What You Need to Know About Liquidity Grabs in Trading

A liquidity grab in trading is when a huge comrade buys a batch of stocks to create a rapid increase in price and then sells them quickly to investors who are seeking to buy at a higher cost. Basically, it is a tactic used by traders or large corporations to benefit from market manipulation and cause a bullish trend in the market.

In the world of finance, liquidity is a crucial aspect, and it is defined as the ease with which an asset can be sold or bought quickly without causing a significant price change. Liquidity grabs occur when a large chunk of stocks is scooped up by big investors with the aim of making a quick profit by selling them at an inflated price to unsuspecting buyers.

This tactic has the potential to catalyze a short-term bull trend; however, it can have severe impacts on the financial market in the long run. In this article, we will discuss its impact, how it operates, and its legality in the trading world.

Credit: www.udemy.com

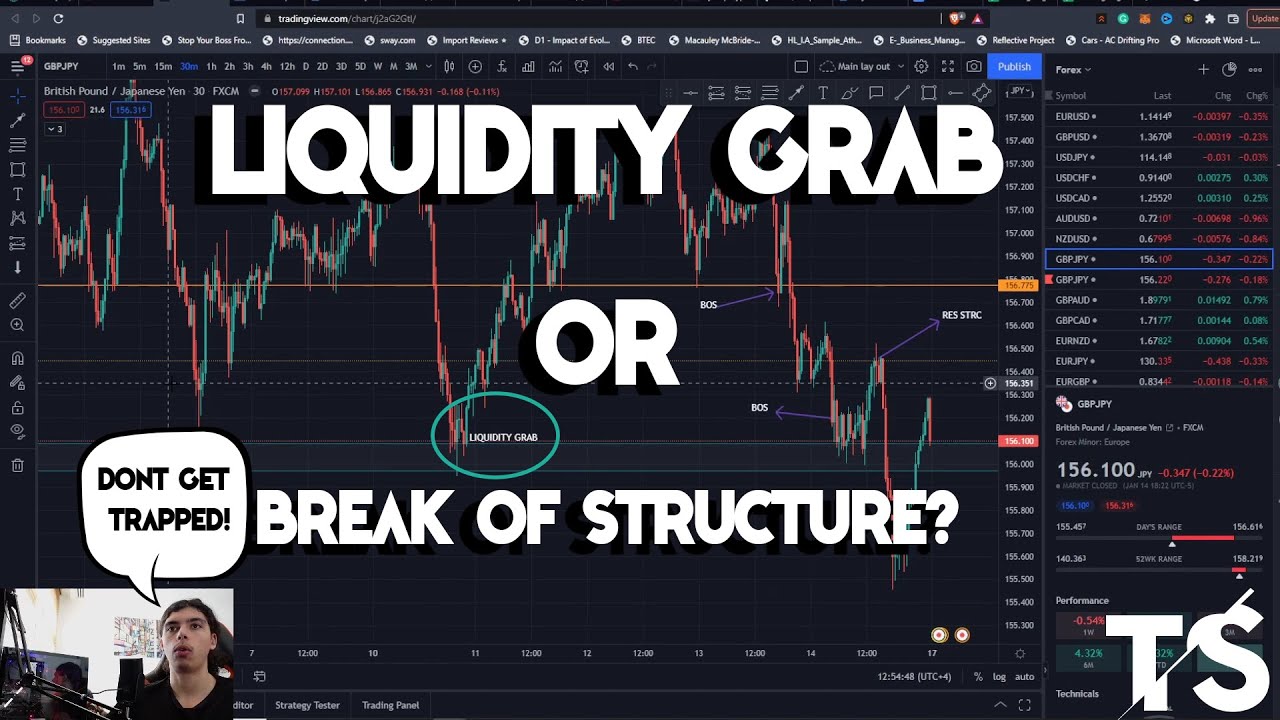

What Are Liquidity Grabs In Trading?

In the world of trading, liquidity grabs are a term that’s gaining traction among investors and traders. It refers to instances where a trader or group of traders manipulate a financial market’s liquidity to create an artificial price movement intending to profit.

Definition And Explanation Of Liquidity Grabs In Trading

Liquidity grabs occur when large traders try to manipulate a market by injecting or withdrawing a huge amount of liquidity intentionally. Some traders take advantage of other investors who need to buy or sell but can’t find a buyer or a seller at the desired prices.

These actions cause dramatic price swings, which benefit the traders manipulating the market.

Historical Context And Examples Of Liquidity Grabs In The Past

Liquidity grabs have been in existence for decades and have often led to market crashes. In october 1929, for instance, a group of traders tried to manipulate the stock market liquidity by buying huge amounts of stock in the hope of creating an artificial bullish momentum.

Once they achieved their goal, they sold their shares, and the market crashed, sparking the great depression.

