One Effective Strategy for Managing Credit Card Debt is to Snowball Payments

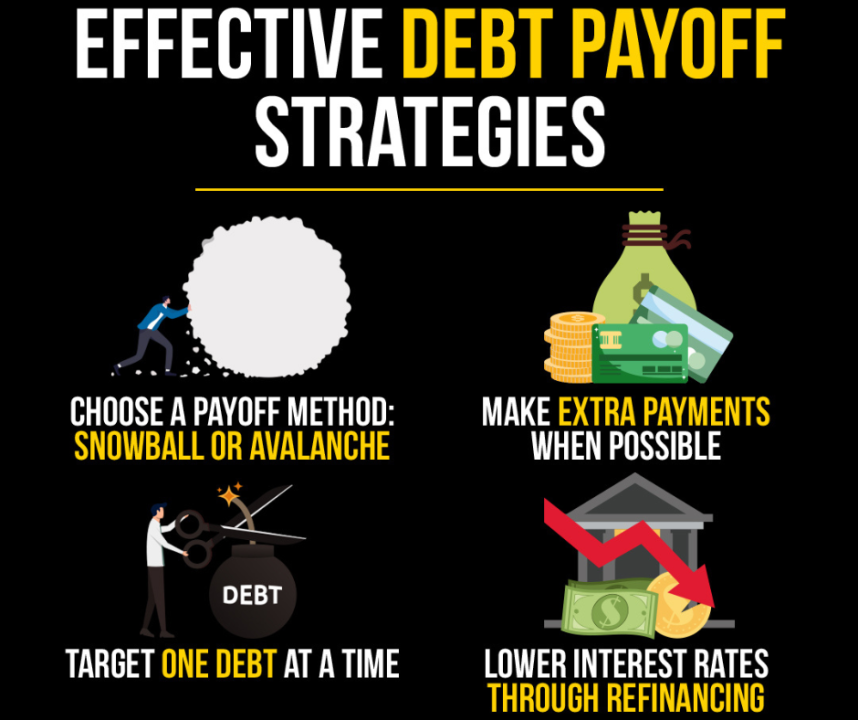

One effective strategy for managing credit card debt is to prioritize paying off the balances with the highest interest rates first. This method, known as the avalanche approach, can significantly reduce the amount of interest you pay over time.

Dealing with credit card debt is a common financial challenge many individuals face. Balancing timely repayments and maintaining a healthy credit score can feel like walking a tightrope. Credit card debt can quickly spiral out of control due to high-interest rates, making it essential to adopt a strategic approach to repayment.

Among several strategies available, targeting cards with the highest interest rates presents a logical starting point. This tactic not only curtails the amount of cumulative interest but also paves the way for more manageable payments down the line. By staying disciplined with repayments and possibly looking into balance transfer options for lower interest rates, controlling and eventually eliminating credit card debt becomes an achievable goal. Conscientiously managing credit card debt is critical to financial stability and requires both diligence and a well-thought-out repayment plan.

:max_bytes(150000):strip_icc()/good-debt-bad-debt.asp_Final-ad0f73162100435486bf302829acffef.jpg)

Credit: www.investopedia.com

Grasping The Snowball Method

Trying to tame credit card debt can feel like a wild beast in your finances. Yet, the Snowball Method offers a strategic approach. It simplifies debt payment and provides clear milestones. Let’s dive into how this method can turn your financial struggles into victories.

The Basic Premise

Here’s how the Snowball Method works:

- First, list your debts from the smallest balance to the largest.

- Make minimum payments on all debts except the smallest.

- Pay as much as you can on the smallest balance.

- When the smallest debt is paid off, move to the next smallest debt.

- Repeat the process, while the “snowball” grows larger as you go.

This approach focuses on quick wins. It’s psychologically motivating as you see debts disappear fast.

Success Stories And Endorsements

Many have shared how the Snowball Method reshaped their financial lives:

| Name | Debt Paid | Time Period |

|---|---|---|

| Emily | $5,000 | 1 year |

| Josh | $10,000 | 2 years |

Experts like Dave Ramsey have endorsed the strategy. They highlight the emotional benefits of seeing debts vanish.

