What Percentage of Millennials Have Student Loan Debt: Alarming Insights

Approximately 34% of Millennials carry student loan debt. This figure represents a significant portion of the generation.

Student loan debt has become a defining financial issue for Millennials, the generation born between 1981 and 1996. This financial burden influences their economic behaviors, impacting life decisions such as buying a home, starting a family, or saving for retirement.

Understanding the scope of this issue is crucial for both policy makers and financial institutions as they strive to address the challenges faced by this demographic. With rising education costs and the increasing importance of a college degree in the job market, the percentage of Millennials with student loan debt underscores the need for comprehensive solutions to student debt management and financing higher education.

Credit: www.linkedin.com

The Millennial Burden

The Millennial Burden casts a long shadow over a generation striving for financial stability. Often characterized by their digital savvy and diverse values, millennials confront a stark economic reality. A financial struggle central to their lives is the albatross of student loan debt—a burden that affects their capacity to accumulate wealth and make major life choices.

Rising Costs Of Education

Acquiring a college degree has long been seen as a ladder to success. Yet, this ladder is now more expensive than ever. Since the late 20th century, tuition fees have skyrocketed well beyond the pace of inflation. This upsurge means higher debt for those seeking higher education.

- Increased tuition fees lead to more loans.

- Additional costs, like books and housing, add up fast.

- Many young adults face a financial catch-22: get educated or avoid debt.

The Debt Statistics

Concrete numbers paint a vivid picture of the issue. Recent studies reveal that a staggering percentage of millennials shoulder student loan debt. The figures are a wake-up call to the gravity of the situation.

| Year | Percentage with Student Debt | Average Debt Amount |

|---|---|---|

| 2021 | 62% | $32,731 |

- Over half of millennials have student loan debt.

- The debt amount often equals a year’s salary for many.

- Debt impacts credit scores, home ownership, and retirement savings.

Profiles Of Millennial Debt Holders

The journey through education is often paved with loans for many Millennials. Understanding their burdens is critical as we explore the profiles of Millennial debt holders. Let’s look at not just the numbers but the people behind them. These profiles tell a story of determination, ambition, and the challenging realities of higher education costs.

Typical Amount Owed

When discussing millennial student debt, the figures stand out. The typical Millennial carries a substantial financial weight after graduation. On average, borrowers from this generation owe between $30,000 to $40,000.

- Recent graduates: Likely to owe near the higher end

- Older Millennials: Have had time to pay off some debt, often owe less

Demographics Of Debt

Student loan debt doesn’t impact all Millennials equally. Diverse factors shape their financial landscapes.

| Gender | Ethnicity | Education Level |

|---|---|---|

| Women often owe more than men | Minority groups face higher debt ratios | Postgraduates carry more debt |

| Family background and economic status also play crucial roles. | ||

Each profile presents a unique blend of circumstances, revealing the widespread impact of student loan debt within the Millennial generation. Employment rates and income levels further complicate these profiles, influencing their ability to repay loans.

Impact On Life Choices

Millennials face significant hurdles due to student loan debt. This debt influences their lives in many ways. From owning a home to saving for old age, each decision involves a financial tussle. Let’s explore how debt shapes key life choices for many young adults today.

Homeownership And Delayed Milestones

It’s no secret that student loan debt can delay homeownership. Millennials often struggle to save for a down payment. They also find it challenging to qualify for mortgages. Student loans increase their debt-to-income ratio. This makes it tough to take on more debt.

- Fewer millennials own homes compared to previous generations at their age.

- Student debt delays buying a first home by several years.

- Debt impacts credit scores, influencing mortgage terms.

Beyond homeownership, student loans postpone major life events. These include starting a family or even marriage. For many, the dream of a white picket fence remains just that—a dream.

