How to Profit with Breakout Trading: Free PDF Guide

To make money with breakout trading pdf, learn how to analyze price patterns and identify reliable breakouts. With proper risk management and discipline, breakout trading can be profitable.

Breakout trading is a popular strategy among traders who want to capture profits from sudden price movements in the market. Breakouts occur when the price of a security breaks through a resistance level or support level. By buying or selling at the right time, traders can profit from these breakouts.

To make money with breakout trading, you need to have a strong understanding of technical analysis and be able to identify reliable breakouts. This involves analyzing price patterns, chart formations, and volume indicators. It’s also important to have a solid risk management plan and the discipline to stick to it. With careful planning and execution, breakout trading can be a profitable way to trade the markets.

Credit: www.amazon.com

Understanding Breakouts

What Are Breakouts?

Breakouts refer to a trading strategy that traders utilize to discover profitable trading opportunities. Breakout trading involves identifying the levels where price movements experience a significant increase. This method aims to identify trading opportunities before they happen by determining areas where prices may exceed the existing trading range.

Types Of Breakouts

There are several types of breakouts in the trading market, and understanding them is critical for profitable trading. Here are the types:

- Resistance breakout: This happens when the price goes beyond the resistance level and signifies the onset of an uptrend.

- Support breakout: A support level is a price below which an asset is unlikely to fall. A support breakout implies an upcoming downtrend.

- Momentum breakout: This occurs when the price quickly exceeds the current trading range, accompanied by a surge in volume, indicating a new trend.

Identifying Breakout Trading Opportunities

To be a successful breakout trader, you need to be equipped with the knowledge of how to identify breakout opportunities. Here’s how you can do it:

- Technical analysis: Utilize technical indicators like moving averages, price action, or bollinger bands to identify breakouts.

- Volume analysis: Observe changes in trading volume to pinpoint potential breakout opportunities.

- News and events: Keep yourself updated with the latest industry news and upcoming events likely to impact the market to identify breakout opportunities.

Keeping an eye on these indicators can help you discover upcoming breakouts and present a profitable trading opportunity. Furthermore, it’s vital to implement sound risk management strategies and stay disciplined throughout the trading journey. By mastering the art of breakout trading, you can make a considerable profit in the financial market.

Essential Elements Of Breakout Trading

Breakout trading is a popular method among traders looking to make money from buying and selling volatile assets like stocks, currencies and cryptocurrencies. However, it requires a competent approach, with well established methods to cope with potential risk. In this post, we will outline the essential elements of this trading strategy that you must consider before diving in.

Setting Up A Breakout Strategy

A breakout trading strategy is focused on identifying the early phases of a trend and taking advantage of a significant price movement in a particular direction. It can be achieved using chart patterns like rectangles, triangles, and wedges which indicate strong support and resistance levels of an asset.

To formulate an effective breakout trading strategy, consider:

- Determine how long you want to hold a position

- Analyze the asset to establish its long-term trend

- Identify support and resistance levels

- Keep a close eye on news and events that can affect the asset

Best Timeframes For Breakout Trading

Investors who are into breakout trading ordinarily have the option to engage with different timeframes, which can vary from minutes to several days, depending on the asset and market. These timeframes can significantly affect trading outcomes. Our recommendation is to factor in:

