How to Profit From Breakout Trading: Download the Ultimate PDF Guide

Breakout trading is a popular strategy to make money in the financial markets by identifying trends and potential price movements. With a well-written pdf guide, traders can learn the necessary skills and techniques involved in breakout trading to generate profits.

In this article, we will discuss the key elements of breakout trading and some strategies for making money with breakout trading pdfs. By following these tips, traders can develop a successful trading plan and achieve their financial goals. Whether you are a beginner or an experienced trader, learning the ins and outs of breakout trading can help you become a more successful investor.

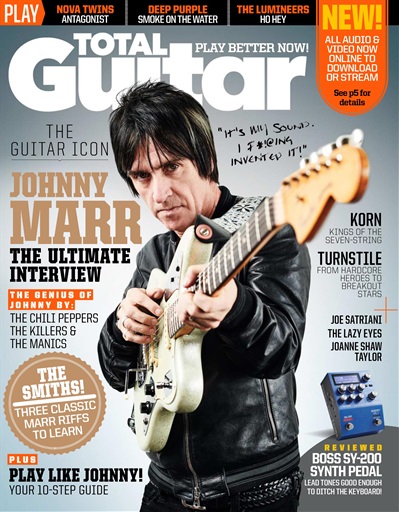

Credit: pocketmags.com

What Is Breakout Trading?

Breakout trading is a popular investment strategy where an investor buys shares that have broken out of their trading range in the hopes of the share price heading higher. This is a method of trading that is used by both institutional and retail traders and is often found in many trading books and online forums that deal with technical analysis.

Keep reading to learn more about breakout trading, its definition, and the importance of this trading strategy in the financial market.

Definition Of Breakout Trading

Breakout trading involves buying a stock that has just broken through its previous high price or just below the previous low price. The strategy is based on the premise that once a stock has broken out of its previous trading range, it is likely to continue in that direction.

If a stock breaks through a resistance level, traders buy the stock, hoping that the price will continue to grow and the value of their investment will rise. Conversely, if the stock breaks through a support level, traders short sell the stock, hoping to profit from its decline.

To execute this strategy, traders use technical analysis tools such as chart patterns, moving averages, and trend lines. By keeping a close eye on these indicators, traders can determine when a security is ready to break out, enabling them to buy or sell at the right time.

Importance Of Breakout Trading In The Financial Market

Breakout trading is a critical strategy for anyone who wishes to succeed in the securities market. Some key reasons why breakout trading is vital in the financial market are:

- It helps investors discover trading positions that have the potential to generate high returns.

- It helps traders spot trends and trading opportunities.

- It enables traders to identify entry and exit points and to limit their losses while maximizing their profits.

- It aids in the creation of a well-rounded investment portfolio by adding stocks that might not have been otherwise considered.

Breakout trading is a trading strategy that helps investors make the most of a dynamic market. It allows them to use technical and fundamental analysis to profit from buying or selling at the ideal moment. By combining market knowledge, discipline, and technical analysis methods, traders that use breakout trading can help increase their chances of success.

Breakout trading is an investment strategy that involves buying or selling individual stocks at times when they are breaking out of their previous trading range. It is an important investment strategy that aims to maximize profits through buying low and selling high.

Investors, both institutional and retail, use this strategy to identify entry and exit points and capture trends and trading opportunities.

Benefits Of Breakout Trading

Breakout trading is one of the most effective ways to make money in the market. In this section, we will discuss some of the key benefits of breakout trading that make it a popular strategy for traders worldwide.

Advantages Of Using Breakout Trading Strategies

Breakout trading strategies have numerous advantages that make them a popular choice for traders. Here are some of the primary benefits:

- Identifies trends: Breakout trading strategies are excellent at identifying market trends. This is because they rely on a security’s price to move beyond its previous high or low, which often indicates a change in the underlying trend.

- Offers higher returns: Breakouts often occur after a period of consolidation, meaning that when a breakout does occur, the price can make a sudden and significant move. This allows traders to make higher returns on their investments.

- Provides clear entry and exit points: One of the most significant advantages of breakout trading strategies is that they provide clear entry and exit points. The entry point is usually at the price level where the security broke out, while the exit point is either a pre-determined price target or a stop-loss order.

- Minimizes risks: Breakout trading strategies can minimize risks as they allow traders to place stop-loss orders at the breakout point. This means that if the price does not continue in the expected direction, the trader can exit the position at a predetermined point, minimizing losses.

Case Studies Of Successful Breakout Traders

Many professional traders have used breakout trading strategies to achieve a high level of success. Here are some case studies of successful breakout traders:

- Paul tudor jones: One of the greatest traders of all time, tudor jones used a breakout trading strategy to make millions of dollars in the 1980s. His strategy involved watching for trends and identifying breakouts, using his proprietary trend-following system.

