What's Happening

Worrying sign in Covid numbers

Seven star’s gravity-defying dress stuns

‘Not OK’: Cotton On called out over product

5 Takeaways From The First Round Of France’s Election

The first-round results are trickier than they look for Macron.

Just In

Confusing $16 dental floss swimsuit roasted

Five Signs of a Highly Intelligent Person

Latin America’s Moonshot

Your Empty Office Turn Into Apartments?

The New Mortal Kombat Movie Rules

Corporations Are People, Too

Is Australian democracy in good health?

Australians have just learned their election will be held on 21 May. At a crucial time for the country, Nick Bryant sees a contest that will be defined, to a large part, by what it lacks.

LATEST

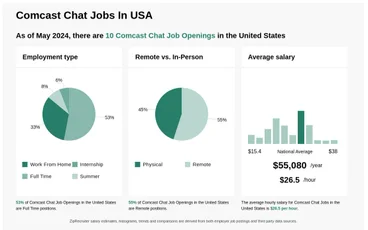

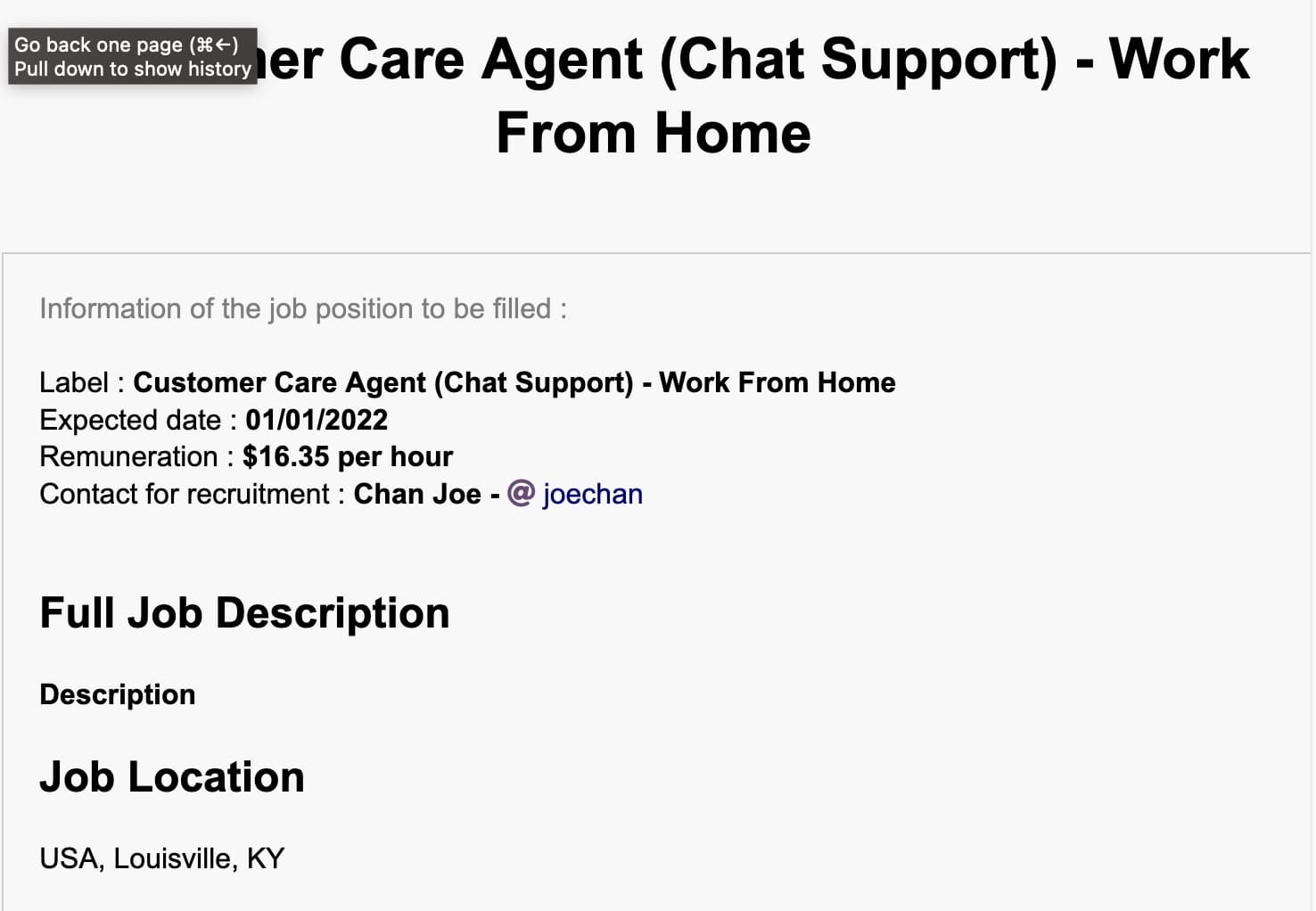

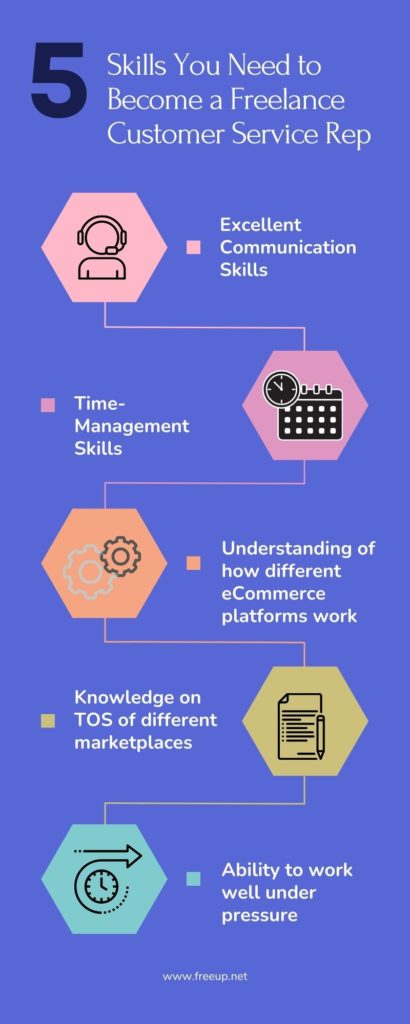

Home Depot Chat Work from Home: Earn Big!

Dunzo Chat Support Job: Unleash Career Growth!

Latest News

The unspoken weight discrimination problem at work

Discrimination linked to weight can affect hiring, promotions and employees’ mental wellbeing. Why aren’t legal protections in place?.

The surprising benefits of ‘scary play’

Discrimination linked to weight can affect hiring, promotions and employees’ mental wellbeing. Why aren’t legal protections in place?

Sweet and festive lemon desserts for Easter

Even though I still hated planks at the end, my core felt tighter after doing them for 30 days straight,

Seven star’s gravity-defying dress stuns

Even though I still hated planks at the end, my core felt tighter after doing them for 30 days straight,

Latin America’s Moonshot

Even though I still hated planks at the end, my core felt tighter after doing them for 30 days straight,

In France, its Macron vs Le Pen again for presidency

Even though I still hated planks at the end, my core felt tighter after doing them for 30 days straight,

Your Ultimate Guide to Getting Bonded in Massachusetts

To get bonded in massachusetts, you need to research, select a surety company, fill in an application form,

Your Empty Office Turn Into Apartments?

Australians have just learned their election will be held on 21 May. At a crucial time for the

Your Empty Office Turn Into Apartments?

PARIS — French President Emmanuel Macron took first place, ahead of far-right leader Marine Le Pen, in the first round

