Receivables Management Debt Collector Phone Number: Quick Contact Tips

The phone number for Receivables Management Debt Collector is not universally available as it can vary by location and company. For accurate contact details, it is advisable to check the official website or recent correspondence from the specific debt collector.

Managing debt collection efficiently is essential for maintaining a healthy financial status. Debt collectors, like Receivables Management, play a critical role in the finance industry, working to recover funds owed by individuals or businesses. To reach out to a Receivables Management debt collector, one must usually refer to the contact information provided on the official communication received from the collector, such as letters or emails.

Ensuring you have the correct contact details helps facilitate productive discussions and potentially resolves outstanding debts. Customers seeking assistance with their debts or aiming to discuss payment arrangements should prepare to contact the collector directly, keeping records of all interactions for future reference.

Mastering The First Contact

Mastering the first contact with a Receivables Management Debt Collector is crucial.

Preparing For The Call

Begin with gathering all necessary documents.

- Account statements.

- Payment records.

- Any previous communication.

Write down key points you wish to discuss. Know your rights under collection laws.

Create a quiet space to take the call. Ensure a good phone connection.

Keeping Your Cool

Maintaining composure is essential.

Speak slowly and clearly. Do not raise your voice.

Stay on topic; focus on resolving the debt.

| Emotion | Action |

|---|---|

| Anxiety | Pause, breathe, continue. |

| Frustration | State factually, seek solutions. |

Remember, it’s a professional call. Aim for a positive outcome.