- The volatility of the asset

- Market liquidity

- Daily trading volume

- Consideration of the length of the trading timeframe

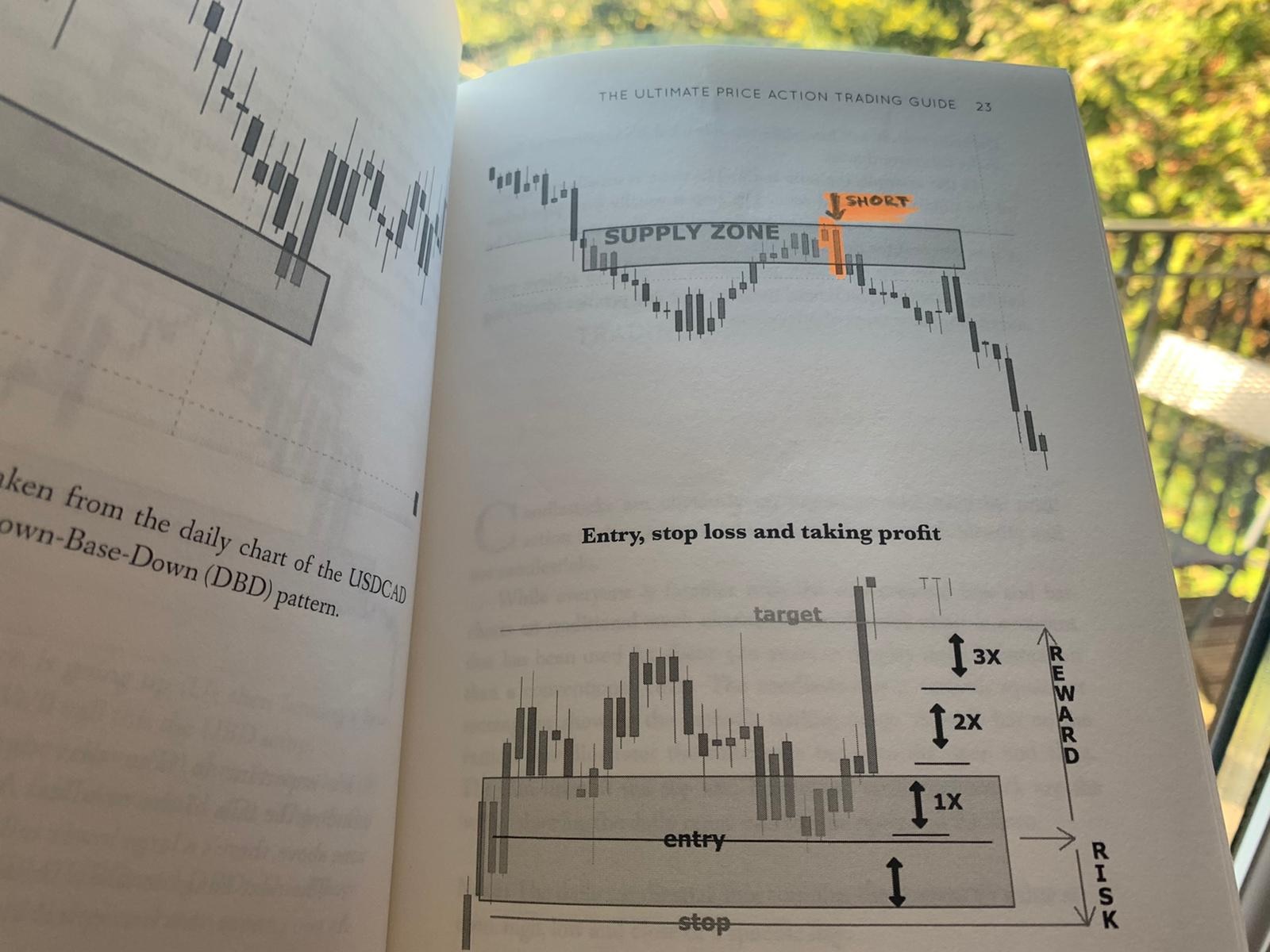

Entry And Exit Points

Identifying entry and exit points is one of the most crucial elements of breakout trading. Here are some things to keep in mind to improve your strategy:

- Enter the market during a confirmed breakout

- Set a stop loss to mitigate risk

- Follow the trend’s progress to identify when to exit

- Consider using trailing stops to protect profits

Risk Management

A sound risk management strategy is essential when trading breakouts to maintain long-term profitability. Here are some tips to better manage risk:

- Risk only a small percentage of your trading account balance per trade

- Limit your overall exposure to a single asset

- Set a stop loss to minimize potential losses

Supporting Indicators

Supporting indicators can be helpful in confirming breakouts and identifying potential trading opportunities. Keep in mind:

- Always back up with price action

- Use an up-to-date trading chart to view the pattern of the price movements

- Rsi and macd indicators are useful for confirming breakouts

Remember, the breakout trading strategy maximizes traders’ profit from price fluctuations in the market. It can be risky, but with a well-planned and strictly followed plan, it can lead to significant rewards.

Implementing Breakout Trading With Free Pdf Guide

Overview Of The Free Pdf Guide

If you’re looking to make profits from trading, breakout trading may be a profitable strategy to consider. The free pdf guide on breakout trading can help you understand the ins and outs of this strategy. With this guide, you can learn how to recognize and make successful trades using breakout trading.

Step-By-Step Guide To Breakout Trading

The free pdf guide provides a comprehensive, step-by-step approach to trading using the breakout strategy. The guide covers the following points:

- Understanding the basics of breakout trading

- Identifying a breakout setup

- Finding the right stock for trading

- Setting stop-loss and take-profit levels

- Entering and exiting trades

Using this guide, you can learn how to implement this strategy in your own trading to make profitable trades.