Comparing Debt Repayment Strategies

When tackling credit card debt, choosing the right strategy changes the game. It’s like picking the right tool for a job. Two popular methods stand out: the Avalanche and the Snowball. Both have their strengths. It’s critical to understand them. Let’s dive into how they stack up against each other.

Avalanche Vs. Snowball

The Avalanche strategy focuses on paying off debts with the highest interest rates first. Here’s how it works:

- List all debts from highest to lowest interest rate.

- Pay minimum on all smaller interest rate cards.

- Allocate extra cash to the highest interest debt.

- Move to the next highest rate card after clearing the top one.

Think of it as stopping the biggest leak first. It’s effective and saves money on interest over time.

The Snowball method, on the other hand, tackles debt differently:

- Order debts from smallest to largest balance.

- Minimum payments go to all but the smallest debt.

- Focus your finances on wiping out the smallest balance first.

- Continue to the next smallest until all debts are cleared.

This approach builds motivation as you see debts disappear quicker.

Choosing The Right Approach

Selecting between Avalanche and Snowball comes down to your preferences.

Ask yourself:

- Do high interest rates worry me?

- Do I need quick wins to stay motivated?

If reducing interest is your goal, the Avalanche might suit you. It’s the mathematically smarter move.

For a morale boost and quick progress, consider the Snowball. It can help you stick to your plan.

Remember to check your budget. Make sure it fits with your chosen strategy.

Snowballing Your Way Out Of Debt

Drowning in credit card debt? Take a deep breath. The Snowball Method rolls your worries away, one payment at a time. This strategy is simple yet effective: pay off small balances first for quick wins that fuel your debt-free journey.

Listing Your Debts

Start by writing down every debt you owe, from smallest to largest. Ignore the interest rates for now; just focus on the balances.

| Credit Card | Debt Amount |

|---|---|

| Card A | $500 |

| Card B | $1000 |

| Card C | $2500 |

Paying The Minimum, And Beyond

Continue to make minimum payments on all your cards. Any extra cash goes to the smallest debt. Knock it out fast!

- Minimize costs elsewhere in your budget.

- Use extra funds to pay off the smallest balance.

Reinvesting The Savings

After clearing a debt, do not spend the freed-up money. Apply it to the next debt on your list. Keep the momentum going!

- Roll over previous payments to the next debt.

- Watch your debts disappear, one by one.

Psychological Benefits Of The Snowball Technique

Managing credit card debt can be overwhelming. The Snowball Technique offers not just a strategic, but also a psychological edge in tackling this challenge. This method involves paying off debts from the smallest to the largest balance, creating mental victories that can spur motivation along your journey to financial freedom. Let’s dig into the psychological perks this strategy delivers.

Boosting Morale With Quick Wins

Securing early successes in debt reduction is vital. Quick wins help build confidence and affirm that your goals are achievable. Picture this: crossing off a credit card debt from your list sooner rather than later—it’s a powerful morale boost. The snowball technique prioritizes these small, swift triumphs, reinforcing positive behavior and laying the groundwork for long-term commitment to debt elimination.

Maintaining Momentum

Consistent progress is key in debt management. The joy from initial successes is infectious—it fuels perseverance through the more daunting stages of repayment. As each smaller debt vanishes, the satisfaction and momentum gained from those victories gently push you towards the next target. The snowball effect isn’t just a financial strategy; it’s a psychological one, keeping you motivated and focused on the ultimate goal: a debt-free life.

Potential Drawbacks And Considerations

Understanding the strategy for managing credit card debt is vital. But, knowing the potential drawbacks is equally important. This section digs into the challenges and what to consider before taking action.

Interest Rates Trade-offs

Making the right move with your credit card debt often involves weighing the trade-offs with interest rates. Not all debts are equal. Credit cards often carry high-interest rates, which can inflate your debt over time. Consider these points:

- Transferring balances might lead to lower rates but watch out for transfer fees.

- Promotional APR offers are tempting, but ensure you can pay off the balance before these rates spike.

- Consolidating debt with a personal loan could offer fixed interest rates, but this depends on your creditworthiness.

