Number of Millennials With Student Debt: Alarming Insights

Around 15 million Millennials in the United States are burdened with student debt. This significant portion represents a wide range of professionals seeking financial stability.

Student loan debt is a defining financial challenge for the Millennial generation, which comprises individuals born between 1981 and 1996. Many of these young adults pursued higher education and are now navigating the competitive job market while managing their debt repayments.

Rising tuition costs and the promise of better career prospects led countless Millennials to take on substantial loans, often resulting in long-term financial planning geared towards debt reduction. As they work toward achieving milestones like homeownership and retirement savings, student loans remain a critical obstacle. This issue also influences their economic behaviors and perspectives on further education. As a socially conscious demographic, the impact of student debt on Millennials continues to shape discussions around education affordability and the value of a college degree.

Credit: www.bloomberg.com

Millennial Burden: Rising Student Debt

The Millennial Burden: Rising Student Debt has become a defining financial struggle. Millennials carry the weight of educational loans like never before. Skyrocketing tuition and fee increases are central factors pushing graduates into years, often decades, of debt repayment. Let’s explore the landscape of this growing concern.

Tuition Inflation Over The Decades

Tuition costs have surged significantly over the years. Higher education expenses outpaced inflation. This trend forces families into challenging financial planning. Universities raise prices, making it harder to graduate without loans. Here are key points:

- Prices doubled or even tripled at many institutions.

- College expenses grew faster than median household income.

- Federal aid hasn’t kept up, leading to larger loans.

- Scholarship and grant aid don’t cover the full tuition hike.

Statistics Of Millennials With Student Loans

The sheer number of millennials with student debt tells a worrying story. They surpass previous generations in educational loans. The following statistics paint a stark picture:

| Statistic | Detail |

|---|---|

| Amount of Millennials with Loans | Over 1 in 3 millennials carry student debt. |

| Average Debt per Millennial | About $30,000 to $40,000 on average. |

| Percentage Struggling | Nearly 60% say student loans affect daily finances. |

Drawing from the table, millennials face significant financial hurdles due to student loans. It’s not just about numbers; it’s about the impact on their lives. These debts delay major life events like buying homes and starting families.

The Impact Of Debt On Millennial Lives

The ever-increasing burden of student debt continues to shape the lives and futures of millions of Millennials. With colossal loan amounts looming over their heads, an entire generation confronts unique challenges that have significant and far-reaching implications.

Delayed Milestones: Home Ownership And Family Planning

Buying a house or starting a family often symbolizes maturity and stability. Yet, for many Millennials saddled with debt, these milestones remain just out of reach. Crippling monthly payments mean saving for a down payment on a home becomes a distant dream. Furthermore, the economic uncertainty caused by this debt leads many to postpone marriage and children.

- Homeownership rates have dropped among those under 35.

- Many cite student loans as a major obstacle to saving for a down payment.

- Family planning decisions are affected, with worries about affording childcare and education.

Mental Health Concerns And Stress

Mental health suffers under the weight of debt. The relentless pressure to keep up with payments can lead to chronic stress, anxiety, and depression. Many Millennials report that their massive debt is not just a financial burden, but also a significant emotional one.

| Mental Health Issue | Percentage Affected |

|---|---|

| Stress | Over 60% |

| Anxiety | Approx. 50% |

| Depression | Around 30% |

Increased stress levels can lead to other health problems, both mental and physical. Balancing debt repayment with other living expenses compounds this stress, often creating a cycle that is difficult to escape.

Educational Investment Or Financial Handicap?

Educational Investment or Financial Handicap? – this question looms large over a generation of Millennials burdened by student loans. The dream of higher education brings with it a potential for higher earnings. Yet, the reality of repaying student debt weighs heavily on many, even as they toss their graduation caps into the air. Is the investment in education worth the financial challenge that follows?

Comparing Educational Outcomes With Financial Struggles

The pursuit of higher education often promises personal growth and career advancement. Student debt, on the other hand, presents a stark contrast to these potential benefits. Let’s weigh the scales:

- Pros: Degrees can unlock doors to better jobs and higher salaries.

- Cons: Monthly loan payments may restrict financial freedom and delay milestones like home ownership or retirement savings.

Many Millennials find themselves in a tug-of-war between the advantages of a diploma and the burdens of its cost. With over 44 million borrowers holding a combined total of over $1.5 trillion in student debt in the United States alone, the impact is far-reaching.

| Degree Level | Average Debt | Average Salary Increase |

|---|---|---|

| Bachelor’s | $30,000 | 50% |

| Master’s | $50,000 | 20% |

Job Market Evolution And Roi Of Degrees

The job market is in flux, with technology and globalization reshaping industries. Millennials must consider the return on investment (ROI) of their degrees:

- Degree Relevance: Education in high-demand fields can yield a considerable ROI, ensuring that the cost of student loans is a smart bet on future earnings.