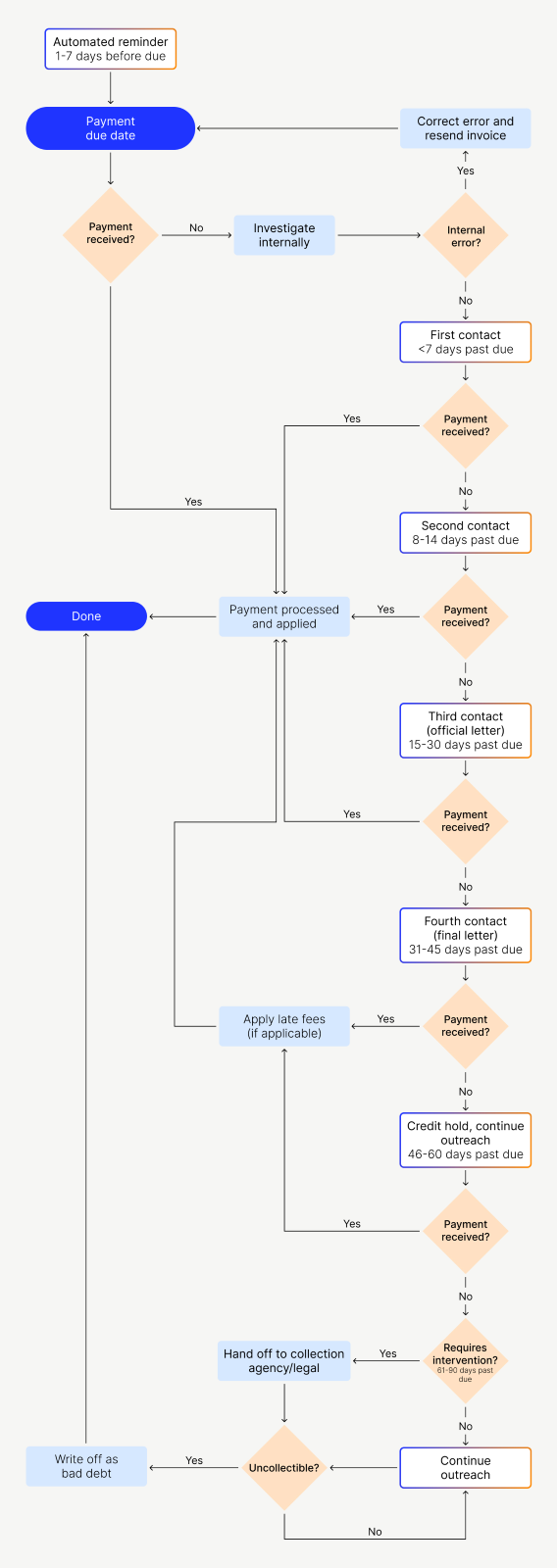

Credit: www.versapay.com

Essential Information To Gather

Dealing with debt collectors can be daunting. Gathering essential information can help you manage the situation more effectively. When a call from a receivables management debt collector comes in, being prepared is vital. Knowing what details to collect ensures you remain in control of the conversation. Stay informed, and you’ll be better equipped to address any debt collection issues.

Verifying The Debt Collector’s Identity

First, confirm that you’re talking to a legitimate debt collector. This step is critical for your security and peace of mind. Ask for the following:

- Name of the person calling

- The name of the collection agency

- Physical address of the agency

- Phone number to call back

- Company website and email

Note these details carefully. A legitimate debt collector will provide this information without hesitation.

Understanding Your Debt Details

Next, ensure you fully comprehend the debt claimed. Gather precise information:

| Debt Detail | What to Ask For |

|---|---|

| Original Creditor | Name of the company you originally owed money to. |

| Debt Amount | Total debt owed, including any fees or charges. |

| Account Number | Specific account or reference number linked to the debt. |

| Date of Debt | When the debt originated. |

| Details of any Disputes | Prior disputes you may have raised about the debt. |

Insist on official documentation. A proper debt collector will send a validation letter within five days of contacting you. This letter must detail the debt and your rights under the Fair Debt Collection Practices Act (FDCPA).

Communication Strategies

Effective communication is crucial in receivables management. Debt collectors must navigate sensitive conversations with skill. Strategies employed during calls can impact success rates. The following sections discuss key techniques.

Effective Questioning Techniques

Questioning smartly helps understand debtor situations better.

- Open-ended questions encourage detailed responses.

- Closed-ended questions can confirm specific details.

- Probing questions delve into issues requiring clarification.

Strike a balance. Use questions to build rapport while getting vital information.

Avoiding Admissions Over The Phone

Debtors might inadvertently admit to debts they dispute.

| Do | Don’t |

|---|---|

| Verify account information first. | Ask leading questions that suggest liability. |

| Document responses carefully. | Pressure debtors into making rushed statements. |

Remain neutral and professional. Ensure conversations do not lead to unintended admissions.

Your Rights Under Collection Laws

Dealing with a Receivables Management Debt Collector phone call can feel overwhelming, but it’s vital to know the rights you have under collection laws. These laws are in place to protect you from unfair practices and give you control during the debt collection process.

Familiarizing With Fdcpa

The Fair Debt Collection Practices Act (FDCPA) sets the standard for how debt collectors must behave. It prevents tactics that may be deemed harassment or deceit. Here are key protections under the FDCPA:

- Debt collectors must identify themselves and inform you of your right to dispute the debt.

- You have the right to request a validation of the debt within 30 days.

- They cannot contact you at inconvenient times or places.

- Use of abusive language is strictly prohibited.

- They must cease communication if you send a written request asking them to do so.

Recording Calls And Privacy

You have the option to record conversations with debt collectors. Check your state’s laws on call recording before doing so – some require consent from both parties.

On privacy matters, debt collectors cannot disclose your debt situation to anyone but you, your spouse, or your attorney. They are also forbidden from publicly sharing your debts, such as on social media or through any sort of “debt shaming.”

Should a debt collector violate your rights under the FDCPA, you have the right to file a complaint with the Federal Trade Commission (FTC) or sue the collector in state or federal court.

| Action | Your Right |

|---|---|

| Call Recording | Check state law; possible in many areas |

| Privacy Violation | Debt not to be disclosed to unauthorized parties |

After The Call

Dealing with a debt collector call often leaves you with mixed feelings and questions. It’s essential to stay calm and organized, even after the phone conversation ends. The actions you take post-call are critical in managing the situation effectively. Let’s go through the best practices once the call ends.