Another example of a liquidity grab is the infamous silver thursday of 1980, when two brothers known as the hunt brothers went on a buying spree for the precious metal’s futures contracts. The brothers manipulated the silver market by buying up most of the market’s silver supply, sending the prices of the precious metal sky-high.

However, when the market caught up with what they were doing, they were forced to declare bankruptcy.

Liquidity grabs have been around for a long time, and although they are not illegal, they can wreak havoc on the financial markets when left unchecked. Understanding liquidity grabs can help investors make better-informed investment decisions, minimizing their exposure to market manipulations.

The Mechanics Of Liquidity Grabs

Have you ever heard the term “liquidity grab” before? If you’re a trader, it’s one you definitely should be aware of. A liquidity grab is a quick and aggressive move by traders to exploit market liquidity. In simple words, it’s a trading strategy where traders aim to make a profit by taking advantage of a price discrepancy created by a sudden and massive flow of money into or out of an asset.

Let’s have a closer look at the mechanics of liquidity grabs.

How Do Liquidity Grabs Work On A Basic Level?

In a liquidity grab, a trader floods the market with a large order to create a stir in the market’s order books. The goal is to manipulate the supply and demand to achieve favorable conditions. The trader uses this opportunity to either buy or sell an asset to maximize their profits.

It’s a risky strategy as the market can turn against the trader in a split second.

Here are some key points to keep in mind:

- Liquidity grabs happen quickly, with traders making rapid decisions in a matter of seconds or minutes.

- They can be carried out for various reasons, such as taking liquidity from other traders, reducing exposure to risk, or taking advantage of market inefficiencies.

- Liquidity grabs can be used in any financial market, including stocks, bonds, and currencies.

The Role Of Traders And Brokers In Executing A Liquidity Grab

Traders typically execute liquidity grabs on behalf of themselves or institutional clients looking to gain a competitive edge in the market. They may conduct their trades through brokers or directly through an electronic trading platform. Here are some key aspects of the role that traders and brokers play in executing a liquidity grab:

- Traders have in-depth knowledge of trading strategies, patterns, and market movements that help them identify an opportunity for a liquidity grab.

- They use advanced software and algorithms to analyze the market, identify mispricings, and make quick decisions.

- Brokers offer access to liquidity and provide essential services to traders, which makes them an integral part of the liquidity-grabbing process. They execute trades on behalf of traders and may provide valuable insights into market conditions.

The Impact Of Technological Advancements On Liquidity Grab Mechanics

Over the years, technology has played a significant role in the evolution of liquidity grabs. The rise of electronic trading platforms has revolutionized the way traders conduct transactions, making it possible to execute trades faster and more efficiently. Here are some ways in which technology has impacted liquidity grab mechanics:

- Algorithmic trading has become increasingly popular as traders look for ways to automate their trading strategies. It has significantly reduced the impact of trading errors, improved the speed and accuracy of trades and increased efficiency in the trading process.

- High-frequency trading (hft) has also had a profound impact on liquidity grab mechanics. Hft firms use powerful computers and algorithms to execute trades at lightning speeds, enabling them to profit from tiny price movements in microseconds.

Liquidity grabs are high-risk, high-reward strategies used by traders to take advantage of market inefficiencies quickly. Traders and brokers play essential roles in executing liquidity grabs, while technology has revolutionized the mechanics of this trading strategy.

The Consequences Of Liquidity Grabs

The pursuit of a massive profit margin has always been at the heart of financial trading, which is why traders employ various strategies to strike a balance between risk and reward. One such technique is a liquidity grab, which involves an attempt to control a particular asset’s market liquidity.

Negative Impacts Of Liquidity Grabs On Market Stability

Liquidity grabs may benefit a handful of traders; however, they ultimately harm the broader market, primarily when it is already fragile. Here are some of the ways that such impacts manifest:

- Market volatility: Whenever a trader executes a considerable trade that significantly reduces the liquidity pool of an asset, it creates volatility. The absence of tradable assets increases the chances of price manipulations and wild market swings, causing many market participants to incur enormous losses.

- Price distortions: Liquidity grabs can cause significant price distortions, creating confusion and uncertainty for traders who were not expecting such abrupt market movements.

- Risk: In the quest to control as much liquidity as possible, traders may be forced to risk more than they would usually be comfortable losing. Liquidity-grabbing strategies often end up being expensive and complex.

- Market disruption: When traders panic due to sudden unexpected price movements, they perform multiple trades, which can cause significant market disruption.

Effects On Individual Traders, Brokers, And Investors

Liquidity grabs can affect different individuals in trading in various ways, such as:

- Individual traders: Liquidity grabs often lead to large market movements that individual traders may find difficult to interpret, making it riskier to hold positions in the market.