- Market Shifts: Some roles have diminished, leading to degrees that once guaranteed employment now facing stiff competition and lower wages.

Degree holders often earn more than those without, but the type of degree and the field it’s in play pivotal roles in this equation. Therefore, understanding the evolving job market is essential for assessing the true value of an educational investment and combatting the potential financial handicap it can create.

Credit: www.bloomberg.com

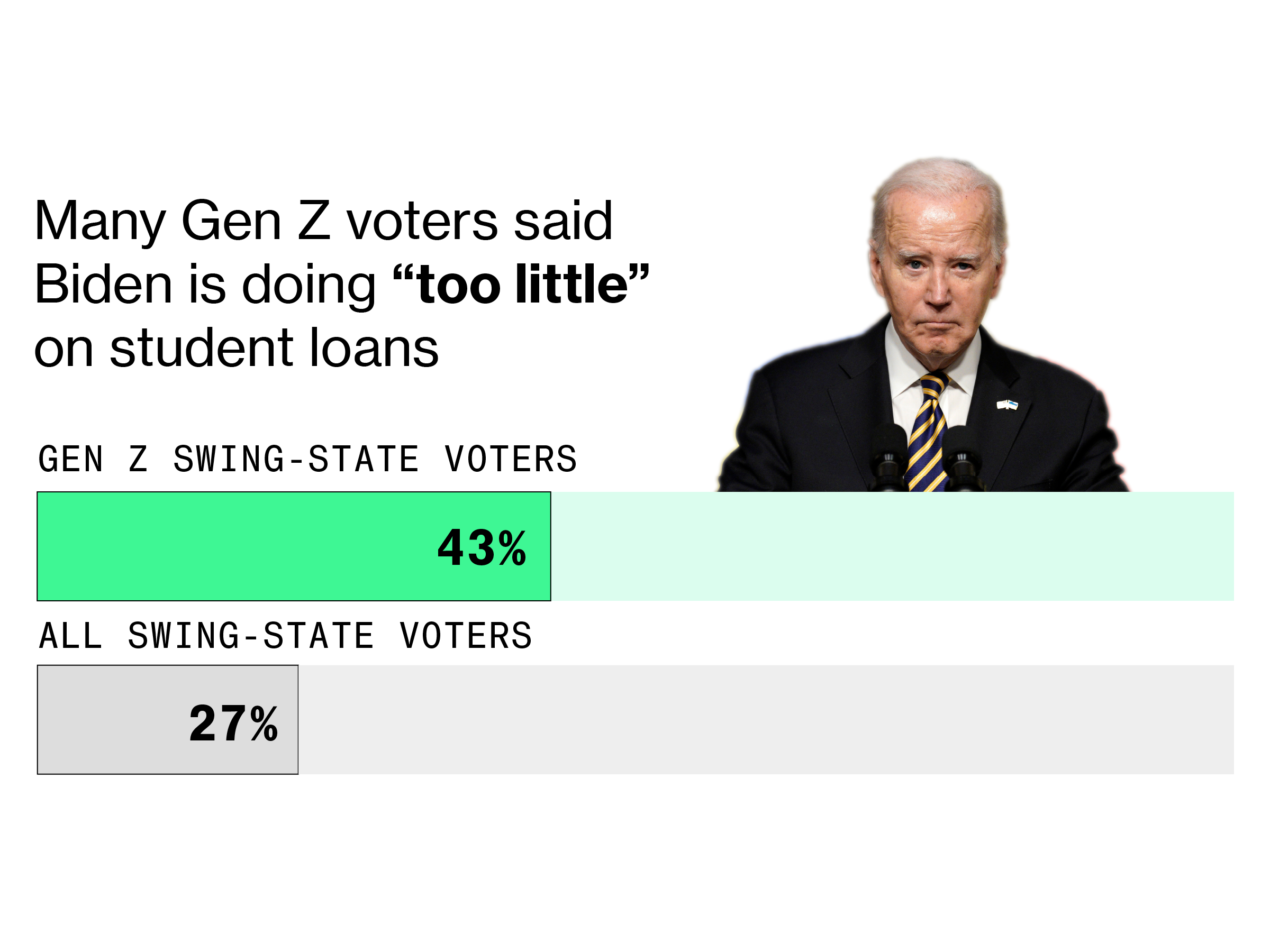

Policy Responses To The Student Debt Crisis

The student debt crisis remains a key challenge for millions of millennials. These graduates need policy-based relief. Lawmakers and educational institutions recognize the urgent need for solutions. Creative and effective strategies now aim to alleviate the financial burden.

