Student Loan Debt Ignites Millennial Class Strife!

Student loan debt is intensifying tensions among millennials, sparking a socioeconomic conflict. This divide pits debt-burdened graduates against their debt-free peers.

The staggering weight of student loans is creating a chasm in the millennial generation, segregating it into classes based on financial burden and opportunity. As university costs soar, a significant segment of millennials find themselves anchored by debt, influencing their life choices and economic mobility.

This financial strain not only hampers their ability to invest and save but also affects career options, homeownership prospects, and retirement planning. On the flip side, millennials unencumbered by student loans navigate a vastly different economic landscape, with access to opportunities often out of reach for their indebted contemporaries. This stark disparity is giving rise to a millennial class war, with far-reaching implications for social cohesion and the future of the workforce. Understanding the depth of this divide is crucial for policy makers, educators, and financial institutions looking to bridge the gap and foster equity among a generation foundational to our future economy.

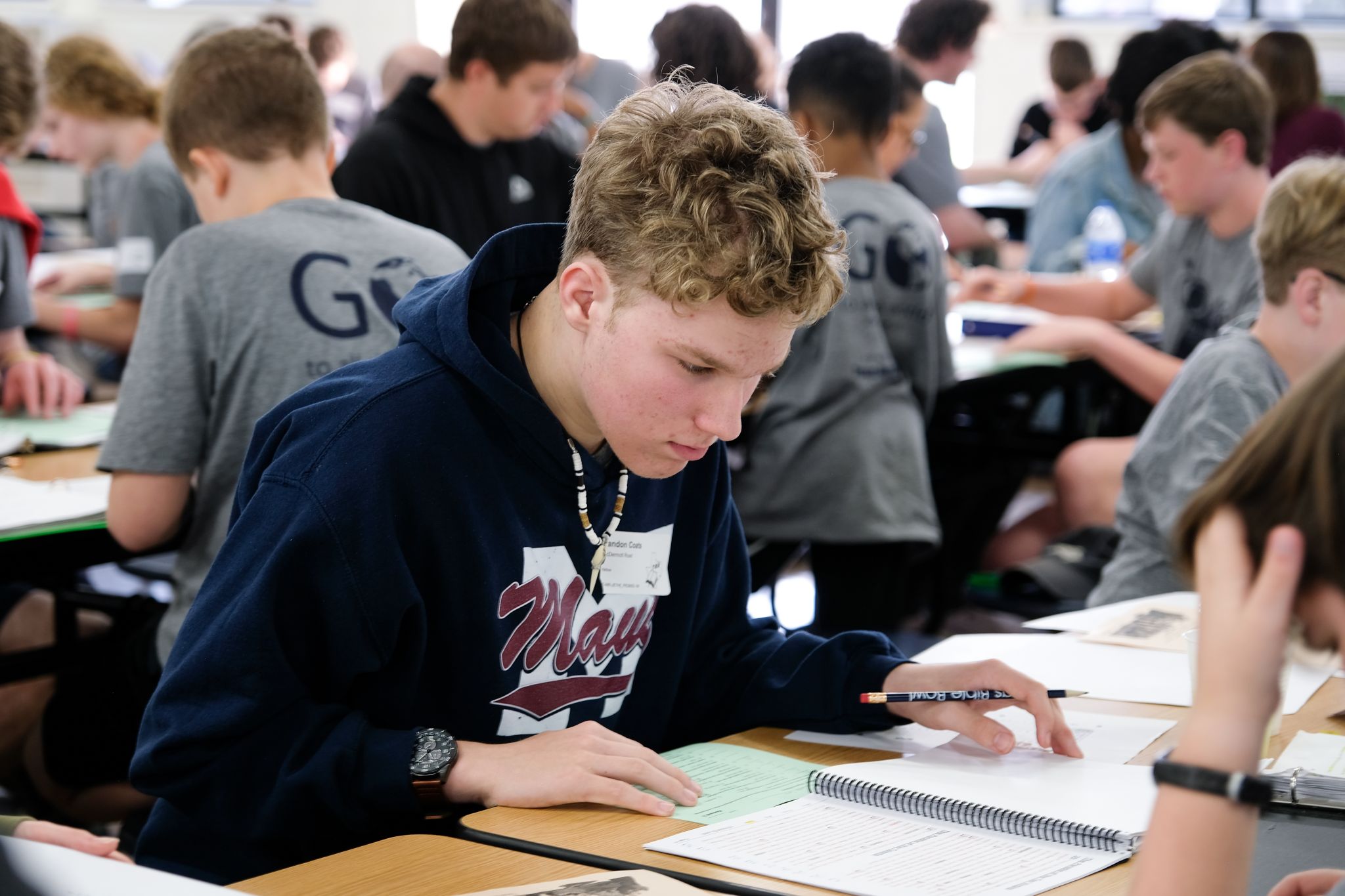

Credit: www.capradio.org

The Scale Of Millennial Student Loan Debt

Millennials face a unique financial challenge. Burdened by heavy student loans, they are entering a class war of their own. With dreams in one hand and debt in the other, understanding the scale of this problem is crucial.

