Student Loan Debt Millennials: Strategies to Escape

Millennials are grappling with substantial student loan debt. This financial burden impacts their economic choices significantly.

Student loan debt is a pressing concern for many Millennials, typically defined as those born between 1981 and 1996. As they entered adulthood, higher education costs soared, prompting immense borrowing. Millennials now face unprecedented levels of debt, altering their spending habits and life milestones.

Their financial strategies often revolve around managing repayments, which influences decisions on home ownership, career paths, and even starting a family. This generation’s struggle with student loans shapes not just individual lives, but the broader economic landscape, as their purchasing power and investment capabilities are hindered by the ongoing responsibility of paying off their educational debts. The ripple effects of this issue stretch beyond personal finance, touching housing markets, consumer spending, and the national economy.

Credit: www.amazon.com

The Burden Of Student Loans On Millennials

The Burden of Student Loans on Millennials paints a picture of financial struggle. Many Millennials bear the weight of paying for an education they completed years ago. This debt influences their daily lives and future plans.

Profile Of Millennial Debt Holders

The typical Millennial student loan borrower faces a unique set of challenges. They have a mix of private and federal loans, generally crossing the $30,000 mark. Let’s break down their profile:

- Average Debt: Over $30,000

- Education Level: Bachelor’s degree or higher

- Employment: Full-time jobs, yet underemployment is common

- Age Range: Mid-20s to late-30s

Impact On Life Milestones

Student loans have a lasting effect on a Millennial’s life trajectory. Key milestones are often delayed or reconsidered due to their financial ramifications.

| Milestone | Impact |

|---|---|

| Homeownership | Delayed or unreachable for many |

| Marriage | Postponed due to financial insecurity |

| Starting a Family | Often on hold due to cost concerns |

| Saving for Retirement | Lower priority as debt takes precedence |

Income-driven Repayment Plans

Student Loan Debt Millennials face a unique financial challenge. Many grapple with substantial student loan debt. Income-Driven Repayment Plans offer relief by adjusting monthly payments according to income. These plans can make loan payments more manageable. Let’s explore how these plans can be a game-changer.

How These Plans Work

Income-Driven Repayment Plans link the amount you pay each month to your earnings. The logic is simple: as your income grows, so does your payment; if your income drops, your payment adjusts accordingly.

To benefit, borrowers must submit their financial details to their loan servicer. The servicer recalculates the payment every year. The payment is often set at 10-20% of your discretionary income.

After 20-25 years of payments, any remaining loan balance may be forgiven. The precise terms depend on the specific plan and when you took out your loans.

Pros And Cons

Exploring the benefits versus the downsides clarifies the suitability of these plans for your situation.

| Pros |

|---|

| Monthly payments suit your income level |

| Potential loan forgiveness after a certain period |

| Reduced financial stress and risk of default |

- Cons

- Interest accrues, increasing the total repayment amount

- Annual documentation of income is required

- Forgiven loan amounts may be taxable as income

Refinancing And Consolidation

Refinancing and Consolidation: Keys to Unlocking Financial Freedom for Millennials

Student loan debt often feels like a heavy burden for millennials. Refinancing and consolidation can lighten the load. These options help to reduce interest rates or monthly payments. Understanding the how-to of this approach is crucial for a brighter financial future.

The Refinancing Process

Refinancing involves replacing existing loans with a new one, often with better terms. Here’s how to start:

- Check your credit score; it plays a big role in the rates you’ll get.

- Gather your loan details and know how much you want to refinance.

- Shop around. Compare rates and terms from multiple lenders.

- Apply for the best option and provide necessary documentation.

- Continue paying existing loans until the process is complete.

Choosing Between Federal And Private Loans

Choose wisely between federal and private refinancing options. Federal loans offer benefits like income-driven repayment plans and loan forgiveness. Private loans may have lower rates. Think carefully about which benefits are most important to you.

| Loan Type | Pros | Cons |

|---|---|---|

| Federal |

|

|

| Private |

|

|

Budget Management And Extra Payments

Millennials carrying student loan debt often find budget management crucial. Extra payments can bring them closer to financial freedom. This section dives into effective strategies to handle this unique financial challenge.

Creating A Debt Repayment Budget

Setting up a practical budget focused on debt reduction is key. Regular assessment and adjustment of expenses ensure you stay on track. Follow these steps:

- List monthly income sources. Include all reliable revenue streams.

- Track your spending. Know where every dollar goes.

- Identify essentials. Rent, groceries, and utilities are priorities.

- Cut unnecessary costs. Dine out less, cancel unused subscriptions.

- Allocate funds for loan repayment. This becomes a fixed monthly bill.

Strategies For Making Extra Payments

Making extra payments reduces the principal faster. This leads to less interest over time. Implement these tips:

- Use windfalls wisely. Tax refunds or bonuses can go toward loans.

- Increase income. Freelance gigs or part-time jobs can help.

- Set up biweekly payments. This results in one extra full payment yearly.

- Round up payments. Paying a bit more each month adds up.

Remember to inform your lender that extra payments should apply to the principal balance. This approach ensures effective debt reduction.

Public Service Loan Forgiveness

Public Service Loan Forgiveness (PSLF) can be a beacon of hope for Millennials crushed by student loan debt. PSLF offers a way to get student loans forgiven after 10 years of payments if you work in public service. Let’s explore how to qualify for this program and understand its intricate details.

Qualifying For Pslf

Qualifying for PSLF requires several steps:

- Employment Verification: Work for a government agency or certain non-profits.

