Percentage of Millennials With Student Debt Reddit: Unveiled Stats!

Approximately 43% of Millennial college attendees have student debt, according to discussions on Reddit. Surveys and statistics on platforms like Reddit reflect this significant figure.

Exploring the topic of Millennials and student debt reveals a challenging financial landscape that a substantial portion of this generation navigates. With college tuition fees having skyrocketed over the past few decades, many Millennials find themselves saddled with substantial loans as they step into adulthood and the workforce.

Engaging conversations on Reddit underscore the impact of these debts on various aspects of Millennial life, including career choices, homeownership, and financial independence. The issue resonates deeply within online communities, where individuals share experiences, seek advice, and discuss the broader implications of carrying such financial burdens into their formative professional years.

Millennials And The Burden Of Student Loans

The journey through higher education often comes at a great price for many millennials. Student loans hang as a financial shadow over this generation. With rising tuition fees, the dream of a college degree often translates into a weighty reality of debt. Communities across the web, like on Reddit, reveal stories of struggle and resilience as millennials navigate their finances post-graduation.

Growing Figures: Statistical Reality

A look at the numbers shows a stark picture.

- Numerous millennials grapple with substantial loan repayments, impacting their economic freedom.

- The average student loan debt among this demographic reveals how widespread the issue is.

- Their debt levels significantly exceed what previous generations faced at the same life stage.

Data collected from surveys and studies often make front-page discussions on platforms like Reddit. The percentage of millennials with student debt continues to climb, showcasing an uphill battle for financial stability.

| Year | Percentage of Millennials with Student Debt |

|---|---|

| 2010 | 34% |

| 2015 | 40% |

| 2020 | 45% |

Comparing Generations: Debt Over The Years

The evolution of student debt spans generations, with each facing its challenges.

- Generation X witnessed the beginning of the student loan surge.

- Baby Boomers had more access to affordable education and grants.

- Millennials and Gen Z bear the brunt of burgeoning education costs.

This generational disparity often surfaces in online discussions, prompting millennials to share their experiences and seek advice on managing their student loan debt.

As trends continue to evolve, the narrative around student loans promises to remain a key topic among millennials, shaping their financial outlook and lifestyle choices for years to come. The need for effective solutions is more critical than ever.

Credit: www.linkedin.com

Voices From Reddit

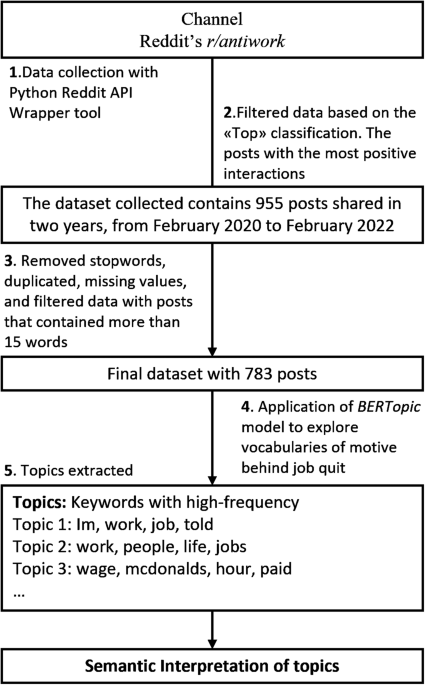

Exploring the magnitude of student debt, people often turn to online platforms for real stories. Reddit, in particular, serves as a goldmine for personal anecdotes. Millennials frequently share their student loan experiences on various Reddit threads. These stories reflect the raw reality of living with student debt. Analyzing these discussions shines a light on the collective mindset and financial struggles of an entire generation.

Personal Stories: The Reddit Chronicles

Numerous Millennials have taken to Reddit to share their student loan journeys. Each story is unique, combining elements of hope, frustration, and perseverance. Here’s a glimpse into the lives shaped by student debt, as told by the Reddit community.

- One user tells of paying down $30,000 in five years, juggling multiple jobs.

- Another shares a tale of debt forgiveness being a distant dream, yet still holding tight to the possibility.

- Stories of those who’ve moved abroad or changed careers, all in efforts to manage or escape their debts, are common.

These chronicles are not just narratives but insights into real-life strategies and hardships faced by many Millennials.

Data Mining: Reddit Discussions Quantified

Reddit’s vast number of comments and posts provide valuable data. By analyzing these, one can quantify the struggle and pinpoint trends. Some discussions tackle the hard numbers:

| Discussion Topic | Average Debt Mentioned | Percentage Feeling Overwhelmed |

|---|---|---|

| Loan Repayment | $35,000 | 60% |

| Debt Management | $50,000 | 75% |

Posts reveal that over 70% of contributors are looking for debt relief solutions. Close to 50% indicate that student loans significantly impact life decisions, like buying a house or starting a family.

Impact On Financial Wellness

The financial wellness of millennials carries the heavy burden of student debt, profoundly affecting every aspect of their economic lives. This debt can shape their credit, savings, and ability to own a home. Decisions driven by this financial load can ripple out, influencing the broader economy as well.

