What You Need to Know About Liquidity Grabs in Trading

A liquidity grab in trading refers to when traders or investors quickly buy or sell an asset to take advantage of a sudden increase or decrease in liquidity. This can cause a rapid fluctuation in prices as traders scramble to either buy or sell the asset.

Trading is an essential element of businesses and investments, and the success of trading often depends on the ability to leverage and capture liquidity. Liquidity grab is a term commonly used in trading to describe a sudden and sharp movement in asset prices following a change in liquidity.

Liquidity refers to the ability to easily buy or sell an asset without causing significant fluctuations in its price. However, when liquidity is suddenly increased or decreased, this can trigger a liquidity grab where traders rush in to buy or sell the asset, leading to a rapid change in its value. Therefore, it is essential for traders to be aware of the potential for a liquidity grab and to develop strategies to manage their investments accordingly.

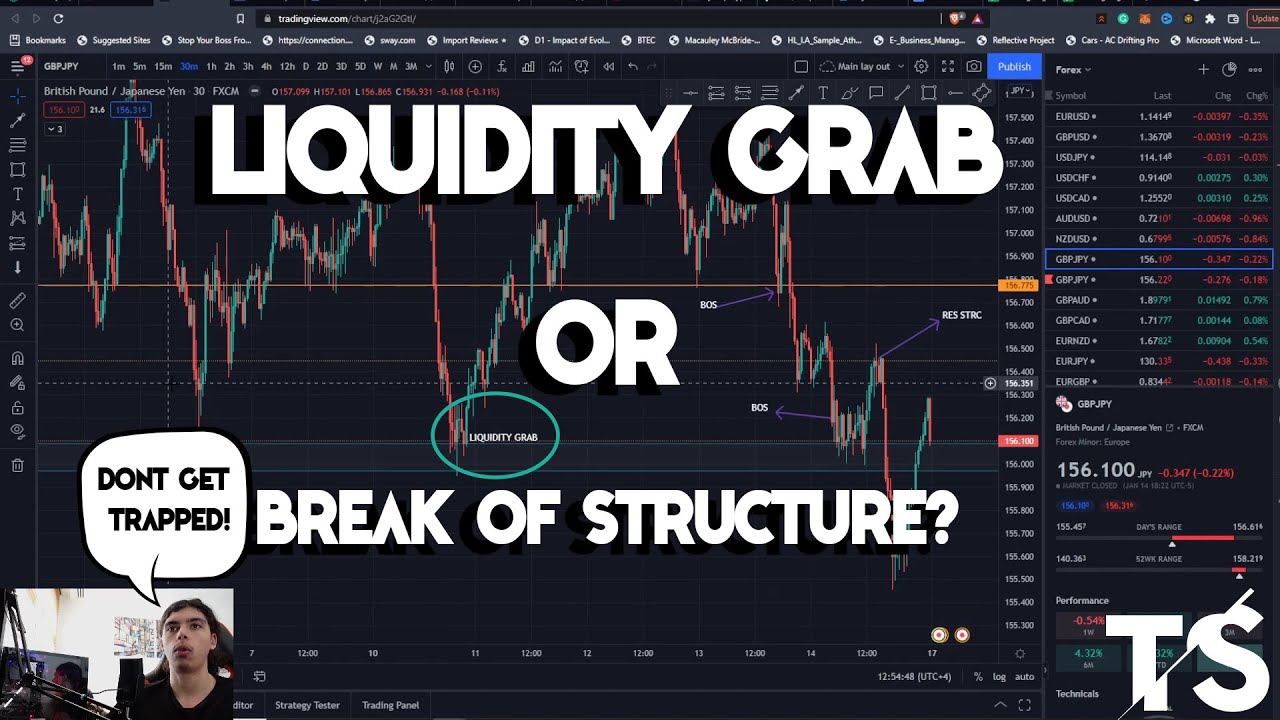

Credit: www.udemy.com

What Are Liquidity Grabs?

What Is A Liquidity Grab In Trading?

As a trader, you may have heard the term ‘liquidity grab’ thrown around, but it can be challenging to understand what it means and how it affects trades. We’ll explore liquidity grabs and how they differ from other market movements.