- Right Loans: Have federal Direct Loans or consolidate other federal loans.

- Repayment Plan: Be on an income-driven repayment plan.

- 120 Payments: Make 120 qualifying payments.

Each aspect of qualifying carries its own requirements. Employers must meet specific criteria outlined by the program. Direct Loans are the only eligible loans, but others can become eligible through consolidation. Your repayment plan must adjust with your income. Lastly, the 120 payments don’t need to be consecutive, but they must be full payments made on time.

The Fine Print Of Pslf

Understanding the fine print ensures you stay on the right path:

| Detail | Description |

|---|---|

| On-Time Payments | Payments must be made within 15 days of the due date. |

| Full Payments | Pay the full amount due as shown on your bill. |

| Payment Period | Each payment counts only if it’s for the month it’s due. |

Records are crucial. Submit Employment Certification Forms annually. This ensures you’re on track. Filling out the paperwork properly is essential for maintaining eligibility. Lastly, remember PSLF is not taxed under federal income tax laws.

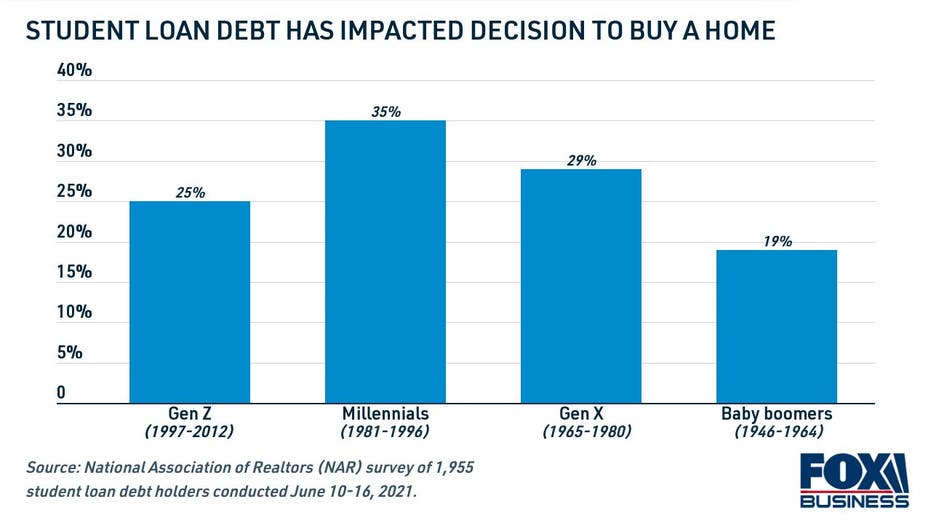

Credit: www.foxbusiness.com

Alternative Paths To Eliminate Debt

Millennials carry large amounts of student loan debt, forming a significant financial burden. Yet, unique solutions exist beyond traditional repayment plans. This section explores creative and targeted strategies for debt relief. It is time to consider alternative paths to eliminate debt and pave the way toward financial freedom.

Side Hustles And Earning Additional Income

Debt does not have to be a lifetime companion. Enterprising millennials can explore side hustles as a tactic to earn extra cash. Let’s dive into ways to supplement income:

- Freelancing: Offer skills online. Think writing, graphic design, or coding.

- Selling handmade goods: Use platforms like Etsy to market creations.

- Ride-sharing or delivery services: Drive for Uber or deliver with DoorDash in free time.

- Online tutoring: Teach subjects you are passionate about.

These hustles can turn into substantial earnings with the right commitment. They help make monthly payments or even pay down principal amounts quicker.

Loan Forgiveness Programs By Profession

Profession-specific loan forgiveness programs offer another escape route from debt. Review some options available, based on one’s career:

| Profession | Program | Requirements |

|---|---|---|

| Teachers | Teacher Loan Forgiveness | Teach full-time for five complete and consecutive academic years in a low-income school. |

| Healthcare Workers | National Health Service Corps Loan Repayment | Work in high-need, underserved areas. |

| Lawyers | Public Service Loan Forgiveness | Work for the government or a non-profit for 10 years while making 120 qualifying payments. |

Many fields offer unique forgiveness paths. It is vital to research eligibility requirements and apply accordingly. Taking advantage of these programs can lead to substantial debt reduction, or even full forgiveness.

Credit: www.sofi.com

Frequently Asked Questions For Student Loan Debt Millennials

How Much Average Debt Do Millennials Carry?

Millennials, on average, carry around $30,000 in student loan debt. This burden can significantly impact their financial decisions, such as home ownership or starting a family.

What Options Are Available For Student Loan Forgiveness?

Several options exist, including Public Service Loan Forgiveness, Income-Driven Repayment plans forgiveness, and Teacher Loan Forgiveness. Eligibility varies, so it’s crucial to research each program thoroughly or consult with a financial advisor.

Are Millennials Delaying Life Milestones Due To Debt?

Yes, many millennials delay milestones such as buying a house, getting married, or having children. The financial strain of student loans often contributes to these decisions, affecting long-term personal and economic goals.

Can Refinancing Student Loans Save Money?

Refinancing student loans can potentially lower interest rates and monthly payments. However, it’s vital to compare the benefits against losing federal loan protections. It’s recommended to consult a financial expert before proceeding.

Conclusion

Navigating student loan debt is a rite of passage for many in the millennial generation. Effective management and strategic planning are key to overcoming this financial hurdle. By staying informed and exploring all available resources, millennials can tackle their student loans head-on, paving the way towards a more secure financial future.