- William j. o’neil: O’neil is the founder of investor’s business daily and a renowned breakout trader. His trading strategy, called the canslim method, combines both fundamental and technical analysis to identify stocks that are poised for a significant move.

- Larry williams: Williams is a famous trader who has won several trading championships. He used a breakout trading strategy to win the world cup championship of futures trading in 1987, turning $10,000 into more than $1 million in one year.

Breakout trading strategies are popular among traders due to their ability to generate high returns while minimizing risks. By following breakout trading strategies, traders can identify trends, enter and exit trades at the right time, and minimize losses, making them a popular choice for traders of all skill levels.

Technical Analysis And Breakout Trading

Understanding Technical Analysis

Before you dive into breakout trading, it’s essential to understand the fundamentals of technical analysis. Here are a few points to get you started:

- Technical analysis involves analyzing charts and data to determine patterns and forecast future price movements.

- Technical analysis is based on the idea that history often repeats itself, allowing traders to predict potential future price movements.

- Technical analysis includes a variety of tools, such as charts, trend lines, and indicators.

Indicators To Identify Breakout Trading Opportunities

Indicators are key tools used in breakout trading to identify patterns and potential breakouts. Here are some important indicators to keep in mind:

- Moving averages: Moving averages help investors identify trends and determine where potential support and resistance levels might be.

- Relative strength index (rsi): The rsi identifies overbought and oversold conditions in the market, which can help traders predict when a breakout might occur.

- Bollinger bands: Bollinger bands show the volatility of a stock, which can be helpful in identifying upcoming breakouts.

Tips For Breakout Trading

Now that you’re familiar with some technical analysis and key indicators, here are a few tips for successful breakout trading:

- Look for stocks that show a steady price increase leading up to a breakout.

- Have an entry and exit strategy in place before you start trading.

- Don’t be afraid to take profits if a stock reaches your target price.

- Use stop-loss orders to minimize potential losses.

- Continuously study charts and indicators to spot new breakout opportunities.

By following these tips and using key indicators, you’ll be well on your way to profitable breakout trading. Remember to continuously study charts and indicators to identify new opportunities. Good luck and happy trading.

Fundamental Analysis And Breakout Trading

Understanding Fundamental Analysis

Before delving into the world of breakout trading, it’s crucial to understand the basics of fundamental analysis. This involves examining various aspects that affect a company’s financial health, such as their earnings reports, revenue growth, and industry conditions. Here are a few key points about fundamental analysis to keep in mind:

- Fundamental analysis helps traders evaluate the intrinsic value of a stock and determine if it’s undervalued or overvalued.

- It involves analyzing a company’s financial statements, as well as macroeconomic factors like interest rates and inflation.

- By understanding the broader market and economic trends, traders can identify potential breakout opportunities.

How To Use Fundamental Analysis To Identify Breakout Trading Opportunities:

Once you have a solid grasp of fundamental analysis, you can begin to use this approach to uncover breakout trading opportunities. Here are a few strategies you can use:

- Look for companies with strong earnings growth: Companies that consistently beat earnings expectations may be poised for a breakout as investors buy in to benefit from that growth.

- Monitor industry trends: By keeping tabs on broader industry trends, you can identify opportunities for companies that are poised to benefit from those trends.

- Keep an eye on interest rates: Changes in interest rates can have significant effects on the market. When interest rates are low, it may be a good time to invest in companies that are expected to grow rapidly, potentially leading to a breakout.

By combining your understanding of fundamental analysis with market trends and other factors, you can uncover solid breakout trading opportunities.

Remember, breakout trading involves risk and should never be the sole approach used when building an investment portfolio. Always conduct thorough research and due diligence before making any trading decisions. As always, investing in the stock market carries an element of risk, and traders should mitigate their risk by practising good money management and utilising stop-loss orders.

Momentum Breakout Trading Strategy

Breakout trading is a commonly used strategy in financial markets to profit from sudden price movements. Momentum breakout trading strategy is a type of breakout trading that involves purchasing an asset when the price breaks out of a particular range.

The goal is to buy the asset when there is positive momentum and sell it as the momentum starts to fade. This article will take a closer look at how you can make money with momentum breakout trading strategy.

Defining The Momentum Breakout Trading Strategy

The momentum breakout trading strategy involves buying an asset when the price breaks through a particular level of resistance. The strategy relies on the premise that once an asset has broken through a particular resistance level, it is likely to continue to move in the same direction, gaining more momentum as it goes.

The momentum breakout trading strategy involves the following key principles:

- Identifying key resistance levels for an asset

- Buying the asset when it breaks through the resistance level

- Setting a stop-loss at a particular point to limit potential losses

- Taking profit when the momentum begins to fade

Indicators To Use For Momentum Breakout Trading

There are a variety of different indicators that can be used to identify key levels of resistance and momentum in an asset price. Here are a few popular indicators:

- Relative strength index (rsi): Rsi measures the momentum of an asset by comparing the magnitude of its recent gains to its recent losses. If an asset is overbought, it may be a signal that its price is likely to reverse.

