Average Millennial Student Loan Debt: Navigate Financial Freedom!

The average millennial student loan debt in the U.S. Hovers around $30,000.

This figure reflects the rising cost of higher education. Navigating the financial landscape of post-secondary education, millennials across the United States grapple with a significant burden: student loan debt. As college tuition has soared over the past few decades, so has the amount that students borrow, culminating in a substantial financial challenge for a generation striving for academic and professional success.

This mounting debt affects not only their personal finances but also broader economic aspects like purchasing power and retirement planning. Many millennials delay major life milestones due to this debt, such as buying a home or starting a family, which underscores the far-reaching impact of the student loan crisis on a generation often characterized by its aspirations and achievements despite economic adversities.

Credit: www.facebook.com

The Millennial Debt Crisis

Millennials face a financial hurdle unlike any before: towering student loan debt. With dreams of success, many take the leap into higher education, unaware of the financial strain awaiting them after graduation. This debt crisis not only threatens their financial stability but also casts a long shadow across their future, affecting life choices from starting families to buying homes.

Rising Cost Of Education

It’s no secret that the cost of obtaining a degree has skyrocketed. Factors include inflation, reduced state funding, and growing campus amenities. These rising costs have put the dream of college out of reach for many without the help of loans.

- Tuition fees have increased by over 25% in the last decade.

- Books and supplies often cost thousands of dollars.

- On-campus living adds a hefty sum to the overall expense.

Statistical Snapshot Of Student Loan Debt

The numbers paint a stark reality of the millennial debt load. On average, upon leaving school, a millennial holds roughly $30,000 in student loan debt.

| Year | Average Debt |

|---|---|

| 2010 | $25,000 |

| 2015 | $30,000 |

| 2020 | $33,000 |

Note that these figures can vary widely. They depend on the type of institution—public or private—and the course of study. With rising interest rates, the total repayment can often exceed the initial loan amount significantly.

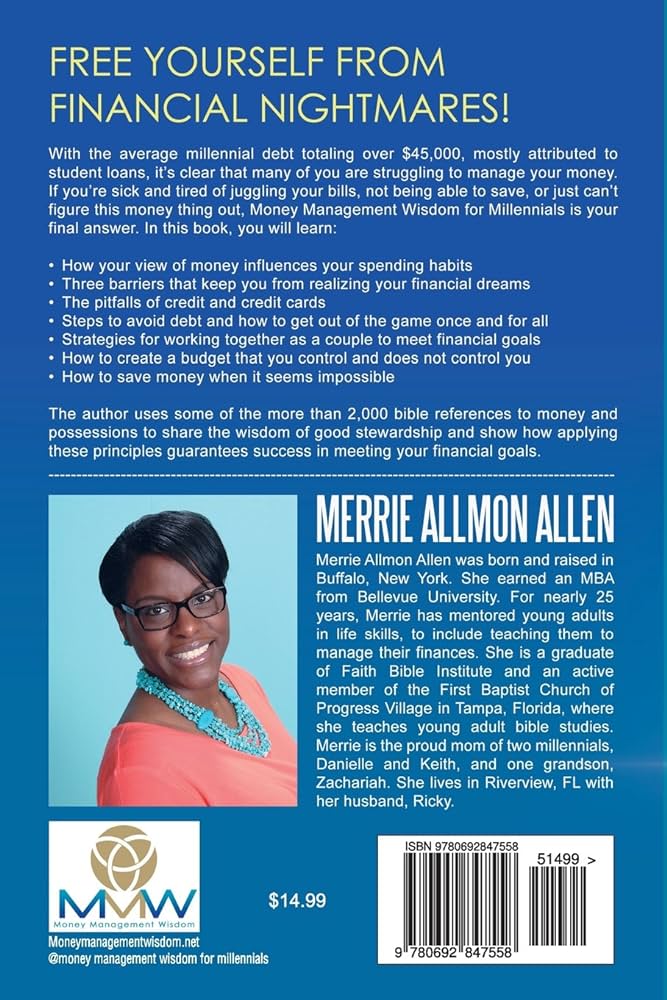

Credit: www.amazon.com

Unpacking The Average Student Loan Debt

Student loan debt is a hot topic. Many millennials find themselves burdened by significant financial obligations following their education. Understanding the nuances, such as the average debt load and its comparison across different generations, can shed light on this issue. Studies often reveal that location, education field, and socio-economic background play roles in this complex picture. Let’s delve into the figures and trends that define the student loan landscape for millennials.