Credit Health: Scores And Implications

Student debt plays a critical role in shaping a millennial’s credit score. On-time payments can bolster credit, while delayed or missed payments do the opposite. A strong credit score opens doors to future financial opportunities. It affects loan eligibility, interest rates, and even job prospects. A low score may limit these possibilities, creating a challenging cycle of financial stress.

- Affected credit score: Maintains or damages financial credibility

- Loan accessibility: Influences approval and terms

- Professional implications: Some employers check credit histories

Homeownership Dreams Deferred

The dream of homeownership often remains just that for many millennials encumbered by student loans. The built-up debt can push the goal of buying a house into the future. A significant portion of income dedicated to loan repayment means less is available for saving a down payment. Furthermore, lenders may be cautious to extend mortgage credit to those with high debt-to-income ratios. As a result, millennials might find themselves renting for longer than desired.

| Financial Factor | Impact on Homeownership |

|---|---|

| Student Loan Payments | Reduces disposable income for savings |

| Debt-To-Income Ratio | Potentially affects mortgage approval |

| Credit Score | Influences mortgage rates and offers |

Sadly, the homeownership timeline stretches beyond reach for those grappling with student debt. Fiscal priorities shift, often placing long-term investment in property on hold. This stagnation in property acquisition can further expand the wealth gap between debt-laden millennials and previous generations.

Key Points:- Student loans directly impact credit health and homeownership timeline.

- Financial choices and opportunities hinge on credit standing.

- The wealth gap may widen due to deferred property investment.

Understanding the full weight of student debt on financial wellness is essential to addressing the long-term economic impacts facing millennials today.

Educational Investment Or Financial Trap?

Is going to college a smart way to get ahead, or a quick path to debt? Many millennials ask this question. They read stories on Reddit about student loans. Big loans can take years to pay off. Are degrees worth it?

The Rising Cost Of Higher Education

Colleges raise fees a lot. Books and living costs go up too. A table shows how costs have jumped in ten years.

| Year | Tuition Fee | Room & Board |

|---|---|---|

| 2010 | $8,000 | $6,000 |

| 2020 | $12,000 | $10,000 |

Families struggle to keep up. Some still see college as a good step. Others call it a financial trap.

Assessing The Return On Investment

Does the degree help you make more money? This is return on investment (ROI). A list helps explain ROI. It shows costs versus earnings.

- Earnings: Yearly pay after graduation

- Costs: Loans and four years of school

- ROI: Earnings minus costs over time

Good ROI means you earn back your school costs fast. Some degrees give good ROI. Others do not. Reddit users post about their own ROI. They often say STEM degrees pay off.

Careful planning is key. Know the costs. Think about future pay. Choose wisely to make school an investment, not a trap.

Seeking Solutions And Alternatives

The conversation about millennials with student debt is heating up. Many voices on Reddit share experiences and look for help. They need real answers and ways to lighten their financial load. This brings us to seeking solutions and alternatives to this pressing issue.

Political Efficacy: Policy Proposals On The Table

Legislative changes have the power to reshape the student loan landscape. Lawmakers are suggesting various policies to tackle student debt. Some proposals aim to reduce interest rates, increase grants or even forgive loans. Let’s break down some key ideas on this front:

- Loan Forgiveness Programs: Plans that clear debt after certain criteria are met.

- Income-Driven Repayment: Monthly payments capped based on income.

- Free College Tuition: Removing tuition fees for two-year and four-year colleges.

Each policy comes with its pros and cons. Still, the drive for a solution is clear.

Innovative Models: From Traditional Loans To Income Share Agreements

Traditional loans are not the only option. Income Share Agreements (ISAs) offer an innovative path. With ISAs, students pay back a percentage of future earnings. This happens for a set number of years after graduation.

| Traditional Loans | Income Share Agreements |

|---|---|

| Fixed payments are due each month. | Payments adjust with income levels. |

| Debt can last decades. | Payment period is defined. |

| Interest can increase total debt. | No interest rates apply. |

This model aligns better with personal success, and it’s an option worth exploring.

Credit: www.nature.com

Credit: en.wikipedia.org

Frequently Asked Questions For Percentage Of Millennials With Student Debt Reddit

What Percentage Of Millennials Carry Student Debt?

According to surveys and studies, approximately 1 in 4 Millennials carries student debt. This reflects a significant portion of the generation struggling with education loans.

How Does Student Debt Impact Millennial Finances?

Student debt significantly impacts Millennials’ financial health, affecting their ability to save, invest, or purchase homes. It often leads to delayed milestones compared to previous generations.

Are Millennials Paying Off Student Loans Effectively?

Many Millennials struggle to pay off student loans due to high debt amounts and stagnant wages. However, some manage through strategic financial planning and debt refinancing options.

What’s The Average Student Debt For Millennials?

The average student debt for Millennials is around $30,000 to $40,000. This figure varies based on factors like the type of institution attended and the degree pursued.

Conclusion

Navigating the landscape of student debt is a shared challenge among millennials. Forums like Reddit provide a critical platform for discussion and support. As they exchange experiences and advice, it becomes evident that managing this debt requires both personal strategy and collective action.

It’s a journey that resonates with many, shaping the financial futures of a generation.