Real-Life Examples Of Breakout Trading With Free Pdf Guide

The free pdf guide provides real-life examples of successful breakout trades. By following the guide, you can learn how to identify and take advantage of breakout opportunities in different market situations. The guide includes examples of both long and short trades, and you can use these examples to learn how to apply the strategy to your own trading.

Some of the examples covered in the guide include:

- How breakout trading helped a trader to make a 30% profit in a single day

- The use of breakout trading to capitalize on market volatility during earnings season

- How to use breakout trading to trade range-bound markets

By learning from these real-life examples, you can refine your understanding of breakout trading and implement it effectively in your own trading.

Maximizing Profits From Breakout Trading

Breakout trading can be a profitable way to trade in the financial market. However, in order to maximize your profits, you need to have a solid trading strategy, learn from your trading mistakes, boost your trading discipline, scale up your trading with breakouts, and avoid common breakout trading pitfalls.

Fine-Tuning Your Breakout Trading Strategy

To fine-tune your breakout trading strategy, here are some key points to keep in mind:

- Use market analysis tools like charts and technical indicators to spot potential breakout opportunities.

- Set a clear entry point, stop loss, and take profit levels before entering the trade.

- Take advantage of market volatility to increase your trading profits.

- Monitor the trade closely using stop loss and trailing stop loss orders.

- Analyze your trading performance regularly and adjust your trading strategy when necessary.

Learning From Your Trading Mistakes

Learning from your trading mistakes is crucial to becoming a successful trader. To learn from your trading mistakes, here are some key points to keep in mind:

- Keep a trading journal to track your trading performance and mistakes.

- Review your trading journal regularly to identify your trading mistakes.

- Analyze your trading mistakes to identify the root cause and find ways to avoid them in the future.

- Learn from successful traders and their experiences.

Boosting Your Trading Discipline

Boosting your trading discipline is essential to becoming a successful trader. To boost your trading discipline, here are some key points to keep in mind:

- Create a trading plan and stick to it.

- Avoid emotional trading decisions and stick to your trading plan.

- Use risk management tools like stop loss and trailing stop loss orders.

- Be patient and wait for the right trading opportunity.

- Limit your trading exposure to a manageable level.

Scaling Up Your Trading With Breakouts

To scale up your trading with breakouts, here are some key points to keep in mind:

- Use a breakout trading strategy that suits your trading style.

- Scale up your position size gradually as your trading performance improves.

- Use trailing stop loss orders to lock in profits.

- Diversify your trading portfolio with different breakout trading strategies.

- Keep learning and adapting your trading strategy based on your trading results.

Common Breakout Trading Pitfalls To Avoid

To avoid common breakout trading pitfalls, here are some key points to keep in mind:

- Avoid trading in low liquidity markets.

- Avoid trading during major news events that could cause sudden price movements.

- Avoid trading without a clear trading plan and risk management strategy in place.

- Avoid overtrading and taking on too much risk.

- Avoid blindly following other traders’ recommendations without doing your own research.

By following these tips and avoiding common breakout trading pitfalls, you can maximize your profits from breakout trading and increase your chances of becoming a successful trader.

Frequently Asked Questions For How To Make Money With Breakout Trading Pdf

What Is Breakout Trading?

Breakout trading is a trading strategy that involves buying stocks that are breaking out of their price ranges.

How Do You Identify A Breakout?

A breakout can be identified by looking for a stock price that has broken through a resistance level and continues to rise.

Can Breakout Trading Be Profitable?

Yes, breakout trading can be profitable if the trader effectively identifies breakouts and has a sound risk management strategy.

How Do You Manage Risk In Breakout Trading?

Risk in breakout trading can be managed by setting stop losses, using position sizing, and having a clear exit strategy.

Conclusion

As we conclude our discussion on how to make money with breakout trading pdf, it is important to note that this trading strategy requires patience, discipline, and a thorough understanding of the market. Success in breakout trading is all about identifying strong trends and executing trades at the right time.

By mastering this strategy and combining it with proper risk management techniques, traders can significantly increase their chances of earning profits. It’s crucial to stick to a trading plan, continuously track and analyze market conditions, and learn from past mistakes.

Whether you are a beginner or an experienced trader, the breakout trading strategy can be a valuable tool to add to your arsenal. So, start exploring this trading strategy, practice, and gradually hone your skills to achieve consistent success.