Comparing Generations: Boomers, Gen X, And Millennials

Generational differences in student loan debt highlight shifts in education costs and economic landscapes over the years. Here’s a snapshot:

| Generation | Average Debt |

|---|---|

| Boomers | $15,000 |

| Gen X | $20,000 |

| Millennials | $30,000 |

Millennials lead with the highest average, often due to elevated tuition fees and living costs.

Understanding Debt Distribution Among Fields Of Study

The choice of major significantly affects student loan debt. Consider these trends:

- Medical and Law degrees often lead to higher debt loads due to extended education periods.

- STEM majors might acquire less debt, with potential for lucrative job prospects out of college.

- Arts and Humanities majors typically face moderate debt with variable employment outcomes.

These variations inform the broader discussion on education and financial planning for prospective students.

Impacts On Millennial Lives

Impacts on Millennial Lives are profound when considering the burdens of average student loan debt. This economic strain shapes both major life milestones and personal well-being for an entire generation.

Delay In Major Life Events

The weight of student loans often pushes key milestones into the future. Buying a home or starting a family are decisions heavily influenced by financial readiness. Millennials find themselves postponing these significant life events. This delay stems from the need to prioritize loan repayments over other investments.

- Homeownership: Often unattainable until debt decreases.

- Marriage: High debt discourages matrimony plans.

- Family planning: Kids’ expenses take a back seat to monthly payments.

The Emotional Toll Of Debt

Debt goes beyond financial consequences; it bears an emotional toll as well. Studies indicate heightened levels of anxiety and depression among young adults with substantial debt.

| Emotional Impact | Percentage Affected |

|---|---|

| Stress | 80% |

| Anxiety | 70% |

| Depression | 60% |

These feelings are often compounded by the pressure to succeed in a competitive job market. As millennials strive to outpace their debt, mental health can suffer.

- Stress management becomes key to wellbeing.

- Support networks prove crucial to combating mental health decline.

- Proactive financial planning aids in reducing anxiety.

Strategies For Managing Student Loans

Striking an average student loan debt of over $30,000, many millennials find themselves in need of effective strategies to manage their loans. This part of the blog post will explore practical ways to tackle student loan debt head-on. By considering these options, borrowers can take control of their finances and chart a path to freedom from student debt.

Consolidation And Refinancing Options

Combining loans can simplify repayment. Loan consolidation merges multiple student loans into a single loan. This means one payment per month instead of several. But there’s more. Look for lower interest rates with loan refinancing. Refinancing replaces old loans with a new loan, ideally at a lower rate. Both options can lead to lower monthly payments.

- Direct Consolidation Loans – Best for federal student loans.

- Private Loan Refinancing – Can include both federal and private loans.

Income-driven Repayment And Forgiveness Programs

Income-driven plans tailor monthly payments to fit income and family size. Payments can be as low as $0 based on these factors. If any balance remains after 20 to 25 years, it may be forgiven. Loan forgiveness programs are another path to consider. Public Service Loan Forgiveness (PSLF) is an option for those in certain public service jobs. Consistent payments under qualifying plans can lead to total loan forgiveness after 120 payments.

| Program | Qualifying Payments | Forgiveness |

|---|---|---|

| PSLF | 120 | Complete forgiveness |

| Income-Driven Repayment | 240-300 | Possible remaining balance forgiveness |

To check eligibility for these programs, visit the official Federal Student Aid website. Advisors can help navigate these choices. Choosing the right strategy makes managing student loans less overwhelming.

Journey Towards Financial Freedom

The path to financial freedom can feel long for millennials grappling with student loan debt. Unlocking the chains of these loans marks the start of true financial empowerment. With the right strategies, the journey can lead to a liberating destination.