Retirement Savings Setbacks

Retirement might seem far away, but student loan debt is a pressing issue. Paying off loans often means less money is set aside for retirement. This can have a compounding effect over a millennial’s working life.

| Without Student Debt | With Student Debt |

|---|---|

| Higher monthly savings | Less available income |

| Benefit from compound interest | Miss out on early investment gains |

| More investment opportunities | Opportunity costs |

Focusing on long-term financial stability is crucial. But with current debt burdens, millennials face significant retirement savings setbacks. This impacts their peace of mind and future security.

Coping Mechanisms And Strategies

Millennials grappling with student loan debt seek effective ways to manage their finances. Strategies range from nuanced payment plans to complete debt overhaul. Discovering the right method can ease the weight of financial burden. Let’s explore some tailored options available to millennials looking to keep their student loan debt in check.

Income-driven Repayment Plans

Income-driven repayment (IDR) plans consider earnings and family size. Monthly payments adjust to suit disposable income, making them more manageable. Following are the key benefits:

- Sliding scale payments cater to current income levels.

- Loan forgiveness possibility after 20-25 years of qualifying payments.

- Reduced financial stress with payments that fit one’s budget.

To apply, millennials must submit income verification annually. This ensures their payment stays aligned with earnings.

Debt Forgiveness And Refinancing

Forgiveness programs can erase parts of student debt. Refinancing might lower interest rates. Important considerations include:

| Strategy | Benefits | Requirements |

|---|---|---|

| Public Service Loan Forgiveness | Complete debt relief after 120 qualifying payments. | Employment in government or non-profit sector. |

| Teacher Loan Forgiveness | Forgiveness of up to $17,500 on certain loans. | Five consecutive years teaching in a low-income school. |

| Refinancing | Potentially lower interest rates and monthly payments. | Good credit score and steady income. |

Millennials can research and apply for these programs to ease their debt load. Timely application and meeting all program criteria are crucial for success.

