Millennial Student Debt Crisis: Solutions and Strategies

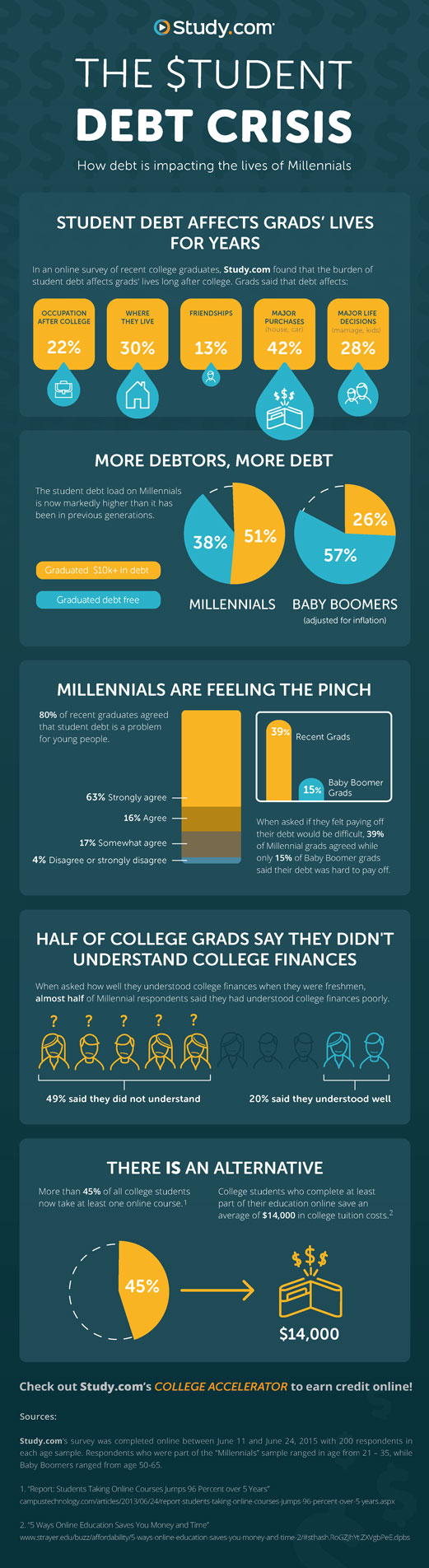

Millennial student debt in the United States has escalated, becoming a significant financial burden. It hampers millennials’ ability to build wealth and make major life purchases.

The rise of student loan debt is one of the most pressing issues facing millennials today. This generation, born between 1981 and 1996, pursued higher education in unprecedented numbers, often facing steep tuition costs. As a result, many have accumulated substantial debt, with student loans becoming their primary financial concern.

This has far-reaching implications, not just on their personal finances but also on the economy at large. Dealing with this debt affects their credit scores, homeownership possibilities, and even retirement planning. Offering clear insights into this challenge, solutions for managing and potentially reducing these debts are becoming increasingly sought after by affected individuals searching for financial freedom. Understanding millennial student debt is crucial for policymakers, educational institutions, and the students themselves as they navigate the complexities of financing higher education.

Credit: www.becker-digital.com

The Scope Of Millennial Student Debt

The burden of student debt on millennials paints a startling financial landscape. With soaring education costs, this generation faces unprecedented challenges. Let’s delve into the depth and breadth of millennial student debt.

Rising Tuition Costs Fuel Debt

Escalating college fees stand at the center of the student debt crisis. Data reveals a sharp increase in tuition over the past few decades. This surge has outpaced inflation, placing a hefty price tag on higher education.

- In-state public college tuition has nearly tripled since the 1980s.

- Private college costs have risen significantly, too.

- Financial aid often falls short, forcing students to seek loans.

Millennials Vs. Previous Generations

The financial outlook for millennials is starkly different compared to their parents’. Higher debt levels paired with a tough job market create a complex scenario for recent graduates.

| Generation | Average Debt at Graduation |

|---|---|

| Millennials | $30,000+ |

| Gen X | $20,000 |

| Baby Boomers | <$10,000 |

Millennials often carry this debt well into their 30s, affecting homeownership, marriage, and other life milestones. In contrast, previous generations generally paid off their debts sooner.

Impact On Millennial Lives

Millennial lives are intricately intertwined with student debt. This financial burden shapes daily choices, careers, and dreams. Let’s explore how hefty student loans are affecting this vibrant generation’s path.