Debt Size Matters

The size of your credit card debt plays a crucial role in deciding your strategy. Tackle this by understanding:

| Debt Size | Strategy |

|---|---|

| Small to Medium | Consider payment accelerations or debt snowball methods. |

| Large | Look into consolidation loans or balance transfer cards. |

Focusing on high-interest debts first helps you save on the total cost of your debt. Large debts might require stronger measures like professional debt management programs or, in some cases, settling with your creditor.

Remember, different debt sizes demand different approaches. Your financial stability, the debt amount, and your ability to pay it off should guide your choices.

Credit: www.quora.com

Implementing Snowball Payments

Struggling with credit card debt can feel like an uphill battle. But there’s a powerful weapon in your arsenal – the snowball method. This strategy involves paying off your cards from smallest to largest balance, regardless of interest rates. By focusing on clear goals and quick wins, the snowball method keeps motivation high and debt balances low.

Creating A Monthly Budget

A solid monthly budget forms the backbone of the snowball strategy. Here’s how:

- List all expenses: Start with your crucial monthly payments.

- Determine your income: Know what comes in every month.

- Subtract expenses from income: This shows money available for debt.

- Adjust as needed: If necessary, cut non-essential costs.

Finding Extra Funds

More money paid toward debt means faster freedom. Consider these options:

| Method | Description |

|---|---|

| Overtime | Extra hours at work can boost your budget. |

| Side Jobs | Freelance or part-time work adds cash flow. |

| Sell Unused Items | Online sales or garage sales can convert clutter to cash. |

Sticking To The Plan

Consistency is key to the snowball method. Follow these steps to stay on track:

- Prioritize your debts: Smallest to largest, remember?

- Make minimum payments: Do this on all debts except the smallest.

- Throw extra cash: Every extra dollar goes to the smallest debt.

- Celebrate the victories: Each paid-off card is a step closer to debt freedom!

By carefully planning, finding additional funds, and adhering to your payment strategy, the snowball method can turn the tide in the fight against credit card debt. Make each payment a step toward your financial liberation!

Beyond The Snowball: Maintaining Debt-free Living

Escaping the clutches of credit card debt is liberating. Yet, staying on the safe shore of financial stability demands foresight. Beyond the debt snowball or avalanche technique, maintaining a debt-free life is a continuous journey.

Building An Emergency Fund

Unexpected expenses can derail even the most meticulous budget.

- Create a safety net to shield against emergencies.

- Start small, aim for $1,000, then expand to cover several months of living costs.

This fund will prevent the need for borrowing and incurring new debt during hard times.

Understanding Credit Utilization

Your credit utilization ratio plays a pivotal role in your credit score. It measures how much credit you use against your total available limit.

- Keeping this ratio below 30% is crucial.

- Regularly monitor balances to maintain a healthy credit profile.

Low credit utilization signals to lenders that you manage credit responsibly.

Adopting Long-term Financial Habits

Long-term financial health is about consistent habits.

| Habit | Benefit |

|---|---|

| Budget Planning | Controls spending |

| Saving Regularly | Prepares for future |

| Investing Wisely | Grows wealth |

Embrace these habits to ensure that you remain debt-free and financially secure.

Credit: www.bankrate.com

Frequently Asked Questions Of One Effective Strategy For Managing Credit Card Debt Is To

What Is The Snowball Method For Debt?

The snowball method is a debt reduction strategy where you pay off debts from smallest to largest, gaining momentum as you eliminate each balance.

Can Balance Transfers Help With Debt?

Balance transfers to a lower interest rate card can reduce the amount you pay in interest, accelerating your debt repayment if you maintain or increase your payment amounts.

How Does Debt Consolidation Work?

Debt consolidation combines multiple debts into one loan with a single payment, often at a lower interest rate, helping you manage payments and save on interest charges.

Is A Debt Repayment Plan Necessary?

Creating a debt repayment plan is essential as it provides a clear roadmap to paying off credit card debts, which can result in savings and improved credit scores.

Conclusion

Managing credit card debt effectively hinges on strategy. Prioritize high-interest balances for efficient repayment and avoid new debts. Consistency is key, along with realistic budgeting. Take control of your finances by initiating this targeted approach and watch the burden of credit card debt diminish.

Financial freedom awaits; embrace this strategy for tangible results.