Us Asset Management Inc Debt Collection: Navigating Pitfalls

US Asset Management Inc. Is a debt collection agency that recovers outstanding debts. They operate within the legal framework set by the Fair Debt Collection Practices Act (FDCPA).

Debt Collection by US Asset Management Inc. Encompasses a range of activities aimed at reclaiming unpaid debts. This firm often contacts debtors on behalf of creditors to settle accounts that are overdue. They strive to provide solutions for both parties, facilitating payments and sometimes agreeing to payment plans.

Understanding one’s rights under the FDCPA can help manage interactions with such agencies and protect against potential harassment. Employing clear communication and maintaining records is crucial when dealing with any debt collection agency, including US Asset Management Inc. To ensure unproblematic dealings, it’s advisable to respond promptly to their attempts to communicate, and when necessary, seek professional advice to navigate the complexities of debt resolution.

Introduction To Us Asset Management Inc

US Asset Management Inc plays a pivotal role in financial recovery. This firm specializes in efficient debt collection. Businesses rely on them to recoup unpaid debts, which is critical for maintaining healthy cash flow. Understanding their strategies and operations offer insights into the world of debt recovery.

The Role In Debt Collection

As a leading player in the debt collection arena, US Asset Management Inc adopts a client-focused approach. Their methods emphasize ethical practices and compliance with laws to protect both creditor rights and consumer dignity. They offer various services:

- Collecting outstanding debts

- Negotiating payment plans

- Legal action facilitation

- Credit reporting guidance

Brief History And Current Operations

Founded with a mission to provide exceptional debt recovery services, US Asset Management has grown significantly. Starting as a small agency, they’ve expanded to serve high-profile clients. Their current operations include:

- Partnering with businesses across various industries

- Utilizing advanced technology for data management

- Training a skilled team of collection professionals

- Continuously improving strategies for higher recovery rates

Common Challenges In Debt Collection

Debt collection represents a critical part of the financial cycle for businesses like US Asset Management Inc., ensuring that they receive payments owed. Yet, this process is fraught with challenges, as companies must navigate a complex landscape that balances firm collection practices with respecting consumer rights and regulations. Recognizing common hurdles within this field can pave the way for more effective and ethical debt recovery strategies.

Understanding Consumer Rights

The landscape of debt collection is deeply influenced by consumer rights. Knowledge of these rights is paramount in creating a fair collection process. Compliance with laws such as the Fair Debt Collection Practices Act (FDCPA) is non-negotiable.

Key consumer rights include:

- Privacy – Debt collectors must protect personal information.

- Transparency – Debtors deserve clear information about their debts.

- Dispute – Consumers can challenge debt validity.

- Communication – Limits exist on how collectors contact debtors.

Violating these rights can lead to serious legal repercussions and tarnish a company’s reputation.

The Impact Of Aggressive Collection Tactics

While persistence is key in debt collection, overly aggressive tactics can backfire spectacularly. Harassment or intimidation practices not only break the law but also harm client relationships and brand image.

Common aggressive tactics include:

- Calls at unreasonable hours

- Misleading or false statements

- Threats of legal action that are not intended to be taken

Businesses must balance assertion with empathy, respecting debtor circumstances while firmly pursuing repayment. A considerate yet consistent approach helps in maintaining positive consumer relations and upholding the company’s integrity.

Strategies For Successful Navigation

Dealing with Us Asset Management Inc can be tough. They are known for their debt collection attempts. Facing them can feel overwhelming. But with the right strategies, you can navigate through this process smoothly. Communication and flexibility are key. Use these tactics to manage the situation effectively. Ready to find out how? Let’s explore together.

Developing Clear Communication Channels

Clear communication is crucial when dealing with debt collectors. You should always document your conversations. This means keeping emails and letters. If you talk on the phone, take notes about what was said. You can ask for their communication in writing too. This way, there’s a clear record of all interactions. This protects you and ensures that agreements are followed.

Creating Flexible Payment Plans

Negotiating a payment plan can ease the stress of debt. Start by understanding your own budget. Know what you can pay. Then talk to Us Asset Management Inc. Be honest about what you can afford. Try to reach an agreement that fits your financial situation. Remember, it’s important that the plan is realistic. You don’t want to promise more than you can deliver. Planned payments can stop collection actions.

| Steps | Actions |

|---|---|

| 1. Review Finances | Check how much you can pay each month. |

| 2. Propose a Plan | Offer a payment amount that is manageable. |

| 3. Get it in Writing | Ensure the agreement is documented. |

| 4. Stick to the Plan | Make payments on time to avoid further issues. |

Credit: www.linkedin.com

Legal Framework Governing Debt Collection

Navigating the murky waters of debt collection is a daunting task for many. It’s crucial for both creditors and debtors to understand the strict laws that guide the collections process. This understanding ensures that all parties involved are acting within their legal rights and obligations.