Career Choices And Flexibility

Debt influences career trajectories for many millennials.

- High-paying jobs are a necessity, not an option.

- Passion projects often take a back seat.

- Career flexibility diminishes due to financial pressure.

- Entrepreneurship takes a hit, fearing financial instability.

Despite talent and ambition, millennials must often choose stability over passion.

Long-term Financial Goals Hurdles

Student debt creates barriers to key milestones.

| Milestone | Impact |

|---|---|

| Homeownership | Delay or inaccessibility |

| Retirement Savings | Reduced contributions |

| Investments | Lower risk appetite |

| Education for Children | Financial planning challenges |

Building wealth becomes harder with ongoing debt repayments.

Failed Policies And Systemic Issues

Millennial student debt is a complex crisis. It reflects deeper systemic problems. Many policies to help borrow fail. They don’t reach everyone. Students face high debts with limited relief.

Shortcomings Of Loan Forgiveness Programs

Loan forgiveness programs promise relief. But many students struggle to qualify. Requirements are strict. Programs are confusing. Some students miss out even after years of payments.

- Public Service Loan Forgiveness (PSLF) offers a path to cancel debt. Yet, red tape turns many away. Less than 2% of applicants get approved.

- The Teacher Loan Forgiveness program targets educators. But, the impact is small. Only certain teachers in specific schools benefit.

- Income-driven repayment plans cap monthly bills. They promise forgiveness after 20-25 years. But the waiting period is long. Interest piles up.

| Program | Qualification Hurdles | Approval Rates |

|---|---|---|

| PSLF | Strict employment and payment criteria | Less than 2% |

| Teacher Forgiveness | Limited to certain schools and roles | Variable |

| Income-Driven Plans | Long forgiveness period, growing interest | Not yet known |

The Burden Of Private Student Loans

Many students turn to private loans. They have fewer protections. Interest rates are high. Loan forgiveness? Almost nonexistent.

- Private loans are not eligible for federal forgiveness programs.

- They often lack flexible repayment options. Bankruptcy rarely wipes them out.

- Co-signers get stuck with the bill if borrowers can’t pay. It’s a family burden.

Students need clear, fair paths to manage and overcome their debt. Current policies fall short. A better system must rise.

Private Sector Initiatives

The burden of student debt weighs heavily on millennials, but the private sector is stepping up with creative solutions. Companies recognize the value of an educated workforce and are launching programs to ease the financial strain of higher education. This not only helps employees but also gives companies an edge in attracting top talent.

Employer Tuition Assistance Programs

Employers are investing in their employees’ futures through tuition assistance programs. These initiatives not only support professional development but also reduce student loan burdens. Such programs provide partial or full reimbursement for tuition expenses, empowering employees to pursue higher education and advance in their careers.

- Partial tuition reimbursement is common, with companies paying a portion of the fees.

- Full tuition coverage is a generous offer from some employers, covering all education costs.

- Programs often include stipulations such as grade requirements or commitment to the company for a certain period post-graduation.

Innovations In Refinancing Options

Financial institutions are recognizing the need for better refinancing options for student loans. Refinancing can lower interest rates and monthly payments, helping millennials manage their debt more effectively.

Here are key refinancing innovations:

- Flexible repayment schedules adjust to income levels.

- Lower fees and no prepayment penalties encourage refinancing.

- Some services offer personalized support, guiding borrowers through the process.

| Feature | Benefit |

|---|---|

| Rate Discounts | Saves money over the loan’s life |

| Variable vs Fixed Rates | Offers choice based on the borrower’s comfort |

| Loan Consolidation | Simplifies loan management with a single payment |

Public Policy Solutions

Public Policy Solutions hold the key to alleviate the burden of student debt weighing down the Millennial generation. These policies can transform the landscape of student loans. They can make education more accessible. Let’s delve into the two critical reforms that promise a brighter future.

Reforming Federal Loan Programs

Reform in federal loan programs can change the game for students facing debt. It’s crucial to ensure loans are both manageable and fair. Here are steps that can help:

- Income-driven repayment plans: Payments match what borrowers can afford.

- Loan forgiveness options: Programs for those in public service roles give relief.

- Interest rate caps: Protection against unpredictable rate hikes.

- Better borrower education: Clearer information on loan terms and conditions.

These changes aim to reduce the stress of loan repayments. This makes a degree more attainable.

