Millennials Average Student Credit Card Debt: Shocking Insights

Millennials’ average student credit card debt is approximately $2,700. This financial burden reflects everyday spending and education costs.

Understanding the financial challenges faced by millennials is crucial for financial planners and credit counselors aiming to provide relevant advice. Credit card debt is just one aspect of the broader financial landscape for this demographic, often coupled with substantial student loans.

Sound financial habits and debt management strategies become essential in navigating these fiscal responsibilities. As they move towards their financial goals, millennials must balance debt repayment with saving for the future. With strategic planning and financial education, overcoming credit card debt can mark the beginning of a more secure financial journey for many in this generation.

Credit: www.forbes.com

Rising Credit Card Debt Among Millennials

Rising Credit Card Debt Among Millennials is a growing concern. Young adults are swiping their credit cards more than ever before. This pattern signals a shift towards cashless transactions. Many struggle with balancing lifestyle aspirations and financial realities.

Factors Driving Higher Debt

Various elements contribute to this unsettling trend. Unemployment and low-paying jobs make it hard for young adults to keep up. The seduction of easy credit tempts many into living beyond their means. Peer pressure and social media influence also play roles. Millennials often face cultural expectations to portray success, leading to overspending.

- Economic Uncertainty: Job instability pushes credit reliance.

- Lifestyle Inflation: A desire for better living standards increases spending.

- Peer Influence: Comparing lives with others encourages more credit use.

- Marketing Strategies: Targeted ads promote a culture of instant gratification.

The Impact Of Education Costs

Education expenses tremendously affect millennials’ finances. With tuition costs soaring, many lean on cards to manage daily expenses. Student loans often cover tuition but neglect living costs, pushing millennials towards credit dependency.

| Education Level | Average Debt |

|---|---|

| Bachelor’s Degree | $3,000 – $5,000 |

| Master’s Degree | $6,000 – $8,000 |

High-interest rates on credit cards make it harder to repay. This situation creates a cycle of debt that can last years.

Demystifying The Statistics

Understanding how Millennials manage their finances, especially student credit card debt, can help us grasp their economic situation. Demystifying the Statistics offers a clear view of what this looks like in real numbers.

Average Debt Figures

The average student credit card debt among Millennials paints an intriguing financial landscape. Let’s draw back the curtain on these revealing numbers.

| Age Group | Average Debt |

|---|---|

| Early 20s | $2,700 |

| Late 20s | $4,500 |

| Early 30s | $7,000 |

This average debt climbs as Millennials move from their early 20s to their 30s.

Comparison With Previous Generations

Digging into these figures reveals Millennials carry very different debt loads compared to previous generations. Here’s how they stack up:

- Baby Boomers: Generally, had lower tuition costs, less reliance on credit cards.

- Generation X: More credit card debt earlier on, but also dealt with a different economic climate.

A direct comparison shows Millennials are dealing with a unique set of financial challenges, including higher education costs and stagnant wages.

Psychoeconomic Influences On Spending

Understanding why millennials rack up credit card debt is crucial. It goes beyond just numbers. It’s about the mind and money. We call this ‘Psychoeconomic Influences on Spending’. Let’s explore these factors and how they contribute to the mounting debt.

The Role Of Social Media

Social media plays a huge part in millennial spending. Seeing friends’ vacations and shopping sprees can trigger a need to keep up. This ‘Fear Of Missing Out’ (FOMO) pushes many to charge expenses to credit cards, often without a plan to pay back quickly.

- Influencer endorsements make products irresistible.

- Ads tailored to browsing habits tap into desires.

- Easy ‘swipe up to buy’ features lead to spontaneous purchases.

Instant Gratification And Consumer Culture

The urge to ‘buy now, worry later’ is a staple of modern culture. Instant gratification is tempting. Millennials often prefer experiences over savings. This mindset contributes to higher credit card balances.

| Spending Trigger | Impact on Debt |

|---|---|

| Immediate purchase ability | Rising debt from quick buys |

| Discounts for immediate payment | More charges on cards for deals |

A culture that prizes owning the latest gadgets and trends pushes millennials towards expenses they can’t afford. This encourages borrowing, thus climbing debt.

