more non-repayable financial aid options. With technology advancements, online learning platforms are providing more affordable education alternatives. These factors combined could significantly reduce future reliance on loans.

- Income-driven repayment plans lower monthly burdens.

- Grants and scholarships remove the need for some loans.

- Online courses offer cost-effective degrees.

Changing Attitudes Towards Debt And College Value

The value of a college degree is now under more scrutiny. Millennials are rethinking the return on investment of their education. Many are pursuing debt-free alternatives, such as trade schools, certifications, and apprenticeships. There’s a growing trend among high school graduates to evaluate college benefits more critically. This shift could lead to a drop in student loan uptake as upcoming generations pursue varied educational pathways.

| Pathway | Pros | Cons |

|---|---|---|

| Traditional college | Broad education, networking | Potential high debt |

| Trade school | Hands-on skills, quicker entry to work | Specialized focus |

| Certifications | Flexible learning, specific skills | May need renewal or updating |

Overall, as the narrative on education and debt evolves, so does the approach of millennials and future generations. A college degree once deemed a surefire investment, now faces competition from alternative educational offerings. With a focus on practical skills over traditional degree paths, a more diverse work-ready population emerges. This trend not only affects how education is valued but also impacts the percentage of those taking on student debt in the years to come.

Credit: www.pewresearch.org

Frequently Asked Questions For Waht Percent Of Millennials Have Student Loan Debt

How Many Millennials Are Burdened With Student Loans?

Recent data indicate that approximately 43% of millennial Americans have some form of student loan debt.

What Is The Average Student Debt For Millennials?

As of the latest surveys, the average student loan debt for millennials is near $30,000.

How Does Student Debt Affect Millennials’ Finances?

Student debt often leads to delayed homeownership and limited savings for many millennials, impacting their long-term financial stability.

Are Millennials Paying Off Their Student Loans?

Yes, many millennials are steadily paying off their student loans, but the process can take a significant amount of time, often decades.

Conclusion

Navigating the reality of student loan debt is a prevalent challenge for many millennials. Our deep dive into the statistics shows it’s a widespread issue. Armed with better understanding and resources, individuals can craft strategies for financial stability. Let’s turn awareness into action and lighten the load of educational expenses for future generations.