Definition Of Liquidity Grabs

A liquidity grab is a sudden, sharp, and massive movement in the market where a vast number of orders are executed in a short period. This type of movement occurs when a large trader buys or sells an asset, causing a chain reaction of trades by other traders.

The goal of a liquidity grab is to cause as much market movement as possible to fill orders before the market’s momentum shifts in the opposite direction.

How Liquidity Grabs Differ From Other Types Of Market Movements

Liquidity grabs differ from other market movements in several ways. Here are some key differences:

- Liquidity grabs tend to happen suddenly and with great speed, while other market movements may occur more gradually.

- Liquidity grabs are often triggered by one large trader’s actions, while other movements may be caused by a variety of factors, such as economic data, political events, or news announcements.

- Liquidity grabs can cause volatility to skyrocket, while other market movements may be less dramatic.

- Liquidity grabs are focused on filling orders, while other movements may be driven by investor sentiment or macroeconomic factors.

Understanding liquidity grabs is crucial for traders as they can provide excellent trading opportunities for those who are prepared. By identifying and predicting liquidity grabs, traders can maximize their profits and minimize their risks.

Identifying Liquidity Grabs

Understanding The Signs And Symptoms Of Liquidity Grabs

Liquidity grab is a tactic used in trading where there is a sudden closure of a position or a rapid influx of orders in the market. Its purpose is to deceive traders by creating a false impression of supply and demand for a particular asset or security.

This can lead to a price shift, subsequently affecting the market. Understanding the signs and symptoms of liquidity grabs can help traders make informed decisions.

- Rapid and unnatural price movements: Liquidity grabs often result in high spikes or dips in the price within a short period. This abrupt movement can be a signal of a liquidity grab.

- Large trading volumes: Liquidity grabs are typically executed with a large trading volume that is well above the average volume. This abnormality can occur suddenly and without warning.

- Unusual bid-ask spreads: A liquidity grab can lead to an unusual bid-ask spread, which means that the price difference between the highest bid and the lowest ask is abnormal. Such an irregularity can signify a liquidity grab.

- Spikes in volatility: Liquidity grabs can cause an increase in volatility, leading to wild swings in prices. Traders need to consider the situation when they see a sudden upsurge in volatility.

How To Differentiate Between A Liquidity Grab And A Genuine Market Movement

It is essential to differentiate between a liquidity grab and a genuine market movement to avoid making a wrong investment decision. Here are some ways to tell them apart:

- Analyze trading volumes: If the trading volume is high but not too out of the ordinary, then it may signal a market movement. However, if the volume is significantly higher than the average, then it could be a liquidity grab.

- Observe pattern: In a legitimate market movement, the asset’s price typically has a particular pattern. It may move gradually with some retracements or corrections. Liquidity grabs, on the other hand, exhibit abrupt and chaotic price movements.

- Monitor news and events: Significant news that affects a particular asset can result in a significant shift in price. It is essential to keep track of such news and verify if it is a liquidity grab or a genuine market movement.

- Check market conditions: During periods of low liquidity, liquidity grabs are more prevalent. Conditions such as holiday periods or weekends can present low liquidity, resulting in more frequent liquidity grabs.

Understanding the signs and symptoms of liquidity grabs is crucial for traders to make informed investment decisions. Knowing how to differentiate between a liquidity grab and a genuine market movement can save traders from significant losses in their investments. As with everything in trading, taking a patient and calculated approach is always the best course to follow.

The Impact Of Liquidity Grabs On Trading

Understanding The Spread Effect

Liquidity grabs in trading are usually associated with changes in the bid-ask spread. The spread between the bid and ask price is a significant factor in determining the liquidity in a market. When the bid-ask spread is narrow, it may be easier and quicker to buy or sell the asset.

However, when the spread widens, there may not be enough liquidity in the market to support traders who want to buy or sell the asset. The spread begins to widen when the market is subjected to a liquidity grab. This can affect the trading process significantly.

How Liquidity Grabs Can Affect Order Execution

Liquidity grabs can have a tremendous impact on order execution. Here are some of the ways they can affect order execution:

- Reduced liquidity: If a liquidity grab occurs, it can reduce the amount of liquidity in the market. Traders may struggle to find the right price when buying or selling assets.