Policy Responses And Proposals

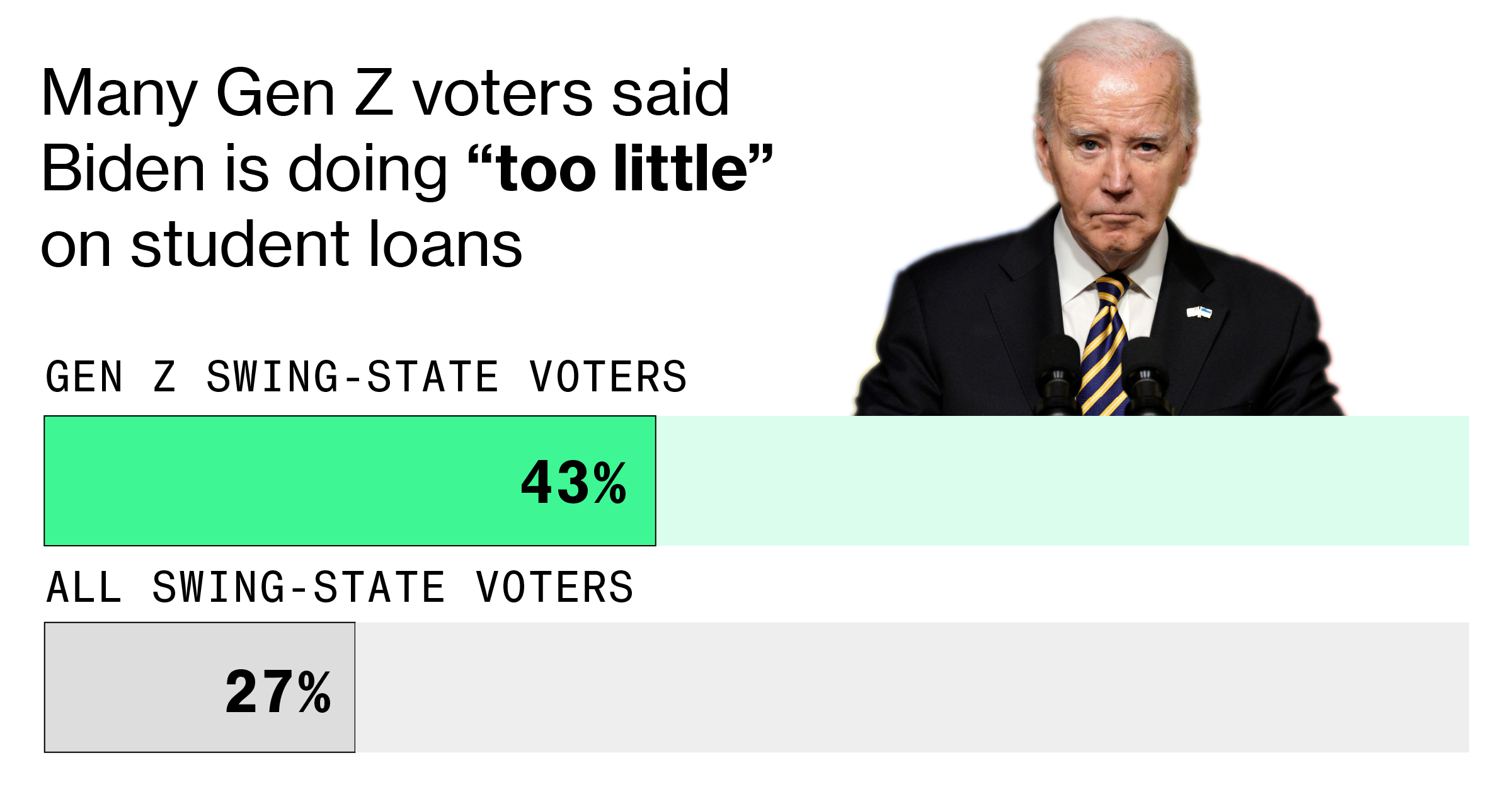

A significant portion of millennials carry the burden of student loan debt. This financial challenge prompts a closer look at how authorities are tackling the issue.

Legislative changes and education system reforms stand out as key areas where improvements could lighten the load for future generations. Explore the initiatives policymakers propose and enact to address this critical matter.

Legislative MeasuresLegislative Measures

Action in Congress has sparked hope for debt-laden graduates. Bold moves aim to ease the repayment terms and even forgive portions of student loans.

- Income-driven repayment plans have gained traction, adjusting monthly dues to match graduates’ earnings.

- Loan forgiveness programs, particularly for public service workers, represent another stride forward.

- Proposed legislation looks to expand these opportunities, potentially cutting debt burdens significantly.

Educational Reform

Reforming education goes beyond legislative action. It targets the heart of the issue—the cost of learning.

- Increasing access to scholarships and grants can reduce the need for loans.

- Encouraging colleges to control tuition hikes is essential to keep education affordable.

- Investing in trade schools and community colleges offers alternative, more affordable paths to qualification.

Credit: www.bloomberg.com

Credit: www.bloomberg.com

Frequently Asked Questions Of What Percentage Of Millennials Have Student Loan Debt

How Many Millennials Are Burdened By Student Debt?

Recent statistics indicate that approximately 1 out of 3 millennials have student loan debt. This reflects a significant financial challenge for this demographic as they navigate adulthood.

What’s The Average Student Loan Debt For Millennials?

Millennials, on average, owe around $30,000 in student loan debt. This considerable amount can impact their financial decisions, like buying a home or saving for retirement.

Are Student Loans Affecting Millennial Homeownership?

Yes, student loan debt is a considerable barrier to homeownership for many millennials. The financial strain often delays the ability to save for a down payment and affects credit scores.

How Does Student Debt Impact Millennial Retirement Saving?

Student debt can severely restrict a millennial’s ability to save for retirement. Prioritizing loan repayment often means less money is contributed to retirement funds in these crucial early years.

Conclusion

Wrapping up, understanding the financial challenges faced by millennials reveals a significant student loan debt impact. This reality shapes their economic decisions daily. As readers, it’s crucial to grasp the gravity of this burden. Let’s keep the conversation around student loan debt reforms active and look towards effective solutions.

Together, we can strive for a future where education is an accessible asset, not a lifelong liability.