Rising Costs Of Higher Education

College tuition has skyrocketed over the past two decades. In the United States, the cost of attending a four-year institution has increased drastically. This makes it tough for millennials to pursue higher education without accruing debt.

- Tuition fees have multiplied, often outpacing inflation.

- Additional costs include books, housing, and supplies.

- Financial aid struggles to cover the totality of these expenses.

Statistics: An In-depth Look At The Numbers

Let’s break down the numbers to grasp the true weight of millennial student debt.

| Year | Average Debt at Graduation |

|---|---|

| 2000 | $20,000 |

| 2010 | $25,000 |

| 2020 | $30,000 |

- Over 45 million borrowers shoulder student debt in the US.

- The total debt is well over $1.5 trillion.

- 1 in 4 American adults is paying off student loans.

The impact of this debt reaches far. It affects credit scores, home ownership rates, and even family planning. Millennials cope with a financial burden unlike any before.

Credit: www.linkedin.com

Impact On Millennial Lives

The far-reaching effects of student loan debt do not end with monthly payments. They seep into every corner of millennials’ lives, reshaping their futures. Understanding these impacts is crucial.

Delay In Major Life Milestones

Heavy debt loads influence major life decisions for millennials.

- Homeownership: High monthly debt payments often lead to delayed home buying.

- Marriage: Financial burdens can push back wedding plans.

- Starting a Family: The costs of raising children appear daunting alongside student loans.

Such delays can ripple through the economy and society, altering the traditional path to adulthood.

Mental Health And Financial Stress

Mental well-being is closely linked to financial situations. Student loan debt is a significant source of stress, triggering anxiety and depression in many millennials.

| Financial Stress | Mental Health Impact |

|---|---|

| Loan Repayments | Anxiety Over Finances |

| Debt Amount | Feelings of Overwhelm |

| Budgeting Strains | Depression Symptoms |

Recognizing these connections prompts necessary conversations on mental health support for millennials grappling with student debt.

Economic Ramifications

The surge in student loan debt among Millennials is causing seismic shifts in the economy. These shifts weigh on financial decisions, spending habits, and even the housing market. Understanding the full scope of economic implications is essential to grasp the deeper story unfolding within this generational dilemma.

Effects On Consumer Spending

Student loan debt directly affects how Millennials handle their finances. Saddled with monthly repayments, many find themselves unable to freely spend. This tightening of the purse strings has far-reaching effects:

- Reduced discretionary spending: Luxury items and non-essential services take a backseat.

- Delayed major purchases: Cars, appliances, and technology upgrades are postponed.

- Dampened economic activity: With spending down, the ripple effect impacts businesses and job markets.

Housing Market And Loan Defaults

The dampening effect extends to the housing market. Struggling Millennials find homeownership outside their reach:

| Market Aspect | Millennial Impact |

|---|---|

| Homeownership rates | Decline as loan repayment takes priority over mortgage savings |

| Rental demand | Increases, inflating rental prices and impacting housing affordability |

| Loan defaults | Rise as borrowers struggle to meet obligations in the face of economic strain |

Loan defaults can lead to a destructive cycle. With each default, credit scores take a hit. This undermines Millennials’ future borrowing potential, further complicating economic recovery efforts.

Comparative Strain: Then And Now

The millennial generation faces the stark challenge of student loan debt like never before. This monetary strain is not just a personal crisis but a potential class conflict. The previous generations had their financial battles. Yet, millennials are fighting a seemingly steeper uphill battle. This struggle is reshaping economic perspectives and demands a closer look at the past and present financial burdens.

Generational Wealth Gap

The wealth gap between millennials and baby boomers is significant.

- Boomers had more affordable education options.

- Millennials face higher housing costs and stagnant wages.

- The ability to acquire assets like a home or savings has diminished.

This gap limits the millennial’s ability to pay off debt and accumulate wealth.

Historical Debt Burdens On Previous Generations

| Generation | Educational Debt | Housing Affordability | Wage Growth |

|---|---|---|---|

| Baby Boomers | Lower costs | More affordable | Consistent growth |

| Gen X | Rising costs | Less affordable | Slowed growth |

| Millennials | Highest costs | Least affordable | Limited growth |

Historically, boomers enjoyed more economic stability. Millennials, on the other hand, grapple with unprecedented financial burdens as seen in the table above.

Solutions And Relief Efforts

Student loan debt weighs heavily on millions of Americans, particularly millennials caught in a tightening grip of financial pressure. The need for solutions and relief efforts has never been more critical. A brighter future demands actionable strategies to lighten this burden.

Loan Forgiveness Programs

Loan forgiveness programs are a ray of hope for many. They offer a chance to have all or part of a student loan wiped clean.

Public Service Loan Forgiveness (PSLF) is one program. It forgives remaining student debt for those who work in public service jobs for ten years.