- Moving average: A moving average smooths out the price of an asset by calculating an average price over a particular number of periods. Traders can use moving averages to identify potential levels of support and resistance.

- Bollinger bands: Bollinger bands are used to measure the volatility of an asset. They can help identify potential breakout points and levels of support and resistance.

The momentum breakout trading strategy can be a useful tool for traders looking to profit from short-term price movements. By identifying key resistance levels and using appropriate indicators, traders can increase their chances of success. However, as with any trading strategy, it is important to manage risk by setting stop-loss orders to limit potential losses.

Reversal Breakout Trading Strategy

Looking to make money with breakout trading? The key to success is understanding the reversal breakout trading strategy. This approach focuses on identifying when trends may be about to change direction, allowing for profitable trades as prices break out of their previous patterns.

Here’s what you need to know:

Defining The Reversal Breakout Trading Strategy

- Essentially, reversal breakout trading involves looking for changes in trend direction, which can present opportunities to profit when prices break out of their existing patterns.

- This strategy focuses on identifying key areas of support and resistance, which are levels that indicate where prices are likely to turn around. When prices break out of these levels, it can signal a shift in direction.

- Traders who use reversal breakout strategies often rely on technical analysis methods, such as chart patterns and indicators, to identify potential opportunities.

Indicators To Use For Reversal Breakout Trading

- Moving averages can be a useful tool for spotting potential reversal breakout trades. For example, if prices have been trending down and then suddenly cross over a moving average, it can indicate a potential shift in direction.

- Bollinger bands, which measure volatility, can also be a helpful indicator for spotting potential reversal breakouts. When prices start to break out of the upper or lower bands, it can signal a change in trend direction.

- Another useful indicator for reversal breakout trading is the relative strength index (rsi), which measures the strength of price momentum. When rsi values reach extreme levels, it can signal a potential reversal.

Remember, it’s important to consider multiple indicators when using this strategy and to also take into account other factors, such as overall market conditions and economic news, that could also impact prices. With practice and patience, however, traders can use the reversal breakout strategy to find profitable opportunities in the market.

Pullback Breakout Trading Strategy

Breakout trading is a strategy commonly used by traders trying to make a profit in the stock market. A breakout happens when the stock price moves above a resistance level or below a support level. The pullback breakout trading strategy is a type of breakout trading that relies on the stock pulling back to a support or resistance level before breaking out in the other direction.

This strategy may be profitable in volatile markets where stocks are moving up and down rapidly.

Defining The Pullback Breakout Trading Strategy

The pullback breakout trading strategy is a type of technical analysis that presupposes that a stock price will bounce back after trending downwards, testing an established support level or trendline before bouncing back. The trader buys when the stock price breaks out of the recent support trendline, in turn reversing the recent dip.

The pulback breakout trading strategy is used in scalable contexts to take advantage of bullish trends or bearish drops in stock prices.

Indicators To Use For Pullback Breakout Trading

Indicators are vital in pullback breakout trading. They assist the trader in identifying an ideal entry point for a trade. Indicators for the pullback breakout trading strategy include moving averages, relative strength index (rsi), and moving average convergence divergence (macd).

Moving Averages

Moving averages are essential in breakout trading. They smooth out the fluctuations in price, giving a clear indication of how the stock is performing over a given period. Traders use two moving averages to determine the support levels and resistance levels.

Relative Strength Index (Rsi)

The rsi is a momentum indicator used by traders to study oversold and overbought conditions. It oscillates between 0 and 100, with anything below 30 considered oversold, while anything above 70 is overbought. The rsi can be helpful in identifying reversals to a range of stocks, providing a context to plan a buy position.

Moving Average Convergence Divergence (Macd)

The macd is a trend-following momentum indicator used to identify the stock’s direction trendings. It consists of two lines: the macd line and the signal line. The macd line is the difference between two moving averages, while the signal line is a 9-day moving average of the macd line.

Traders follow the macd’s trend as an indication of the stock’s price direction.

To sum up, the pullback breakout trading strategy is a profitable breakout trading strategy used by traders in volatile markets. Traders use indicators such as moving averages, rsi, and macd to identify the ideal entry and exit points for trades.

With the appropriate indicators, one can curb risky trading and make good returns.

Importance Of Risk Management

Are you interested in learning how to make money with breakout trading? It’s a popular trading strategy that involves entering a trade when the price breaks through a significant level of support or resistance. However, it’s important to keep in mind that this type of trading carries risks, which is why implementing effective risk management strategies is crucial.