- Buy now, pay later schemes

- Credit as a means to own now

- Low down payments with high interests

Consequences Of Ballooning Debts

The weight of student credit card debt can press down hard on the shoulders of many Millennials. This financial burden often swells to more than just monthly payments. Let’s explore the wider impact of excessive debts.

Credit Scores And Future Borrowing

A credit score acts like a report card for lenders. Credit card debt can lower this score. A low score makes new loans costly or impossible to get. Below, find out how debt influences credit health:

- Payment History: Late payments hurt scores.

- Credit Utilization: Maxed out cards signal risk.

- Length of Credit History: Long-term debt shortens positive history.

Poor credit scores compromise future goals. These include buying homes or cars. Meanwhile, high-interest rates pile up. Young adults face obstacles in major financial milestones.

Long-term Financial Stability Risks

Persistent debt threatens long-term financial health. Students may believe small debts are manageable. Yet, unchecked balances grow silently. Examine the risks below:

| Risk | Consequence |

|---|---|

| Savings Delay | Retirement and emergency funds are sidelined. |

| Investment Hesitation | Missed opportunities for wealth growth. |

| Debt Spiral | Continued borrowing leads to a debt trap. |

Over time, compounding interest spells danger. Monthly payments become overwhelming. Millennials risk a future shadowed by financial insecurity. Reducing debt is essential to avert these looming threats.

Strategies For Debt Management

Among the millennial crowd, managing student credit card debt is a common challenge. But fear not, as there are smart strategies to not only manage but also overcome this financial hurdle. Effective budgeting techniques coupled with options like debt consolidation and seeking professional counseling can make a world of difference. Let’s explore these strategies.

Effective Budgeting TechniquesEffective Budgeting Techniques

Mastering your cash flow is the first step to financial freedom. These methods can help.

- Track Your Expenses: Use apps or spreadsheets to see where money goes.

- Set Realistic Goals: Know your income, plan your spending, and stick to it.

- Cut Unnecessary Costs: Cook at home more, cancel unused subscriptions.

- Save for Emergencies: Put a little away each month for unexpected bills.

Debt Consolidation And Counseling

If multiple debts overwhelm, consolidation might be the key. Credit counseling services can guide as well. Here’s how they work.

- Combine Debts: Roll them into a single loan with potentially lower rates.

- Seek Advice: Professional counselors offer personalized debt management plans.

- Stay Informed: Learn about terms, conditions, and potential fees involved.

- Plan for the Future: Work with counselors to build a long-term financial plan.

Credit: www.facebook.com

Policy Actions And Financial Literacy

The millennial generation faces a unique financial challenge when it comes to student credit card debt. Effective policy actions and improved financial literacy are crucial tools in helping to alleviate this burden. In a society where credit is a cornerstone of financial stability, equipping young adults with the necessary skills and protections can transform their economic futures. Let’s delve into the significant roles that education reform and legislative measures play in empowering millennials to manage their finances successfully.

Education Reform For Financial Skills

Financial literacy is a must-have skill for the digital age. Schools can lead the way. Current education systems need a shift to prioritize practical financial education. By integrating real-life financial scenarios into the curriculum, students can learn about credit, savings, and debt before they graduate. With hands-on experience, graduates can make smarter decisions and avoid common financial pitfalls.

- Curriculum Overhaul: Schools can introduce courses on personal finance.

- Interactive Learning: Simulations of financial planning can be very effective.

- Early Start: Financial education should start as early as middle school.

- Parental Involvement: Schools can host workshops for both students and their families.