Expanding Access To Community College

Community colleges offer an affordable pathway to higher education. Expanding access includes:

| Strategy | Benefit |

|---|---|

| Tuition-free programs | Reduce upfront costs for students |

| Grants for low-income students | More opportunities for those in need |

| Online course offerings | Flexible learning options |

| Partnerships with local businesses | Job-ready skills upon graduation |

Expanding access helps students start their careers debt-free. They can achieve their dreams with fewer financial barriers.

Personal Finance Strategies

Struggling with millennial student debt requires smart personal finance strategies. Crafting a plan to tackle student loans can be daunting. Yet, there are effective methods to manage and eventually eliminate debt.

The Snowball Vs. Avalanche Methods

Two popular debt repayment strategies are the Snowball and Avalanche methods. Both can help borrowers take control of their finances.

- The Snowball Method: This involves paying off debts from smallest to largest, regardless of interest rate. It’s designed to give you quick wins and motivate you to continue.

- The Avalanche Method: Contrary to the Snowball, Avalanche prioritizes paying off debts with the highest interest rates first. Over time, this can save you more money in interest payments.

| Method | Focus | Best for |

|---|---|---|

| Snowball | Smallest debt first | Motivation boost |

| Avalanche | Highest interest rate | Interest savings |

Utilizing Income-based Repayment

Income-Based Repayment (IBR) plans can ease the burden of student loans. These plans adjust your monthly payments according to your income level.

- Your payments under IBR plans are a percentage of your discretionary income.

- They ensure your student loan payments are affordable based on your income and family size.

- After a certain number of years on an IBR plan, any remaining student loan debt might be forgiven.

Cultural Shifts And Education Value

The landscape of higher education is transforming. Values surrounding college and its worth are evolving. Millennials face student debt at unprecedented levels. This burden prompts a critical evaluation of education’s return on investment. There’s a pivot towards alternative learning paths. These changes are reshaping societal norms around education and career success.

Changing Perceptions Of College Roi

Return on Investment (ROI) is a major concern for students today. Millennial students weigh the cost of college against potential earnings. This scrutiny is leading to a cultural shift. Many question the once undisputed value of a college diploma. Studies highlight a mismatch between degree costs and job market returns. This shift impacts how students approach post-secondary education.

- Students prioritize fields with clearer career prospects.

- Debt-conscious learners seek scholarships and part-time opportunities.

- Public discourse increasingly supports vocational and trade skills.

Alternatives To Traditional College Paths

With the reassessment of college value, alternative education models gain traction. Online courses, coding bootcamps, and industry certifications present new opportunities. These options promise skill acquisition without hefty loans. They align with the immediate needs of the job market.

| Alternative Path | Benefits |

|---|---|

| Online Courses | Flexible, cost-effective, and comprehensive. |

| Coding Bootcamps | Focus on practical skills and job placement. |

| Professional Certifications | Industry-specific, recognized, and often sponsored by employers. |

These educational alternatives offer clear advantages:

- Decrease or eliminate debt.

- Enable faster entry into the workforce.

- Provide relevant skills for in-demand jobs.

Credit: m.facebook.com

Credit: www.cfr.org

Frequently Asked Questions For Millennial Student Debt

How Much Debt Do Millennials Have?

On average, millennials carry nearly $30,000 in student loan debt. This amount varies based on factors like education level and field of study. Efforts to manage and pay off these debts are a significant financial focus for this group.

Are Student Loans Impacting Millennials’ Home Ownership?

Yes, student debt has a considerable impact on millennials’ ability to buy homes. High monthly repayments and debt-to-income ratios make it harder for them to save for a down payment and qualify for a mortgage.

What Are Common Strategies For Millennials To Pay Off Student Loans?

Millennials often use tactics like debt consolidation, refinancing for lower interest rates, making extra payments, and enrolling in income-driven repayment plans to efficiently tackle their student loan debt.

Can Millennials Get Student Loan Forgiveness?

Certain programs are available for student loan forgiveness, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness. Eligibility often requires specific conditions like job sector, payment history, and type of loan.

Conclusion

Navigating millennial student debt remains a key challenge. With smart strategies and informed decisions, relief is possible. Embrace financial literacy and seek guidance for managing loans effectively. Remember, overcoming student debt paves the way to financial freedom and a brighter future.

Let’s tackle this together, toward a debt-free tomorrow.