In this section, we’ll discuss the importance of risk management when it comes to breakout trading.

Understanding The Risks Associated With Breakout Trading

Breakout trading can be highly profitable, but it also comes with its own set of risks. Here are some of the risks associated with this trading strategy:

- False breakouts: The price may break a level of support or resistance, only to quickly reverse direction. This can lead to losses for traders who enter trades based on the false breakout.

- Volatility: Breakouts often occur during periods of high market volatility, which means that the price can move quickly and unpredictably. This can also lead to sudden losses that are difficult to anticipate.

- Stop-loss orders: Many traders use stop-loss orders to limit their losses on a trade. However, during periods of high market volatility, stop-loss orders may not be executed at the desired price.

Consequences Of Not Implementing Effective Risk Management Strategies

If you don’t have a solid risk management plan in place, you could be putting yourself at risk for significant losses. Here are some consequences of not implementing effective risk management strategies:

- Loss of capital: Trading is inherently risky, but failing to manage your risks can result in significant losses that wipe out your trading account.

- Emotional stress: Trading losses can be emotionally draining, particularly if you’re not prepared for them. This can lead to impulsive trading decisions and further losses.

- Inconsistent results: Without a solid risk management plan, your trading results may be inconsistent over time. This can make it difficult to achieve your trading goals and objectives.

To avoid these consequences, it’s important to have a clear risk management plan in place before you start trading breakout strategies. This plan should include guidelines for setting stop-loss orders, limiting position sizes, and managing your emotions during periods of market volatility.

By implementing effective risk management strategies, you can increase your chances of success in breakout trading.

Effective Risk Management Strategies

Breakout trading is a popular trading strategy in which traders buy stocks or assets at a breakout level, hoping they will continue to rise. This strategy involves risk, but with effective risk management, it can be quite profitable. In this post, we’ll explore some effective risk management strategies to help you make money with breakout trading.

Implementing Stop-Loss Orders

Stop-loss orders are important in breakout trading because they help you limit your losses. By setting a stop-loss order, you instruct your broker to sell your position when it reaches a certain price. This means that if the stock or asset starts to fall rapidly, your position will be closed, and your losses will be minimized.

Here are some key points to keep in mind regarding stop-loss orders:

- Set your stop-loss orders at a level that makes sense based on the stock’s volatility and your risk tolerance.

- Use trailing stop-loss orders to protect your profits on winning trades.

- Avoid moving your stop-loss orders further away from your entry point after the trade has started.

Diversifying Your Portfolio

Diversification is key to successful trading, and breakout trading is no exception. By diversifying your portfolio, you spread your risk over several different stocks or assets. This means that if one of your trades goes sour, you won’t lose all your investment capital.

Here are some key points to keep in mind regarding portfolio diversification:

- Don’t put all your capital into one stock or asset.

- Diversify your portfolio across different sectors and industries.

- Consider investing in both long and short positions to hedge your exposure to market risk.

Setting Realistic Profit Targets

While making money is the ultimate goal, it’s essential to set realistic profit targets to ensure you don’t take unnecessary risks. By setting profit targets, you can know when it’s time to exit a trade. Here are some key points to keep in mind when setting profit targets:

- Use technical analysis to identify support and resistance levels to help you set your profit targets.

- Avoid being overly greedy and setting unrealistic profit targets.

- Remember that taking small gains consistently adds up over time.

By implementing effective risk management strategies, you can successfully make money with breakout trading. Create a plan by following these guidelines and take calculated risks. Remember, like any trading strategy, breakout trading requires patience, discipline, and constant learning.

Frequently Asked Questions For How To Make Money With Breakout Trading Pdf

What Is Breakout Trading?

Breakout trading is a strategy in which traders aim to profit from sharp market movements.

How Does Breakout Trading Work?

Breakout traders typically take positions in an asset when its price breaks through a key resistance or support level.

What Are The Key Factors To Successful Breakout Trading?

The key factors to successful breakout trading include a well-defined trading plan, good risk management, and strong market analysis skills.

Is Breakout Trading Risky?

Like any trading strategy, breakout trading does carry some degree of risk. Traders should ensure they have a solid understanding of the strategy and its risks before investing.

Conclusion

As we wrap up this guide, it’s clear that breakout trading can be an exciting and lucrative strategy for making money in the stock market. By identifying key levels of support and resistance and taking advantage of price movements, you can profit from breakout trades and grow your portfolio.

However, it’s important to remember that breakout trading does carry some risks and requires careful analysis and planning. It’s also essential to stay disciplined and not let emotions cloud your judgement. With the right mindset, knowledge, and tools, breakout trading can be a valuable addition to your investment strategy.

So, whether you’re a beginner or a seasoned trader, roll up your sleeves, follow the steps outlined here, and start making profitable trades with breakout trading today.