- Slippage: Liquidity grabs can cause price slippage, which is the difference between the expected price of a trade and the actual executed price. This can cause traders to incur losses or receive lower profits than expected.

- Order rejection: Some traders may experience order rejections when liquidity grabs happen because the market may not have enough liquidity to support all the orders coming in.

Examples Of Liquidity Grabs And Their Impact On Trading

Liquidity grabs can occur in various ways. Here are some examples of liquidity grabs and their impact on trading:

- Flash crashes: A flash crash is an extreme example of a liquidity grab. It happens when a significant amount of orders come into the market, overwhelming the available liquidity and pushing the asset’s price down suddenly.

- News events: Major news events can significantly impact a market’s liquidity. For instance, if a major company releases its quarterly earnings report, it can affect the liquidity of the stock market, making it challenging to trade the assets effectively.

- Trading strategies: A trading strategy that involves the use of high-frequency trades can also trigger liquidity grabs. Such strategies rely on speed to execute trades, putting pressure on the market’s liquidity.

Overall, liquidity grabs can come in various ways and sizes, but their impact on trading is always significant. Understanding them better can help traders navigate the market as best they can with the least risk of loss.

Strategies For Trading Through Liquidity Grabs

How To Prepare For A Liquidity Grab

Liquidity grab affects market liquidity, causing the price to skyrocket or drop in a very short amount of time. This sudden movement is often due to the aggressive buying or selling of institutional traders. To prepare for a liquidity grab, you should consider the following steps:

- Perform thorough market research, including fundamental analysis, to detect any potential market risks before trading.

- Identify the market’s key support and resistance levels to get an idea of the market’s momentum.

- Set stop-loss orders at key support and resistance levels to minimize losses in the case of a liquidity grab.

- Trade with small position sizes so that you can exit the market fast when you detect something unusual happening.

Risk Management Strategies For Trading During Liquidity Grabs

Liquidity grabs involve high market volatility and unpredictability, leading to a high risk of losses. However, you can manage risk during liquidity grabs through the following strategies:

- Use technical analysis to detect trend changes and entry and exit points to minimize risks during liquidity grabs.

- Implement risk-reducing orders such as stop-loss orders, limit orders, and take profit orders.

- Monitor market prices and take immediate action when a liquidity grab happens to minimize losses.

- Avoid holding positions for long periods during liquidity grabs as the market could turn against you very fast.

Techniques For Taking Advantage Of Liquidity Grabs

Liquidity grabs can present great opportunities to make profits if you approach them wisely. The following are some techniques you can utilize to take advantage of liquidity grabs:

- Use limit orders to buy or sell at a predetermined price level to enter the market instead of aggressively buying or selling.

- Look for excessive market moves and place limit orders in that direction to buy or sell at favorable prices during market reversals.

- Implement algorithmic trading strategies that can detect market imbalances and automatically buy or sell during price spikes.

- Focus on the long-term market and portfolio goals rather than short-term market movements.

Frequently Asked Questions On What Is A Liquidity Grab In Trading

What Is A Liquidity Grab?

A liquidity grab in trading is a sudden spike in trading volume aimed at executing all orders at a specific price level.

What Causes A Liquidity Grab?

A liquidity grab is usually caused by traders using large orders to manipulate the market.

How To Spot A Liquidity Grab?

A sudden surge in trading volume, followed by a sharp price reversal is a typical sign of a liquidity grab.

How To Protect Against A Liquidity Grab?

To protect against a liquidity grab, set stop-loss orders and avoid placing large trades on thinly traded assets.

Conclusion

After understanding liquidity and its importance in trading, we can conclude that liquidity grab is one of the most commonly used tactics in trading that can make or break a trader’s fortune. It involves buying or selling large amounts of an asset in a short time frame to either trigger stop-loss orders or exhaust other traders’ liquidity.

Traders must keep an eye on the market to stay ahead of such tactics and avoid being caught in a liquidity grab. Additionally, understanding the volume, timing, and price of a trade can also help traders make informed decisions and avoid market manipulation.

Liquidity grab can be viewed as a double-edged sword, as it may provide opportunities for quick profits, but it can also lead to significant losses. Hence, traders must exercise caution and vigilance to stay ahead of such market manipulations and make informed decisions.