Building A Debt Repayment Plan

Creating a debt repayment plan is the first step towards financial liberation. Know what you owe, and straighten your priorities. Higher interest loans should go first. The snowball or avalanche methods offer effective ways to tackle debt. Use online tools or consult a financial advisor to craft your unique plan.

Here’s a straightforward method to organize your debt:

| Loan Type | Interest Rate | Monthly Payment | Remaining Balance |

|---|---|---|---|

| Federal Student Loan | 5% | $150 | $10,000 |

| Private Student Loan | 10% | $300 | $15,000 |

| Credit Card | 20% | $200 | $5,000 |

Importance Of Savings And Investment

While repaying debt, don’t neglect savings and investment. An emergency fund avoids the need for more debt when life throws surprises. Even a small, regular saving’s contribution makes a difference. Over time, compound interest transforms modest savings into significant sums.

- Start with a high-interest savings account.

- Consider low-cost index funds for long-term growth.

- Automate your savings to ensure consistent contributions.

Investment, although riskier, accelerates wealth creation. Starting early, diversifying, and routinely contributing to retirement accounts lay a foundation for future financial stability. Seek professional advice to align your investment goals with your financial capacity and risk tolerance.

Policy And Reform

Millennial student loan debt remains a pressing topic in America. Today, let’s dive into policy and reform. This section plays a crucial role in shaping the financial future of graduates. As they embark on their careers, the burden of debt can feel overwhelming. Change is necessary. Understanding recent shifts in policy will help us look forward to what still needs advocacy.

Recent Changes In Student Loan Policies

Many millennials have seen the landscape of student loan debt shift significantly in recent years. Government policies have adapted as the issue garners more attention. For example, adjustments to repayment plans are now more flexible. Interest rates have seen changes too.

- Income-driven repayment plans ensure that bills are more manageable.

- Loan forgiveness programs have expanded for certain public service jobs.

- Potential for interest rate caps aims to prevent debt from ballooning.

These developments represent steps forward. They also signal the government’s recognition of the issue. They highlight an understanding that policy responses are key to resolving the crisis.

Advocacy And Future Of Education Funding

Looking ahead, the task falls on both public officials and the community at large. Continued advocacy is critical. It ensures that the issue of student debt remains a priority. Advocates push for more comprehensive reform.

| Advocacy Focus | Goal |

|---|---|

| Broadened Loan Forgiveness | Reduce debt for more graduates |

| Increased Grants | Lessen the need for loans |

Innovative funding methods like income share agreements are also on the table. Stakeholders call for tuition restructuring. It may lead to more accessibility. The goal is clear. To ensure education is a right, not a financial barrier.

Students, alumni, and their families continue to lift their voices. They demand action. Thus, the future of education funding could look radically different. It can pave the way for emerging generations. It can free them from the chains of crippling debt. With solidarity and resolve, real change is within reach.

Credit: medium.com

Frequently Asked Questions For Average Millennial Student Loan Debt

What Is The Average Student Loan Debt For Millennials?

The average millennial carries approximately $34,504 in student loan debt. This figure reflects the rising costs of higher education and increased borrowing.

How Does Millennial Student Loan Debt Affect Homeownership?

Millennial student loan debt significantly delays homeownership, as many prioritize repaying loans over saving for a down payment. This debt burden often translates into postponed home-buying decisions.

Can Millennials Get Loan Forgiveness Or Repayment Assistance?

Yes, millennials may qualify for loan forgiveness or repayment assistance programs. These include Public Service Loan Forgiveness and income-driven repayment plans, which are intended to ease the financial strain of student loans.

What Percentage Of Millennials Have Student Loan Debt?

Nearly 1 in 4 millennials has student loan debt, with a sizable percentage of the demographic shouldering this financial responsibility. It’s a common issue impacting a significant portion of this generation.

Conclusion

Navigating the terrain of millennial student loan debt is daunting. Yet, awareness and education pave the way for sound financial health. With each repayment, graduates take a step towards freedom. Embrace these steps, and let’s shift the narrative towards achievable debt management and brighter economic futures.