Boomers Millennials Less Than 2 000 Student Loan Debt: Myth Busted!

Many Baby Boomers and Millennials have student loan debt balances below $2,000. This low level of debt impacts their financial decisions differently than higher debts would.

Understanding the extent of student loan debt among generations reveals diverse financial landscapes. Baby Boomers, often perceived as financially stable due to long-standing careers, still carry the burden of student loans, with some nearing retirement. Millennials, on the other hand, are at a pivotal point in their financial journeys, dealing with various debts including student loans.

A significant number of both generations hold under $2,000 in student loan debt. Such relatively small amounts can still influence credit scores, savings, and the ability to invest in other areas, like housing or retirement. This information is crucial for financial planners and policymakers aiming to address the nuances of student loan debt across different age groups.

Credit: en.wikipedia.org

The Myth Of Meager Debt

Talk of student loan debt often paints a picture of staggering financial burden for millennials and boomers. Yet, some suggest that many owe less than $2,000. This notion can be misleading. It’s crucial to unearth the real statistics and understand the true weight of loans on these generations.

Perception Of Financial Burden

It’s easy to believe most young adults and older generations have minimal student loans. Success stories and anecdotes might lead us to think that student debt is a manageable hurdle. The truth is more complex. Debts under $2,000 can still be a significant pressure for many. The impact on day-to-day finances for boomers and millennials should not be overlooked.

- Small debts can affect credit scores

- Marginal loans might hinder life milestones

- Even minimal debts cause financial anxiety

Statistical Realities

Data shows a different scenario than the minimal-debt myth. A large portion of students owe much more than $2,000. This debt affects life decisions and financial stability.

| Generation | Average Student Loan Debt |

|---|---|

| Millennials | $30,000+ |

| Baby Boomers | $40,000+ |

Understanding these figures is essential. Student loans are a significant concern for a wide segment of the population, not just a few. Remember:

- Statistics offer clarity

- Many owe more than superficial discussions suggest

- Perception doesn’t always match reality

Credit: www.theatlantic.com

Student Loan Debt Across Generations

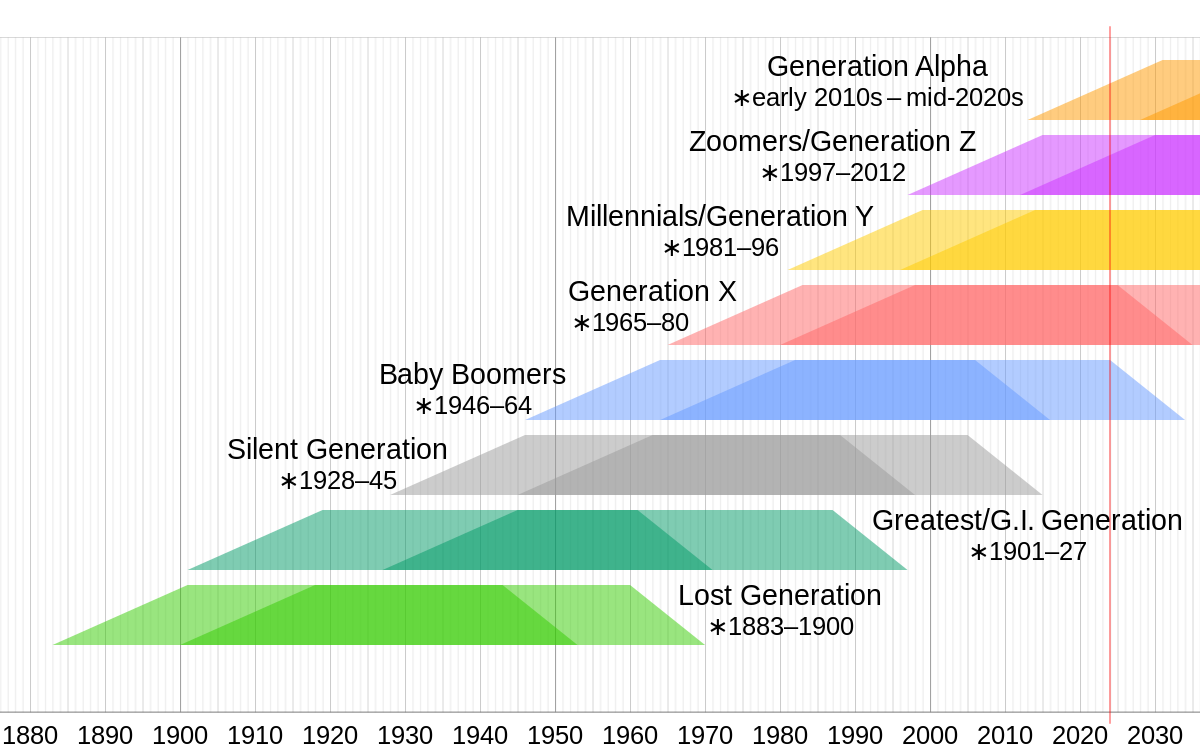

Student loan debt affects many Americans. Different generations handle this burden in various ways. Two groups stand out: Baby Boomers (Boomers) and Millennials. Boomers now face retirement challenges. Millennials deal with rising costs of education. Let’s dive into their financial worlds and understand their struggles.

Boomers’ Financial Struggles

Many believe Boomers have it easy. That’s not the case. Some still struggle with student loans. After years in the workforce, Boomers face a new challenge: retirement with debt. Debt amounts vary, but for many, it’s less than $2,000. Paying this off can be tough on a fixed income.

- Boomers’ budgeting must account for debts

- Social Security and pensions may not suffice

- Medical costs can add to financial strain

Millennials And Rising Education Costs

Millennials have it different. They entered a world where college prices soared. Student loans became a necessity. The burden often exceeds $30,000. This debt impedes milestones like home ownership or starting a family. It’s a stark contrast to the less than $2,000 debt some Boomers face.

- Education costs have outpaced inflation

- Grants and scholarships fail to cover all expenses

- Loan repayment can span decades

Analyzing The Numbers

Welcome to our deep dive into the student loan burdens shouldered by different generations. In this ‘Analyzing the Numbers’ section, we slice through the data on Boomers and Millennials. Our focus here rests on those managing less than $2,000 in student debt – a seemingly small amount that often has a larger-than-expected impact.