Worrying sign in Covid numbers

PARIS — French President Emmanuel Macron took first place, ahead of far-right leader Marine Le Pen, in the first round

Winning Custody: Your Ultimate Guide to Full Custody in Massachusetts

To get full custody in massachusetts, you must file a petition with the family court. The court will consider several

Why the Flags are Half Mast Today near Massachusetts: Unveiling the Reason

The flags are at half-mast today near massachusetts to honor the 13 u.s. service members who lost their lives in

Zap Guardian Reviews (Scam or Legit) – Must Read Before You Buy!

Zap Guardian reviews reveal mixed opinions, making its worth as a mosquito zapper debatable. Consumers should scrutinize the

Worrying sign in Covid numbers

PARIS — French President Emmanuel Macron took first place, ahead of far-right leader Marine Le Pen, in the

World Finance Winder GA: Navigating Financial Solutions

World Finance in Winder, Georgia, provides personal installment loans and tax services. It is located at 47 West May St.

World Finance Valdosta Ga: Expert Money Management Tips

World Finance in Valdosta, GA, provides personal installment loans and tax services. They specialize in helping individuals with their financial

World Finance Tifton Ga: Unveiling Money Solutions!

World Finance in Tifton, GA provides personal installment loans and tax services. Check their website or local branch for loan

World Finance Thomasville Ga Insights: Fiscal Trends

World Finance in Thomasville, GA, offers personal installment loans and tax services. The company provides financial solutions tailored to individual

Zap Guardian Reviews (Scam or Legit) – Must Read Before You Buy!

Zap Guardian reviews reveal mixed opinions, making its worth as a mosquito zapper debatable. Consumers should scrutinize the

Worrying sign in Covid numbers

PARIS — French President Emmanuel Macron took first place, ahead of far-right leader Marine Le Pen, in the

World Finance Winder GA: Navigating Financial Solutions

World Finance in Winder, Georgia, provides personal installment loans and tax services. It is located at 47 West May St.

World Finance Valdosta Ga: Expert Money Management Tips

World Finance in Valdosta, GA, provides personal installment loans and tax services. They specialize in helping individuals with their financial

World Finance Tifton Ga: Unveiling Money Solutions!