Government Legislation And Loan Forgiveness Programs

The government has taken steps to ease student loan strains. New laws and programs are on the rise. These aim to help borrowers manage or even erase their debt.

- Income-Driven Repayment Plans: These cap monthly payments. They consider the borrower’s income and family size.

- Public Service Loan Forgiveness: This erases the balance after ten years. It applies to those working in government or nonprofit sectors.

- Recent Legislative Acts: Officials have passed acts. These help by offering temporary relief. Some offer payment suspensions during economic hardships.

Institutional Changes In Tuition Pricing

Institutions are reassessing tuition costs. They see the need to make college more affordable. This reduces future debt burdens for students.

- Tuition-Free Programs: Some colleges now offer programs. These cover tuition for eligible students, reducing the need for loans.

- Sliding Scale Tuition Models: Colleges set tuition based on family income. This approach makes education more accessible.

- Increased Scholarships: Institutions boost scholarship funds. They award more money based on merit or need.

Beyond Statistics: Personal Stories Of Struggle And Success

Millennials carry the weight of student loans, but numbers don’t tell the whole story. Hidden in the staggering statistics are real-life tales of hardship and triumph. This section dives deep into the individual journeys lay bare the raw impact of student debt on everyday lives.

Case Studies: Millennial Debt Journeys

Every millennial with student debt has a unique story. Many face challenges that shape their lives in profound ways. Here, we explore three personal case studies.

| Name | Debt Amount | Occupation | Current Status |

|---|---|---|---|

| Emily | $85,000 | Graphic Designer | Struggling with monthly payments |

| Michael | $50,000 | Teacher | Second job as a tutor |

| Sarah | $30,000 | Nurse | Loan forgiveness program |

Emily’s balance grows with interest. Michael tutors after school to keep up. Sarah’s perseverance pays off with a lifeline from a loan forgiveness program.

Success Despite Debt: How Some Millennials Are Thriving

Defying the odds, some millennials with student debt are not just surviving but thriving. Let’s delve into how they are achieving success.

- Budgeting: Tight spending plans help them manage debt.

- Side Hustles: Extra income streams turn the tide.

- Financial Education: Learning about money maximizes their choices.

Rachel, an entrepreneur, channels her creativity to build a startup. Jake’s side gig as a freelance writer blossoms into a profitable career. Liam invests in stocks wisely, using dividends to chip away at his loans.

Each thriving millennial teaches us that with resilience, strategic planning, and a bit of ingenuity, it’s possible to write a success story, even when starting with a script weighed down by debt.