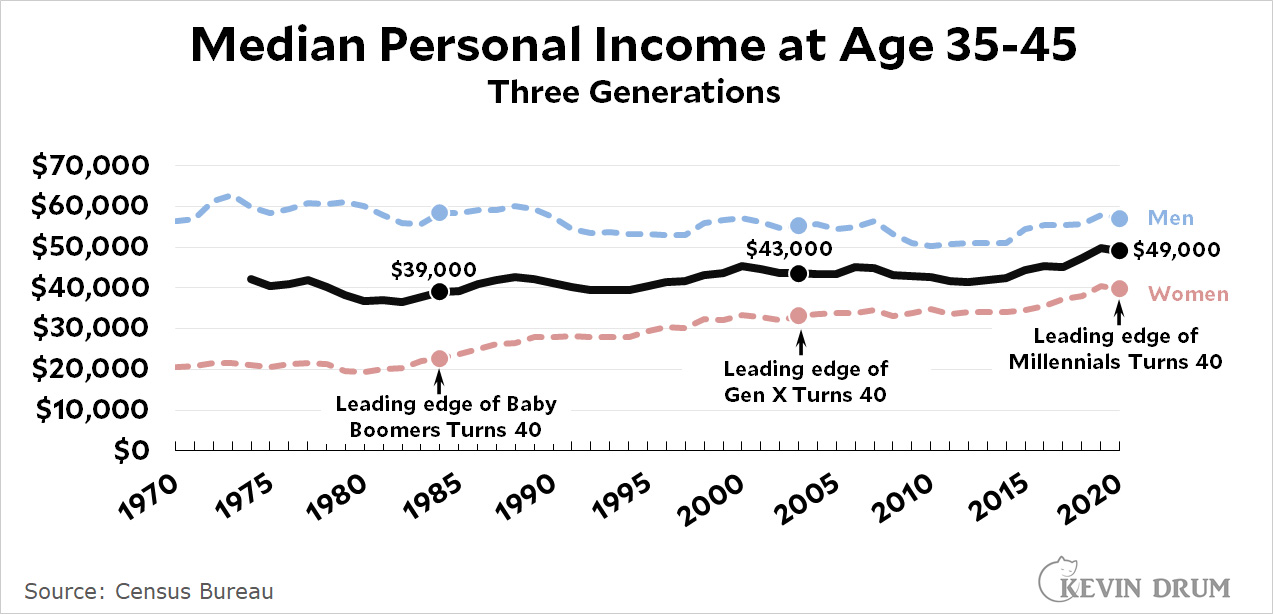

Average Debt Statistics

Understanding the average figures starts with a comparative look at generational debt loads. Our analysis begins with Boomer and Millennial groups. Experts point to variations in tuition costs and economic environments during their education years. Dissecting these figures reveals unexpected insights into financial pressures. Let’s explore the data:

| Generation | Average Student Loan Debt |

|---|---|

| Baby Boomers | $40,000 |

| Millennials | $34,000 |

The Underestimated Overhang Of Small Debts

Small debts often slip under the radar, but they create a unique struggle for debtors. Less than $2,000 might seem insignificant compared to larger loan balances. Yet, smaller debts linger, indicating borrowers face obstacles in closing these accounts. We will outline the stumbling blocks encountered by those with “small” debts:

- Persistent monthly payments that stretch over years

- Additional fees that inflate original loan amounts

- Psychological weight, despite the lower balance

- Impact on credit scores, affecting financial opportunities

Borrowers are often caught in a cycle due to these factors. This cycle hinders their ability to achieve financial freedom. An effective debt management plan is crucial for them. It requires awareness and resources to navigate these choppy waters.

Credit: jabberwocking.com

Psychological Impact Of Student Loans

The weight of student loan debt leaves a mark on one’s psyche, shaping their well-being and future. This impact is different for each generation. Boomers and millennials both grapple with the financial and emotional toll of less than $2,000 in student loans. Though the debt might seem small, it can trigger a profound psychological effect.

Stress And Mental Health

Student loans often lead to chronic stress. Stress affects our sleep, mood, and how we interact with others. Over time, this stress can turn into anxiety or depression. Millennials report feeling overwhelmed by their loan payments. They experience stress even with smaller amounts of debt. Boomers, on the other hand, may feel this stress as they near retirement. They worry about paying debt on a fixed income.

- Sleep disturbances due to ongoing worries

- Mood swings that disrupt daily life

- Increased anxiety about future financial stability

Long-term Effects On Life Choices

Student loans impact life decisions like buying a house or starting a family. Both boomers and millennials may hesitate to make big purchases. Fear of debt can lead to postponing these significant life events. Some people might avoid further education due to the fear of accumulating more debt.

| Life Event | Boomers | Millennials |

|---|---|---|

| Home Ownership | May sell existing homes | Delay buying first home |

| Retirement | Postponed or affected | Worries start early |

| Education | Less likely to return to school | May avoid graduate programs |

Living with student loan debt, even a smaller amount, can limit opportunities and shape one’s fate. People may choose jobs for money over passion. They might take on extra work to pay off debt. This can lead to burnout and dissatisfaction with work.

Strategies For Managing Student Debt

Many Boomers and Millennials find themselves grappling with less than $2,000 in student loan debt. While the amount might seem small to some, it can be a pesky hurdle for others. To effectively manage this debt, understanding your options is crucial. The right strategy can turn a financial annoyance into a minor blip on your financial radar. Below are key strategies to help chip away at student loans methodically.