World Finance in Tifton, GA provides personal installment loans and tax services. Check their website or local branch for loan

World Finance Thomasville Ga Insights: Fiscal Trends

World Finance in Thomasville, GA, offers personal installment loans and tax services. The company provides financial solutions tailored to individual

Zap Guardian Reviews (Scam or Legit) – Must Read Before You Buy!

Zap Guardian reviews reveal mixed opinions, making its worth as a mosquito zapper debatable. Consumers should scrutinize the

Worrying sign in Covid numbers

PARIS — French President Emmanuel Macron took first place, ahead of far-right leader Marine Le Pen, in the

World Finance Winder GA: Navigating Financial Solutions

World Finance in Winder, Georgia, provides personal installment loans and tax services. It is located at 47 West May St.

World Finance Valdosta Ga: Expert Money Management Tips

World Finance in Valdosta, GA, provides personal installment loans and tax services. They specialize in helping individuals with their financial

World Finance Tifton Ga: Unveiling Money Solutions!

World Finance in Tifton, GA provides personal installment loans and tax services. Check their website or local branch for loan

World Finance Thomasville Ga Insights: Fiscal Trends

World Finance in Thomasville, GA, offers personal installment loans and tax services. The company provides financial solutions tailored to individual

More Top Headlines

Home Depot Chat Work from Home: Earn Big!

Dunzo Chat Support Job: Unleash Career Growth!

Is Australian democracy in good health?

Australians have just learned their election will be held on 21 May. At a crucial time for the country, Nick Bryant sees a contest that will be defined, to a large part, by what it lacks.

Cubs’ Keegan Thompson suspended for hitting Brewers’ Andrew McCutchen with pitch

CHICAGO (CBS/AP) — Cubs pitcher Keegan Thompson has been fined and suspended three games after hitting Milwaukee.

Home Depot Chat Work from Home: Earn Big!

Dunzo Chat Support Job: Unleash Career Growth!

VIDEOS

Restoring The Lost Water Tanks Of Ancient Kings

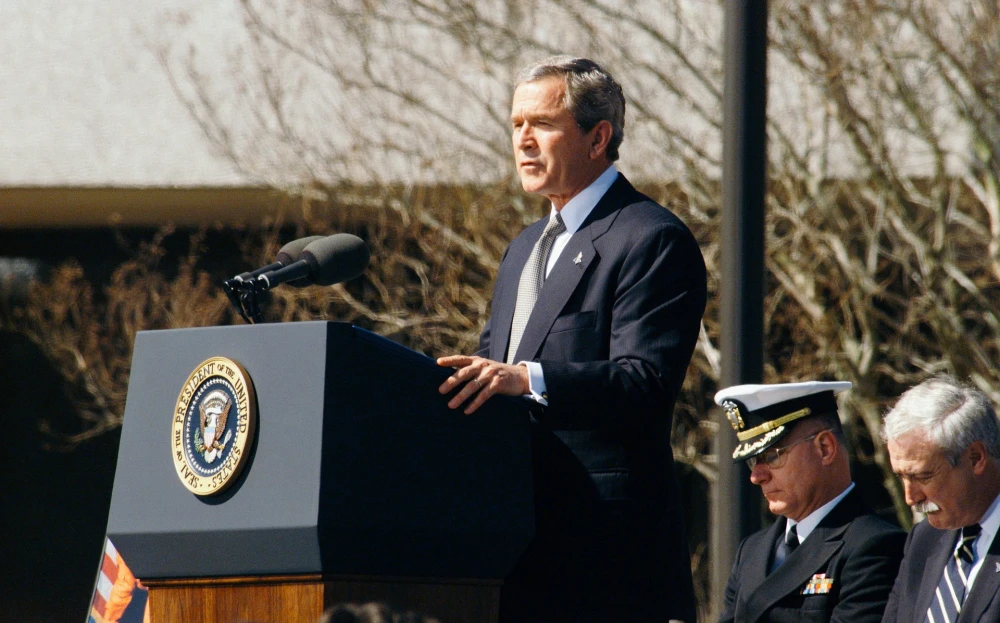

Even though I still hated planks at the end, my core felt tighter after doing them for 30 days straight, and my back felt awesome, too. French President

Entertainment

Your Empty Office Turn Into Apartments?

Australians have just learned their election will be held on 21 May. At a crucial time for the country, Nick Bryant sees a contest that will be defined, to a large part, by what it lacks.

MORE NEWS

Corporations Are People, Too

Even though I still hated planks at the end, my core felt tighter after doing them for 30 days straight, and my back felt awesome, too. French President Emmanuel Macron

Why are Sri Lankans protesting in the streets?

15 Beauty Brands You Probably Didn’t Realize You Can Get At Target

PARIS — French President Emmanuel Macron took first place, ahead of far-right leader Marine Le Pen, in the first round of France’s presidential election on Sunday, but he is on