Legislative Measures To Protect Consumers

Legislation plays a pivotal role in safeguarding consumers from predatory credit practices. To protect millennials, new laws can be enacted to cap interest rates and fees. Transparency in credit agreements is also critical. This ensures millennials are fully informed about the terms of their credit. Importantly, such measures help to level the playing field between big financial institutions and individual borrowers.

| Legislative Focus | Benefits to Millennials |

|---|---|

| Interest Rate Caps | Reduces financial burden |

| Fee Limits | Lessens hidden costs |

| Transparent Agreements | Ensures clear understanding of terms |

| Credit Education Requirements | Prepares consumers to manage credit responsibly |

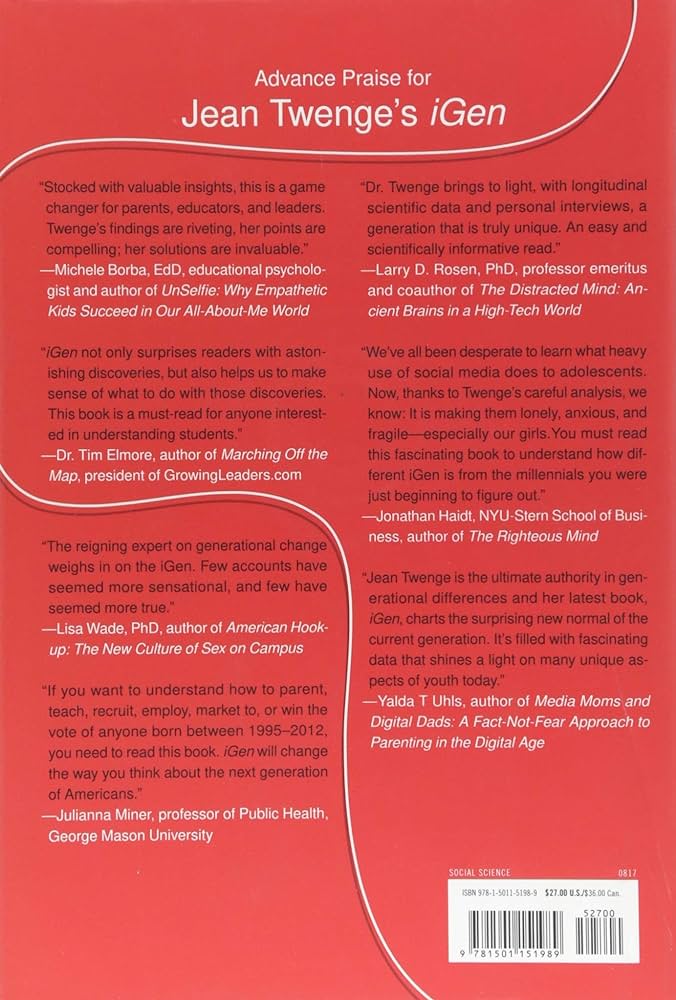

Credit: www.amazon.com

Frequently Asked Questions On Millennials Average Student Credit Card Debt

What Is The Average Credit Card Debt For Millennials?

The average credit card debt for millennials is approximately $4,712. This figure reflects challenges like high living costs and student loan payments.

How Does Student Debt Affect Millennials’ Credit?

Student debt can significantly impact millennials’ credit scores. Maintaining high balances or missing payments may lower scores, while consistent, timely payments may improve credit standing.

Can Student Credit Cards Help Build Credit?

Yes, student credit cards can help build credit when used responsibly. Regular, on-time payments and keeping balances low are key to positively impacting credit scores.

What’s The Best Way To Manage Student Credit Card Debt?

The best way to manage student credit card debt is to create a budget, minimize expenses, pay more than the minimum due each month, and consider a low-interest consolidation loan if necessary.

Conclusion

Navigating the landscape of student credit card debt is a challenge for many millennials. Diligence and smart financial strategies are key to managing this burden. Resources and support systems exist to aid in this journey. As empowerment through education continues, the goal of financial freedom becomes increasingly achievable for this generation.

Embrace the tools and knowledge available to turn the tide on student credit card debt.