Repayment Plans

Navigating repayment plans is essential. Federal student loans offer various options:

- Standard Repayment Plan: Fixed payments over 10 years.

- Graduated Repayment Plan: Payments start low and increase every two years.

- Income-Driven Repayment Plans: Payments are recalculated each year based on your income and family size.

Borrowers with smaller debt loads might opt for a shorter timeline to save on interest.

Loan Forgiveness Programs

Loan Forgiveness Programs can erase some or all debt. To qualify, one must typically work in certain public service jobs or meet other criteria. Key programs include:

- Public Service Loan Forgiveness (PSLF): After 120 qualifying payments while working for eligible employers.

- Teacher Loan Forgiveness: For those teaching full-time in low-income schools for five consecutive years.

Research carefully to find programs that apply to your situation.

Financial Literacy And Planning

Improving financial literacy is a powerful debt management tool. Create a budget with these steps:

- Track your spending.

- Identify areas to cut back.

- Set a debt repayment goal.

- Allocate funds to pay off your student loan faster.

Use free online resources to enhance your financial knowledge.

Shifting The Narrative

Shifting the Narrative around student loan debt is vital in our current discourse, especially considering the contrasting financial landscapes of Baby Boomers and Millennials. As many millennials struggle with ballooning educational debts, it’s time to reassess and reconstruct the public’s understanding of this issue. With different generations facing vastly different economic realities, reframing the conversation on student loans is not only necessary but also overdue.

Challenging The Debt Stigma

The idea that student loans are a personal failure is outdated and harmful. The truth shows a systemic problem, not an individual one. Debt stigma can prevent people from seeking help or pursuing education. It’s time to highlight success stories where individuals manage, or even thrive, in spite of their debt. By spotlighting these narratives, society can foster a more compassionate and realistic view of student loans.

Education Reform Advocacy

Championing education reform is crucial for Millennials plagued by student loan debts. Advocacy efforts shift focus to tangible policy changes that can offer relief and pave the way for future generations. Strategies include promoting income-based repayment plans, lobbying for lower interest rates, and campaigning for expanded loan forgiveness programs. Here’s a snapshot of essential reform areas:

- Increased federal scholarships and grants

- Support for tuition-free community college initiatives

- Reform of private student loan regulations

Empowering Millennials through education reform is not just beneficial for this group; it’s a long-term investment in the nation’s economic prosperity.

Frequently Asked Questions For Boomers Millennials Less Than 2 000 Student Loan Debt

How Much Student Debt Do Millennials Have?

Millennials typically carry a diverse range of student debt burdens. However, those with less than $2,000 in student loan debt may find it manageable and are often close to paying off their loans. Strategies like extra payments can expedite loan clearance.

What Challenges Do Boomers Face With Student Loans?

Many boomers face the challenge of either carrying their own student debt into retirement or supporting their children’s education financially. Despite possibly having smaller loan amounts, fixed retirement income can make managing and repaying student debt a significant concern for them.

Can Student Loans Be Forgiven For Boomers Or Millennials?

Loan forgiveness programs exist, but eligibility often hinges on several factors, such as the type of loan, repayment plan, and occupation. Both boomers and millennials can explore Public Service Loan Forgiveness (PSLF) or income-driven repayment plans that may lead to loan forgiveness after a certain period of time.

Are There Specific Loan Repayment Strategies For Small Debts?

Yes, for small student loan debts like those under $2,000, debt snowball or avalanche methods can be effective. Paying more than the minimum, refinancing, or consolidating loans are strategies that can help speed up repayment.

Conclusion

To wrap up, it’s clear that both Boomers and Millennials grapple with student loan debt, albeit often under $2,000. Understanding this cross-generational challenge paves the way for targeted financial solutions. It’s time to bridge the gap with smarter education financing.

Let’s take action – for every generation’s future.