- Brokers: Brokers will have to resort to higher margin requirements and adjustable financing to protect themselves from the risks associated with liquidity-grabbing strategies.

- Investors: Liquidity grabs can result in poor execution of orders or even lead to order failure, which can harm the investors’ overall portfolio performance.

Legal And Ethical Implications Of Liquidity Grabs

Liquidity grabs are incredibly controversial, and there are several legal and ethical implications associated with them, such as:

- Market manipulation: Liquidity grabs are a form of market manipulation and can have severe legal repercussions for traders caught engaging in such practices.

- Impact on the integrity of the market: Liquidity grabs can undermine the integrity of the market, affecting the average trader’s confidence in its fairness.

- Violation of ethical standards: Engaging in liquidity-grabbing strategies is often viewed as a violation of ethical trading standards as it is primarily aimed at benefiting a few individuals at the expense of the broader market.

Liquidity grab strategies come with considerable risks and can harm the market’s broader stability. Traders, brokers, and investors must understand the consequences of these strategies before deploying them.

Remember, always trade ethically and abide by legal requirements to keep the integrity of the market a priority.

Protecting Yourself Against Liquidity Grabs

In trading, liquidity grabs occur when there is a sudden drop in liquidity, which may cause significant price fluctuations. A liquidity grab can be triggered by a range of different factors, such as geopolitical events or large trades from market makers.

However, as a trader, there are strategies you can use to identify and mitigate the risks associated with liquidity grabs. Here are some key tips to help you protect yourself against liquidity grabs:

Strategies For Identifying And Mitigating The Risk Of Liquidity Grabs

- Diversify your portfolio: By diversifying your investments across various markets and asset classes, you can mitigate the risk of a liquidity grab impacting your entire portfolio.

- Set stop loss orders: Stop loss orders can be used to sell an asset automatically if a certain price is reached, thereby preventing any further losses if a liquidity grab occurs.

- Pay attention to order books: Keep an eye on the order books of the assets you are trading to identify any unusual trading activity that may indicate a liquidity grab is about to occur.

Tips For Staying Informed About Market Changes And Trends

- Follow news and market analysis: Stay informed about market trends and news that may affect your investments. By keeping up to date with economic data releases and analyst reports, you can better anticipate any potential liquidity grabs and mitigate risk accordingly.

- Use technical analysis: Technical analysis involves using past price data to identify patterns that may help predict future price movement. By using technical analysis, you can identify key levels of support and resistance, which can help you make more informed trading decisions.

How To Choose A Reputable Broker With Safeguards Against Liquidity Grabs

- Reputation: Choose a broker with a good reputation for protection against liquidity grabs. Look for a broker that has been in the industry for a long time and has a track record of transparency and integrity.

- Regulatory compliance: Make sure the broker you choose is regulated by a reputable regulatory body and adheres to strict financial rules and regulations. This will give you confidence that your funds are safe from liquidity grabs.

- Safeguard measures: Look for a broker that has measures in place to protect against liquidity grabs, such as automatic stop-loss orders or access to liquidity pools. This will help ensure that your investments are protected from market volatility.

By using these strategies and tips, you can help safeguard yourself against the risks associated with liquidity grabs in trading. Remember to always stay informed and choose a reputable broker with protection measures in place. Happy trading!

Frequently Asked Questions Of What Is A Liquidity Grab In Trading

What Is A Liquidity Grab In Trading?

A liquidity grab is a market manipulation tactic where a trader intentionally triggers a large number of stop-loss orders to create a temporary supply or demand imbalance.

How Does A Liquidity Grab Work?

In a liquidity grab, traders intentionally execute a large number of trades in a short period, triggering stop-loss orders and creating a brief, artificial surge in supply or demand.

Why Do Traders Use Liquidity Grabs?

Traders use a liquidity grab to manipulate the market, causing prices to move in their favor. It allows them to make large profits in a short time.

Is A Liquidity Grab Illegal?

Liquidity grabs are illegal and considered market manipulation. Regulators will investigate and take action on anyone found guilty of using a liquidity grab.

Conclusion

A liquidity grab is a strategy used by both retail and institutional traders in the market to maximize profits. It exploits temporary price movements by buying or selling a large amount of assets, drawing in other traders and creating a surge in liquidity.

While this can result in a profitable outcome, it can also have negative impacts if not executed correctly. Hence, it is essential to carefully analyze market conditions before initiating any trades. Expertise in technical analysis and risk management is also a requisite.

The world of trading is dynamic and ever-changing, and the concept of liquidity grab is just one of the many strategies utilized in trading. As a trader, it is vital to stay informed and continually update oneself with the latest developments in the market.

With appropriate skills, effective risk management, and thorough analysis, the liquidity grab can be a profitable strategy in a trader’s arsenal.