Income-Driven Repayment (IDR) Plans also help. They cap monthly payments at a reasonable percentage of income. A portion of the loan could be forgiven after 20-25 years of consistent payment.

The Teacher Loan Forgiveness Program is another example. It’s aimed at teachers working in low-income schools and can forgive up to $17,500.

Educational Reforms To Prevent Future Debt Spirals

Educational reforms work towards reducing future debt before it happens.

College affordability is key. Tuitions should be low enough that students don’t need large loans.

Courses can teach financial literacy. Students learn to manage money wisely.

Grants and scholarships should be widely available. They reward talent and hard work without debt.

Voices Of The Movement

The voices behind the student loan debt crisis are loud and clear. They resonate with the frustrations of a generation overburdened by financial strain. These are the voices of real people facing real challenges. They are students, graduates and dropouts. Their cries for change spark a movement with ripples throughout society. Let’s dive into the heart of this movement and hear their powerful stories.

Real Stories, Real Struggles

Debt is more than numbers on a page, it’s about the people behind them. Here are some of their stories:

- Emily delayed her dream of opening a bakery due to her student loans.

- Jackson works three jobs, yet barely chips away at his debt.

- Maria fears she’ll never afford a home as her debt-to-income ratio is too high.

Advocacy Groups And Political Actions

The movement for change strengthens as advocacy groups climb aboard. They lobby, educate, and empower:

| Group | Focus | Impact |

|---|---|---|

| Student Debt Crisis Center | Loan forgiveness advocacy | Policy change campaigns |

| Debt Collective | Debtors’ union formation | Debt strike organization |

| Higher Ed, Not Debt | Education affordability | Resources and tools for borrowers |

Addressing The Class Divide

Within the landscape of millennial financial challenges lies a brewing storm of class differences. The rising tide of student loan debt has hit this generation with unprecedented force, creating a sharp divide between the haves and have-nots. The key to bridging this gap and establishing a fair playing field for all? It lies in taking a closer look at social mobility and how education and policy can become pivotal tools in this quest. Let’s dive into how these aspects work within the context of addressing the class divide.

Social Mobility And Education

The link between schooling and climbing the social ladder has always been strong. Yet for many millennials, education has become a double-edged sword. On one side, degrees often lead to better jobs. On the other side, they bring heavy debts. This burden can stifle long-term progress, anchoring young professionals to lower economic rungs.

- College costs skyrocket: They outpace inflation and family incomes.

- Debts pile up: Graduates carry loans that weigh on life choices.

- Income stagnation: Salaries don’t keep up with living expenses or debt repayment.

Strategies must evolve to ensure education boosts, rather than hinders, upward mobility. This may include initiatives like:

- Sliding scale tuition fees based on family income.

- More grants for low-income students.

- Loan forgiveness programs tied to public service.

The Role Of Policy In Leveling The Playing Field

Policy has the power to transform the landscape. Lawmakers play a critical role in crafting solutions that can ease the strain of student debt. Through well-thought-out policy, they can foster conditions that promote mobility rather than hinder it. Concrete steps might entail:

| Policy Area | Current Challenge | Proposed Action |

|---|---|---|

| Loan Terms | High-interest rates cripple repayment. | Cap rates and extend terms for manageable payments. |

| Tax Benefits | Deductions don’t keep pace with costs. | Enhance credits for education expenses. |

| Workplace Incentives | Employer contributions are rare. | Encourage company-paid education benefits. |

Policies like these can help mitigate the class disparities exacerbated by student debt. With strategic moves toward more equitable education financing, the hope for a leveled playing field becomes more attainable.

Credit: christianchronicle.org

Frequently Asked Questions Of Student Loan Debt Is Bringing On Millennial Class War

How Are Millennials Affected By Student Loans?

Millennials often face financial strain due to high student loan debt. This affects their ability to purchase homes, invest, or save for retirement, leading to stress and delays in achieving typical financial milestones.

Can Student Debt Trigger A Class War?

Student debt has potential to exacerbate class divides. Graduates with heavy debt burdens may struggle to advance economically, while those without such debts or with wealthier backgrounds can accumulate wealth more readily, possibly leading to increased social tension.

What’s The Average Student Loan Debt For Millennials?

The average student loan debt for millennials is approximately $30,000. This amount varies greatly depending on the individual’s choice of college, the length of their education, and their degree.

Is Loan Forgiveness An Option For Millennials?

Loan forgiveness programs do exist, but they have specific qualifications, such as working in public service or education. Many millennials may not qualify, making them reliant on other repayment or refinancing options.

Conclusion

The divide student loan debt creates cannot be ignored. It’s reshaping how millennials approach careers, home ownership, and retirement. As this financial burden continues to fuel a class struggle, society must seek viable solutions. The future of this generation hinges on actionable, empathetic policy changes and financial education.

Let’s address this pressing issue together, fostering a climate of understanding and support.