Credit: www.bloomberg.com

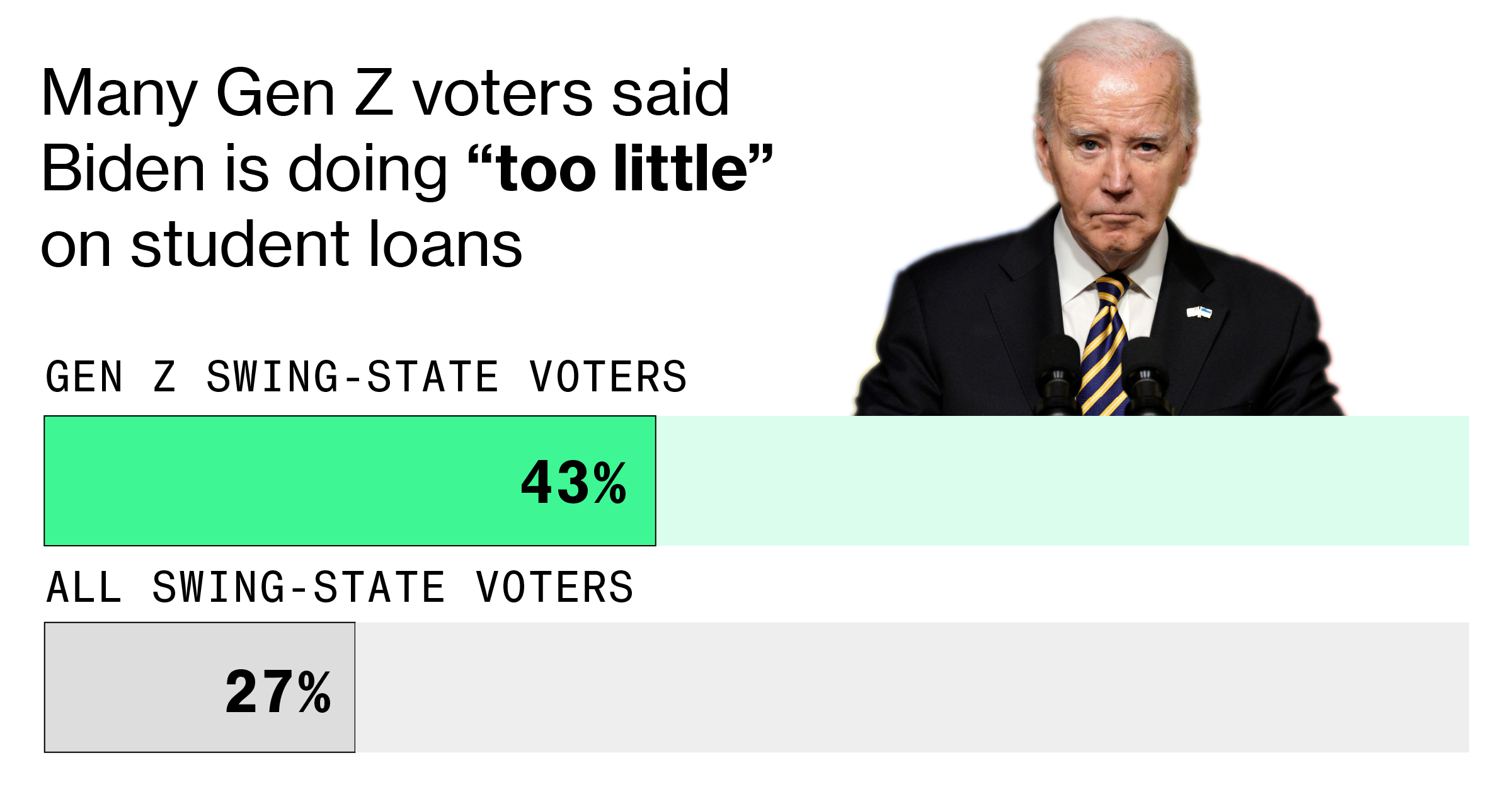

Future Prospects For Generation Z And Beyond

The number of Millennials saddled with student debt underscores a critical question: what lies ahead for Generation Z and beyond? Eyes now turn to the future, scrutinizing the ripple effects on upcoming generations. Will they chart a similar course, or navigate a new path avoiding the pitfalls of their predecessors?

Lessons Learned From Millennials

Generation Z enters adulthood as Millennials share tales of financial woe. Cautionary stories spark reevaluation of the value of traditional college. Not all degrees guarantee success. Highlighting this, Generation Z prioritizes financial literacy and explores diverse learning options. They embrace community colleges, trade schools, and online courses. These choices reflect hopes for a brighter, debt-free future.

Changing Perceptions Of Higher Education

Higher education no longer escapes scrutiny. With soaring college prices and ballooning debt figures, Generation Z weighs the return on investment meticulously. Tech-savvy and pragmatic, they harness information from various sources to make informed decisions. Apprenticeships gain traction, blending education and on-the-job training. Meanwhile, employers increasingly value skills over degrees, prompting a rise in certification programs.

- Skill-based hiring takes precedence

- Self-driven, online learning platforms surge in popularity

- Student debt aversion shapes academic and career choices

Frequently Asked Questions Of Number Of Millennials With Student Debt

How Many Millennials Have Student Loans?

Millennials are one of the most educated generations, with over 40% carrying student debt. This substantial financial burden significantly shapes their economic behaviors and life choices.

What Is The Average Millennial’s Student Debt?

On average, millennials have around $30,000 in student debt. This varies by degree and institution, influencing their creditworthiness and financial stability as they progress in their careers.

How Does Student Debt Affect Millennials’ Lives?

Student debt impacts millennials’ ability to buy homes, save for retirement, and make other significant financial decisions. High monthly payments can delay these milestones compared to previous generations.

Are Student Loan Forgiveness Programs Helping Millennials?

Student loan forgiveness programs provide relief to qualified individuals, reducing or eliminating debt and aiding financial recovery. However, not all millennials qualify, making the impact of these programs variable.

Conclusion

Understanding the millennial struggle with student debt is crucial. This demographic faces unique financial hurdles, often delaying life milestones. Prioritizing debt management and seeking assistance can pave the way for a more stable future. Let’s empower millennials with knowledge and tools for overcoming these financial challenges together.