Documenting The Interaction

Immediately after the call, jot down every detail while it’s fresh in your mind. Note the time, date, and the collector’s name. Write what you discussed and any agreements made. Use a dedicated notebook or digital document for this purpose.

- Date and Time of Call: Helps track frequency of communications.

- Debt Collector’s Name: Useful for any follow-up interactions.

- Conversation Summary: Essential for maintaining records of what was discussed.

- Payment Plans or Dispute: Keep a clear record of any financial agreements or disputes.

Next Steps To Take

A proactive approach after the call can safeguard your interests. Here’s what you should consider doing next:

| Step | Action |

|---|---|

| 1 | Review your debt and financial records for accuracy. |

| 2 | Send a written request for a validation notice, if not received. |

| 3 | Consider contacting a credit counselor for guidance. |

| 4 | Dispute the debt in writing, if necessary. |

- Validate the Debt: Ensure the amount and creditor details are correct.

- Request Validation: If you haven’t already, ask for a written validation notice.

- Seek Advice: Getting help from a professional might be a smart move.

- Dispute Any Inaccuracies: Verbal claims won’t suffice; put it in writing.

Acting quickly and effectively after a conversation with a receivables management debt collector will make the process smoother and can lead to better outcomes for your financial health.

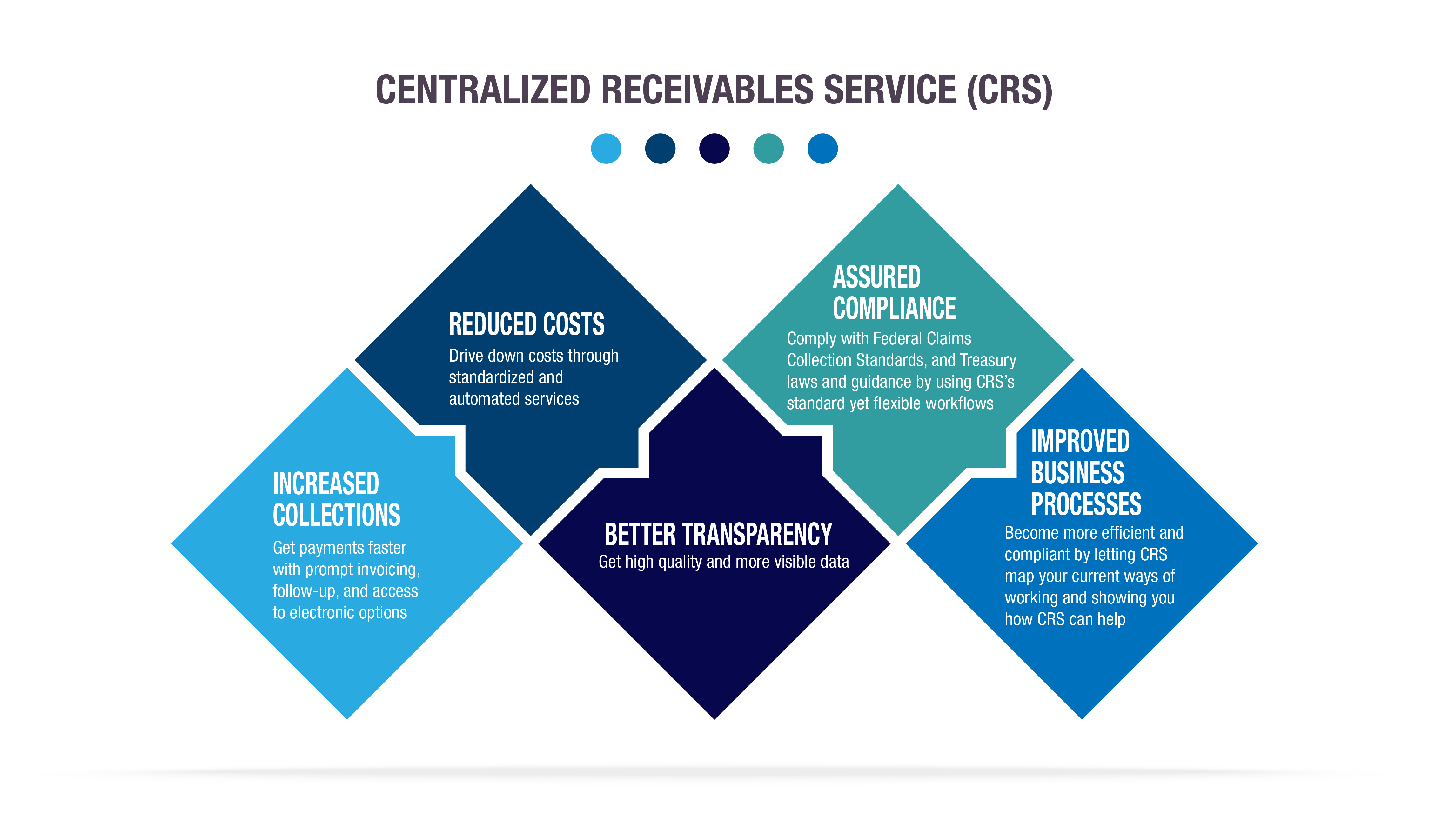

Credit: www.fiscal.treasury.gov

When To Seek Legal Help

Dealing with debt collectors can be stressful. You need to know your rights. If you feel overwhelmed or harassed, it might be time to seek legal help. Understanding the line between lawful collection practices and harassment is crucial.

Identifying Harassment

Debt collectors must follow the law. The Fair Debt Collection Practices Act (FDCPA) sets the rules. Harassment includes:

- Excessive calls at unreasonable hours

- Threats of violence or harm

- Publicly sharing your debt information

- Use of abusive or profane language