Fair Debt Collection Practices Act (fdcpa)

The Fair Debt Collection Practices Act (FDCPA), established in 1977, is a pivotal component of the legal framework for debt collection. This federal law protects consumers from abusive, deceptive, and unfair debt collection practices.

Under the FDCPA, several key rules must be followed:

- Debt collectors can only call between 8am and 9pm.

- Collectors must stop contacting you if you request in writing.

- They are prohibited from using misleading tactics.

- You must be given a verification of the debt.

State Laws And Regulations

Besides the FDCPA, states have their own regulations that may be more stringent.

| State | Limits on Contact | Debt Validation Requirements |

|---|---|---|

| California | Calls restricted to business hours | Collector must provide license number |

| Texas | No calls at work if prohibited | Collector must provide itemized accounting of debt |

It’s vital for individuals facing debt collection to review both federal and state laws. Knowledge is power, and understanding your rights can make a significant difference in your experiences with debt collection.

Dealing With Disputes And Errors

Dealing with disputes and errors can be a challenging aspect of navigating the waters of debt collection with US Asset Management Inc. It’s important to know your rights and how to handle any issues that may arise during this process. Understanding the steps to identify and correct mistakes, as well as resolving conflicts efficiently, can make all the difference in setting the record straight.

Identifying And Correcting Mistakes

It’s crucial to review your debt statements for any inaccuracies that may appear. If you spot an error, take action immediately. Here’s a streamlined approach:

- Check your records: Gather your documents to compare against the debt statement.

- Write to the agency: Send a formal letter pinpointing the error.

- Wait for a response: The agency must acknowledge your claim within 30 days.

- Cooperate with investigations: Provide any additional info if required.

Remember, you have rights under the Fair Debt Collection Practices Act (FDCPA) that protect you from incorrect debt reporting.

Resolving Conflicts Through Mediation

Mediation can be a peaceful solution to debt disputes. This process involves:

- Engaging a mediator: A professional who acts as a neutral third party.

- Discussing the issues: Both parties present their sides.

- Reaching an agreement: With the mediator’s help, aim for a fair resolution.

Document the final agreement to ensure all parties abide by the terms. This strategy can save time and reduce stress associated with long disputes.