Keep records of all interactions. Note dates, times, and call content. Documentation strengthens your case in legal actions.

Consulting A Consumer Rights Attorney

Consumer rights attorneys specialize in protecting you from unfair practices. Consulting a lawyer is advisable if:

- You feel your rights have been violated

- The debt collector continues to harass

- You need clarification on your legal standing

Many lawyers offer a free initial consultation. Bring all evidence you have to the meeting. An attorney can help stop the harassment and may identify potential claims for damages.

Contact a reputable consumer rights attorney today for peace of mind and restore your rights.

:max_bytes(150000):strip_icc()/AverageCollectionPeriod-4201163-Final-2eeeb0f96410477c8016a7d936a28932.jpg)

Credit: www.investopedia.com

Frequently Asked Questions On Receivables Management Debt Collector Phone Number

What Is Receivables Management Debt Collector?

Receivables Management is a company specializing in debt collection. They work with creditors to recover owed funds. Debtors can receive calls from their debt collectors to settle accounts.

How To Contact Receivables Management Debt Collector?

The phone number for Receivables Management Debt Collector can usually be found on their official website or correspondence letters. It’s important to have your account information handy when calling.

Is There A Way To Stop Calls From Receivables Management?

To stop calls, request a written communication or write a letter to cease calls. Under the FDCPA, consumers have rights to limit how debt collectors contact them.

Can Receivables Management Sue For Debts?

Yes, Receivables Management can legally sue for unpaid debts. However, they may negotiate a payment plan as an alternative. Promptly addressing the debt is recommended to avoid legal action.

Conclusion

Navigating the maze of receivables management can be daunting. Yet, having direct access to a debt collector’s contact details simplifies the process. This post aimed to arm you with the essential phone numbers to tackle your financial challenges head-on. Remember, clear channels lead to efficient solutions — reach out effectively, resolve swiftly.