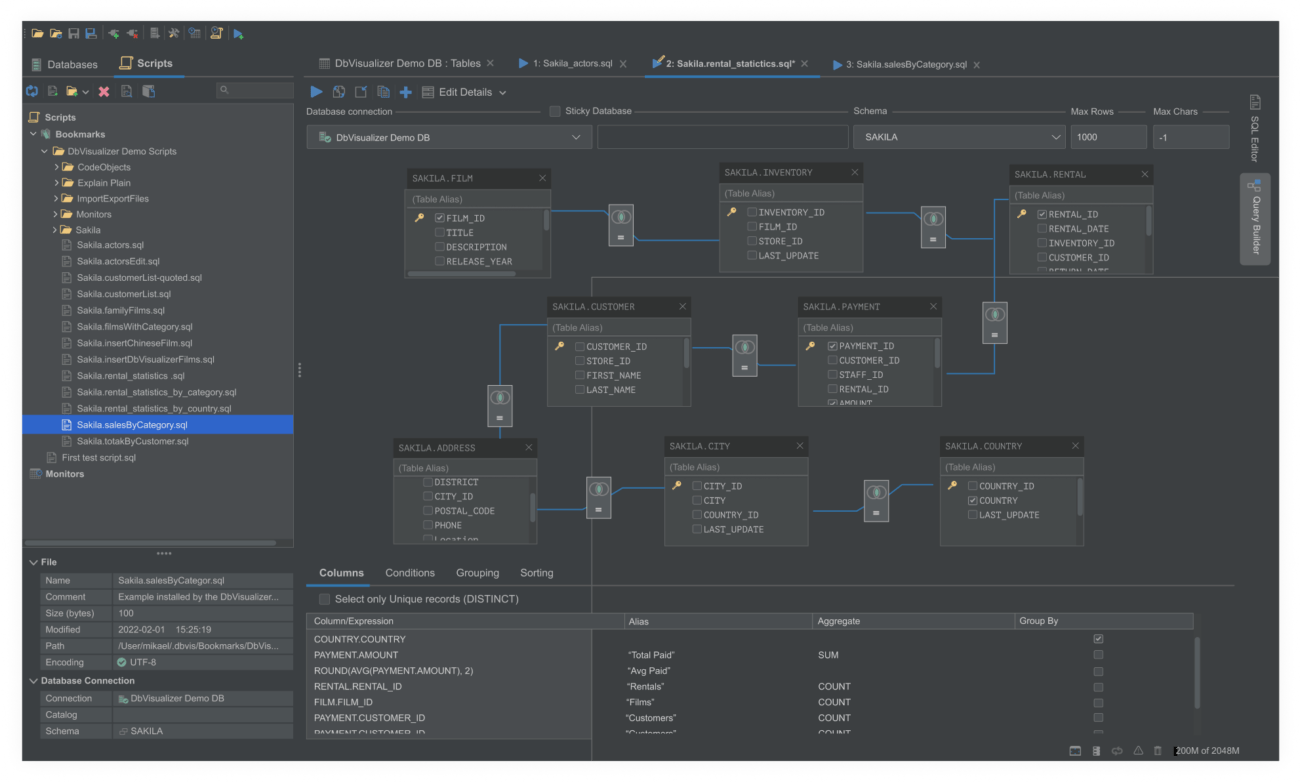

Credit: www.dbvis.com

Building A Positive Relationship With Collectors

Building a Positive Relationship with Collectors can transform a stressful situation into a manageable one. Debt can be a heavy burden. But working with collectors, like those from US Asset Management Inc, doesn’t have to be a battle. Understanding their goals and negotiating can lead to mutually beneficial outcomes. Here’s how to align interests and work towards a positive resolution.

Understanding Collectors’ Perspectives

Collectors have a job to do, and recognizing this is crucial. Their primary role is to recover debts, but they are people too. They appreciate a good communicative relationship with debtors. When debtors show willingness to resolve their debts, collectors often become more flexible. Here’s what to keep in mind about collectors:

- Goal Alignment: Your aim to settle debt aligns with their recovery goals.

- Communication: Open lines help reduce confrontation.

- Professionalism: They expect and respect it, just like you do.

Negotiating For Better Outcomes

Negotiation is key to any debt repayment situation. Preparation and transparency often lead to a better plan. Here’s how to approach it:

- Assess Your Finances: Know what you can reasonably afford.

- Propose a Plan: Offer a payment plan that works for you.

- Stay Calm: Keep discussions friendly and professional.

- Document Everything: Record all agreements for future reference.

Remember, success in negotiation often means both parties feel like they’ve won.

Preventive Measures And Financial Education

Understanding preventive measures and financial education can transform how you handle debt. It is vital to equip yourself with the knowledge and tools to manage debts effectively. This approach not only helps avoid the stress of dealing with debt collectors like US Asset Management Inc but also bolsters your economic well-being.

Enhancing Personal Finance Skills

Better management of personal finances begins with improving your skills in handling money. Strong finance skills prevent debt accumulation. These include budgeting, understanding interest rates, and recognizing the importance of savings.

- Budgeting: Track income and expenses to gain control over your finances.

- Interest Savvy: Know how interest rates work to avoid costly debts.

- Emergency Funds: Save consistently to build a buffer against unforeseen expenses.

Adopting Proactive Debt Management Strategies

Stay ahead of potential debt problems with proactive strategies. These involve timely repayments and understanding your credit.

- Timely Payments: Pay bills on time to avoid penalties and additional fees.

- Credit Insight: Regularly check credit reports for accuracy and signs of identity theft.

- Communication: Engage with creditors early if you anticipate payment issues.

Credit: www.amazon.com

Frequently Asked Questions For Us Asset Management Inc Debt Collection

What Is Us Asset Management Inc?

US Asset Management Inc is a debt collection agency. They work with creditors to collect outstanding debts. Their approach might vary, but typically includes contacting debtors on behalf of the creditors they represent.

Can Us Asset Management Inc Affect Credit Score?

Yes, US Asset Management Inc can affect your credit score. If they report a collection account to credit bureaus, it may lower your score. It is essential to address any outstanding debts to avoid negative impacts.

How To Deal With Us Asset Management Collections?

Deal with US Asset Management by first verifying the debt. Communicate in writing and understand your rights under the FDCPA. Consider a payment plan or negotiate a settlement, if necessary, but seek advice from a financial advisor.

Are There Ways To Stop Us Asset Management Calls?

You can stop calls by sending a written request asking them to cease communication. Alternatively, hiring an attorney can also lead to the cessation of calls, as further communication will go through the attorney.

Conclusion

Navigating the complexities of debt collection is crucial for financial well-being. US Asset Management Inc. Offers strategies to manage such obligations effectively. Remember, informed decisions and proactive steps can transform debt into a stepping stone for fiscal stability. Start reclaiming control of your finances today.